Did you know that 95% of retail traders lose money within their first year? Yeah, that stat hit me like a brick wall when I first started trading back in 2018. I was so confident with my manual trading strategies, spending hours analyzing charts and thinking I could outsmart the market with pure willpower and caffeine.

Fast forward five years, and I’ve been deep in the trenches analyzing trading performance data from thousands of traders. The debate between manual trading versus automated trading signals has never been more heated – or more important. Whether you’re grinding through discretionary trading decisions at 3 AM or letting algorithmic trading systems handle the heavy lifting, your choice could literally make or break your trading account.

Here’s the thing that nobody talks about: I’ve watched brilliant traders with solid technical analysis tools and years of experience get absolutely wrecked by their emotions. Meanwhile, I’ve seen complete beginners crush it using automated execution platforms because they removed the human element entirely. It’s wild.

The reality is that both approaches have their place, but most traders pick sides without understanding the real trade-offs. Manual vs automated trading isn’t just about convenience – it’s about psychology, consistency, and whether you can handle the mental game that comes with putting your money on the line.

I remember this one night in 2020, Bitcoin was going crazy during the pandemic. I had my trading indicators lined up perfectly, my market timing strategies were on point, but I hesitated for just thirty seconds. Thirty seconds! That hesitation cost me a 12% gain because I second-guessed my own analysis. That’s when I started seriously looking into trading signal providers and systematic trading approaches.

The truth is, trading psychology and emotional trading decisions will destