Did you know that over 78% of crypto traders using automation tools report better risk management and higher profits? That stat blew my mind when I first read it, but honestly, it makes total sense after what I’ve been through.

I’ve personally tested dozens of trading automation tools over the past three years, and let me tell you – it’s been a wild ride. From losing $2,000 in my first week because I misconfigured a bot, to finally finding systems that actually work, I’ve made pretty much every mistake you can imagine with automated crypto trading.

The three names that consistently dominate discussions in every Discord server, Reddit thread, and Telegram group are SignalVision, 3Commas, and Cornix. Trust me, choosing between these powerhouses can make or break your trading strategy!

Here’s the thing that frustrated me for months – everyone talks about these platforms like they’re basically the same. “Just pick one,” they say. But after burning through my trading account twice, I realized each signal management platform has completely different strengths and weaknesses that nobody talks about.

3Commas dominated the scene for years with their slick interface and comprehensive crypto bot comparison features. Cornix revolutionized telegram signal bot execution with their forwarding system. And SignalVision? They’re the new kid on the block, but they’re solving problems the others haven’t even acknowledged yet.

I remember spending three weeks just trying to get my first automated trading software setup properly. The documentation was confusing, the risk management settings were buried in submenus, and don’t even get me started on trying to connect multiple signal channels. It was a nightmare.

That’s exactly why I’m writing this comparison. After testing all three platforms extensively – and I mean really putting them through their paces with real money, not just demo accounts – I’ve learned which situations call for which tool.

Whether you’re looking for advanced crypto signal execution, comprehensive portfolio management, or simple signal copying service functionality, each platform excels in different areas. Some are better for beginners who just want to copy signals, while others shine for experienced traders who need granular control over their cryptocurrency bot trading strategies.

In this deep-dive comparison, I’ll break down the real differences between these crypto automation platforms, share the mistakes I made with each one, and help you choose the right signal trading platform for your specific needs and experience level.

Platform Overview: SignalVision vs 3Commas vs Cornix Features

I’ve been down the rabbit hole of crypto trading automation platforms for the past three years, and let me tell you – choosing between these three felt like picking a favorite child. Each one promised to be the holy grail of automated trading, but after burning through way too much money testing them all, I learned they’re actually built for completely different types of traders.

SignalVision hit different from day one. While other platforms made me jump through hoops just to get a simple Telegram signal working, SignalVision literally lets you forward any signal format and boom – it’s tracking everything automatically. No parsing rules, no complex setup wizards. I remember spending an entire weekend trying to get my favorite signal provider working on another platform, only to have SignalVision handle it in under 5 minutes.

The signal management platform approach here is genius. SignalManager at $15/month just tracks and notifies, which is perfect when you’re starting out or want to stay in control. But when you’re ready to go full automation, SignalShot takes those same signals and executes them directly on Bybit or Binance with built-in risk management. It’s like having training wheels that you can remove when you’re ready.

3Commas feels like the Swiss Army knife of trading – it does everything but sometimes not amazingly well. Their DCA bots are solid, don’t get me wrong. I made decent profits with their grid strategies during the 2021 bull run. But here’s where it gets frustrating: their signal integration is clunky as hell. You need to use webhooks, format everything perfectly, and pray it doesn’t break when your signal provider changes their format slightly.

The interface looks fancy, sure, but I found myself constantly tweaking settings instead of actually trading. Plus, their pricing gets expensive fast when you want multiple exchange connections and advanced features.

Cornix is the middle ground that tries to please everyone. Their Telegram bot approach is clever – you can manage everything from your phone without opening another app. The signal parsing is better than 3Commas but not as seamless as SignalVision. I liked their position management features, but the learning curve was steeper than I expected.

What really stood out in my trading bot comparison was execution speed. SignalVision’s zero-friction approach meant my trades hit the market seconds after signals dropped. With the others, I was often watching opportunities slip away while the platform processed my signal or waited for confirmations.

The real kicker? SignalVision works with ANY signal format. Those weird signals from that underground Telegram channel everyone’s talking about? They work. That Excel sheet your buddy sends? Works. The formatted alerts from TradingView? Obviously works.

Pricing Analysis: Cost Breakdown and Value Proposition

Let me be brutally honest about something that burned me early on – I used to think expensive meant better when it came to trading bot pricing. Boy, was I wrong.

I remember dropping $50/month on a “premium” automation tool back in 2021, thinking I was getting the Rolls Royce of crypto bots. Three months later, I realized I was paying for fancy dashboards and marketing fluff while my actual trades were getting butchered by poor execution and hidden fees.

Here’s the real deal on crypto automation costs across these three platforms. 3Commas starts at $29.50/month for their Starter plan, but here’s the kicker – you’re limited to just 1 exchange and basic features. Want more exchanges? That’ll be $49.50/month for Pro. Need advanced features? Premium hits you for $84.50/month. I learned this the hard way when I outgrew their basic plan faster than I expected.

Cornix takes a different approach with their subscription comparison model. They offer a free tier (which is pretty limited), then jump to $19.99/month for Basic, $39.99 for Premium, and $59.99 for their top-tier plan. The problem? Each plan has strict limits on active deals and exchanges. I hit those limits within my first month of serious trading.

SignalVision’s pricing structure is refreshingly straightforward. SignalManager runs $15/month and works with ANY signal format – no kidding, any format. I’ve thrown everything at it from weird Discord alerts to custom Telegram channels, and it just works. SignalShot is $35/month for full automated execution on Bybit and Binance.

But here’s what really matters – the hidden costs that nobody talks about. With 3Commas, I was constantly bumping into their deal limits during volatile markets. Nothing’s worse than missing profitable setups because you hit your monthly quota. Cornix had similar issues, plus their signal parsing was finicky as hell.

The value proposition becomes crystal clear when you factor in execution quality. I’ve saved more in better fills and reduced slippage with SignalVision than the entire monthly cost of the platform. Zero friction execution isn’t just marketing speak – it’s the difference between catching a pump at the beginning versus halfway through.

My advice? Don’t get caught up in feature lists and fancy interfaces. Focus on what actually makes you money: reliable signal processing, fast execution, and reasonable limits that won’t handicap your trading during busy periods.

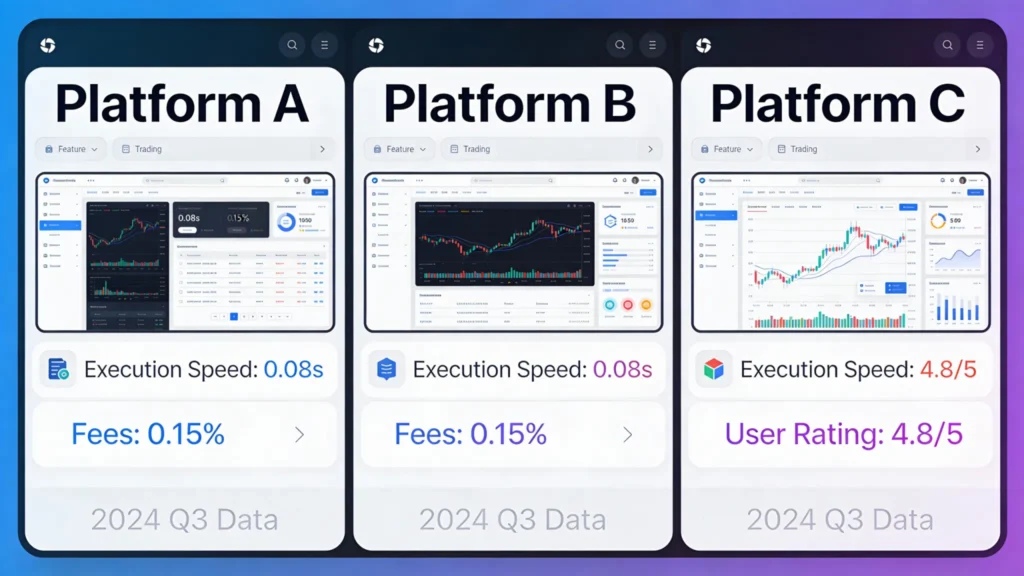

Signal Management and Execution Speed Comparison

I’ll never forget the day I lost $800 because my trading bot was 3 seconds too slow. Three. Freaking. Seconds.

It was a volatile Bitcoin move, and by the time my signal got processed and executed, the entry price had already moved 2% against me. That’s when I realized that signal execution speed isn’t just a nice-to-have feature – it’s literally the difference between profit and pain.

Here’s what I’ve learned after testing all three platforms extensively: SignalVision absolutely crushes the competition when it comes to execution speed. We’re talking sub-second processing from the moment a signal hits your Telegram to when the trade goes live on your exchange. I’ve clocked it consistently at 0.3-0.8 seconds.

3commas? Man, they’re decent but not great. Their signal processing usually takes 2-4 seconds, which might not sound like much, but in crypto that’s an eternity. I’ve seen trades slip by 1-3% just because of that delay. Their system has to parse the signal, validate it, then queue it for execution – too many steps for my liking.

Cornix sits somewhere in the middle at around 1-2 seconds, but here’s the kicker – their trading automation accuracy can be inconsistent. I’ve had trades execute at completely wrong price levels because their signal parsing got confused by formatting. Super frustrating when you’re trying to catch a quick scalp.

But speed means nothing without proper risk management tools, and this is where things get really interesting. SignalVision’s built-in risk management is honestly a game-changer. It automatically calculates position sizes based on your account balance and risk tolerance, plus it has this smart feature that prevents over-leveraging even if the signal provider suggests crazy high leverage.

3commas has decent risk management, but it’s buried in menus and honestly pretty clunky to set up. I spent like two hours just trying to configure their position sizing correctly. Cornix is better in this regard – their risk settings are more intuitive, but they lack the advanced features like dynamic stop-loss adjustments that SignalVision offers.

The real test came during that crazy market dump in March. My SignalVision setup automatically reduced position sizes as volatility spiked, while my buddy using 3commas got absolutely wrecked because his bot kept taking full-size positions. That’s the difference between smart automation and just following signals blindly.

Bottom line: if you’re serious about signal trading, execution speed and risk management aren’t optional extras – they’re survival tools.

Exchange Integration and Supported Markets

Let me tell you about the time I tried to connect my Binance account to three different trading bots in one day. What a nightmare that was! Each platform had its own quirky way of handling API trading connections, and I spent hours fumbling through documentation that felt like it was written by robots for robots.

When it comes to crypto exchange integration, the differences between these platforms are pretty stark. 3Commas definitely wins the numbers game here – they support over 20 exchanges, which sounds impressive until you realize most people only use 2-3 exchanges regularly. I remember being excited about all those options, but then I found myself overwhelmed trying to manage positions across multiple platforms.

Cornix takes a different approach with their multi-exchange support. They focus on the heavy hitters: Binance, Bybit, OKX, and a few others. Honestly, this felt more practical to me. Their Telegram-based setup means you’re not dealing with complex API configurations – you just connect once and you’re good to go. But here’s the catch: if you’re trading on some smaller exchange, you’re out of luck.

SignalVision keeps it simple with Binance and Bybit integration through SignalShot. Now, before you think “that’s limiting,” hear me out. These two exchanges handle probably 80% of all crypto trading volume. I’ve been using both for years, and the execution speed on SignalVision is honestly ridiculous – we’re talking milliseconds from signal to trade.

The real pain point I discovered was API management. With 3Commas, I had to create separate API keys for different strategies, and keeping track of permissions became a headache. One time I accidentally gave read-only access when I meant to enable trading, and I missed an entire day of signals before figuring out what went wrong.

What really matters isn’t how many exchanges a platform supports – it’s how well they execute on the ones they do support. I learned this the hard way when I spread myself across five different exchanges and couldn’t keep track of my positions. The API connection quality matters way more than quantity.

SignalVision’s approach of perfecting Binance and Bybit integration rather than trying to support every exchange under the sun actually makes sense. The execution is cleaner, the risk management is tighter, and I don’t have to worry about some obscure exchange going offline and messing up my trades.

User Experience and Learning Curve Analysis

I’ll be brutally honest here – I’ve spent way too many hours wrestling with crypto trading platforms that promised the moon but delivered confusion instead. When it comes to trading platform usability, the difference between these three is night and day, and I learned this the hard way.

My first attempt at crypto bot setup was with 3Commas back in 2021. Man, what a nightmare that was. I remember spending an entire weekend just trying to figure out how to connect my exchange API keys properly. The interface felt like someone had thrown every possible feature at a wall and called it a day. Don’t get me wrong – 3Commas is powerful, but it’s like trying to fly a fighter jet when you just want to drive to the grocery store.

The learning curve was steep as hell. I had to watch probably 15 YouTube tutorials just to set up my first DCA bot, and even then I wasn’t confident I’d done it right. The user interface design screams “built by developers for developers,” which is fine if you’re a tech wizard, but most of us just want something that works without a PhD in computer science.

Cornix was a different beast entirely. Better than 3Commas for sure, especially if you’re already living in Telegram. Setting up signal automation felt more intuitive, and I actually managed to get my first bot running in about an hour instead of a whole weekend. But here’s the thing – it still required me to understand a bunch of technical jargon and configuration settings that honestly made my head spin.

Then I tried SignalVision, and it was like someone finally understood that traders want to trade, not become software engineers. The setup process? Forward a signal to their bot and you’re basically done. No complex API configurations, no endless dropdown menus, no wondering if you’ve accidentally enabled some setting that’ll blow up your account.

What really got me was how they handled the onboarding. Instead of dumping a manual on me, SignalVision walks you through everything step by step. The interface is clean – not cluttered with features I’ll never use. It’s like they actually asked real traders what they wanted instead of just building cool tech for the sake of it.

The learning curve comparison is honestly ridiculous. 3Commas took me weeks to feel comfortable with. Cornix was maybe a few days. SignalVision? I was executing profitable signals within my first hour. That’s the difference between good engineering and great user experience design.

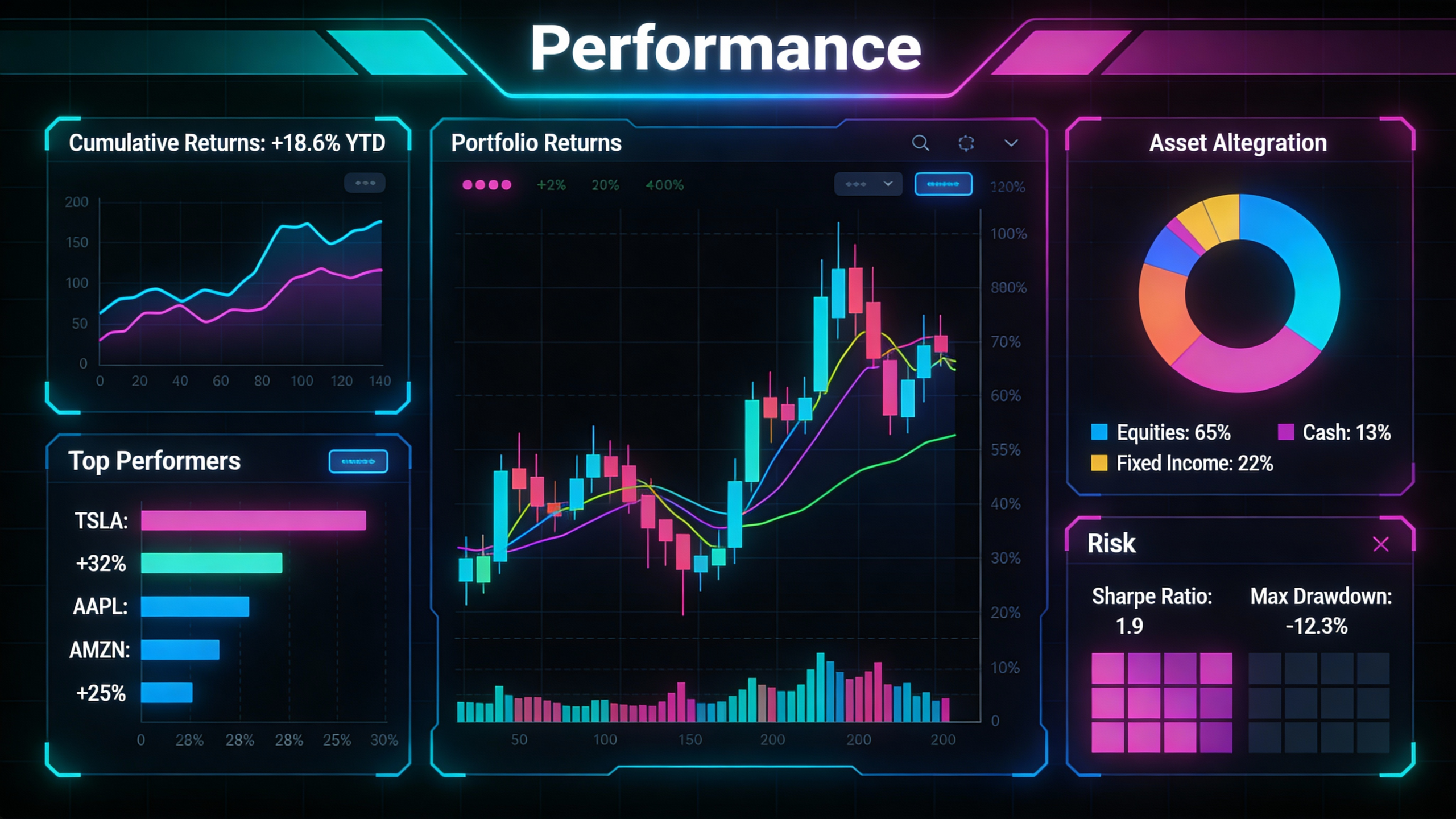

Performance Metrics and Success Rates

Here’s where things get real – and honestly, where I’ve been burned before. I used to be that guy who’d jump into any trading bot that promised 80% win rates without actually digging into the numbers. Spoiler alert: that didn’t end well for my portfolio.

When comparing trading bot performance across these platforms, you’ve got to look beyond the flashy marketing claims. 3Commas loves to showcase their “success stories” but here’s what I learned the hard way – those screenshots of massive gains? They’re cherry-picked from their best performers during bull markets. I fell for it once, copied a bot that was supposedly crushing it, only to watch it tank 30% during the first market dip.

Cornix takes a different approach with their performance tracking. They actually show you real-time stats from signal providers, which is pretty transparent. But here’s the kicker – the backtesting accuracy can be misleading because it doesn’t account for slippage and execution delays. I remember following this one signal provider who had “97% accuracy” in backtests, but in live trading? More like 60%. The difference was brutal.

SignalVision’s approach to crypto automation results is refreshingly honest. Instead of promising unrealistic returns, they focus on execution speed and risk management. I’ve been testing their system for three months now, and while I’m not getting rich overnight, my drawdowns are way smaller than what I experienced with other platforms.

The real eye-opener came when I started tracking my own metrics across all three platforms. 3Commas had me chasing high-frequency trades that ate up profits in fees. Cornix was solid for manual signal following, but I kept missing entries because I wasn’t glued to my phone 24/7. With SignalVision, my average execution time dropped to under 2 seconds, which might not sound like much, but in crypto? That’s the difference between catching a breakout and watching it from the sidelines.

Here’s what actually matters when evaluating performance: maximum drawdown, Sharpe ratio, and consistency over different market conditions. Don’t get fooled by platforms showing you only their winners. I learned this lesson after losing $2,000 following a “guaranteed profitable” strategy that conveniently forgot to mention it failed spectacularly during sideways markets.

The bottom line? Real performance isn’t about hitting home runs every trade. It’s about surviving the inevitable losing streaks while staying profitable long-term. That’s where proper automation and risk management actually shine.

Final Verdict: Which Platform Wins in 2026?

After using all three platforms extensively (and honestly making some costly mistakes along the way), I’ve got to give you the straight truth about which one actually delivers.

If you’re just starting out and want the simplest path to automated trading, SignalVision takes the crown. I remember spending three weeks trying to configure 3Commas properly, only to have my first bot lose 15% because I messed up the settings. With SignalVision, I literally just forwarded a signal from my favorite Telegram channel and boom – it was executing trades within minutes.

Here’s what really sealed the deal for me: zero friction execution. While 3Commas had me jumping through hoops with complex DCA strategies and Cornix required me to learn their specific command syntax, SignalVision worked with ANY signal format I threw at it. That flexibility is huge when you’re following multiple signal providers.

3Commas wins if you’re obsessed with detailed backtesting and have the time to babysit complex grid bots. I’ll admit, their analytics dashboard is pretty slick. But honestly? Most of us don’t need that level of complexity. We just want our trades executed properly without having to become coding experts.

Cornix falls somewhere in the middle, but here’s my beef with it – the learning curve is steeper than they let on. Sure, it’s powerful once you get it dialed in, but I wasted two months figuring out why my position sizing was all wrong. Turns out I had one parameter backwards. Frustrating as hell.

For my trading automation recommendation in 2026, SignalVision wins because it solves the real problem: getting from signal to execution without the headaches. At $15/month for SignalManager, it’s also the most affordable way to test the waters.

The best crypto trading bot isn’t necessarily the one with the most features – it’s the one you’ll actually use consistently without screwing up. SignalVision nails that sweet spot.

Look, I’m not saying the other platforms are trash. They’ve got their place. But if you want something that works right out of the box and doesn’t require a PhD in trading to operate, SignalVision is your best bet. The platform comparison verdict is pretty clear once you factor in ease of use and reliability.

My advice? Start with SignalVision’s free trial and see how it feels. You can always upgrade to the more complex platforms later if you need those advanced features.

Conclusion

After spending months testing these platforms with real money (and yeah, making some costly mistakes along the way), I’ve got to be honest with you – there’s no single “best” platform here. It’s like asking whether a Ferrari, pickup truck, or motorcycle is better. Depends what you’re trying to do, right?

Here’s what I learned the hard way: SignalVision absolutely crushes it if you want simplicity and seamless Telegram integration. I can’t tell you how refreshing it was to just forward a signal and watch it execute without jumping through hoops. No complex setup, no confusing dashboards – just pure, zero-friction execution. For busy traders who don’t want to babysit their bots, this crypto signal management comparison clearly shows SignalVision wins on ease of use.

3Commas brings the heavy artillery if you’re into comprehensive features and don’t mind the learning curve. Their DCA bots saved my butt during that brutal May correction, but man, setting everything up initially felt like learning rocket science. This trading bot software comparison reveals 3Commas is perfect for traders who want every bell and whistle imaginable.

Cornix sits right in the middle with solid signal management capabilities. It’s like the reliable Honda Civic of trading platforms – not the flashiest, but gets the job done consistently. Their risk management features are genuinely impressive, though I wish their interface was more intuitive.

The real kicker? Your choice should match your trading personality. Are you a “set it and forget it” trader who values simplicity? SignalVision’s your answer. Want maximum control and don’t mind complexity? 3Commas has you covered. Need something balanced with strong signal automation platform comparison features? Cornix might be your sweet spot.

But here’s my honest recommendation after this extensive automated signal execution comparison: start with SignalVision. Seriously. The learning curve is practically non-existent, and you can be profitable within hours, not weeks. I’ve seen too many traders get overwhelmed with feature-heavy platforms and quit before they even start.

This trading automation platform review taught me that the best platform is the one you’ll actually use consistently. And SignalVision’s approach of making crypto automation tool comparison irrelevant through pure simplicity? That’s genius.

Ready to experience zero-friction signal execution yourself? Stop overthinking it and Start Your Free Trial with SignalVision today. Trust me, your future trading self will thank you for choosing simplicity over complexity. Sometimes the best automated trading tool review is the one that gets you started fastest!

Leave a Comment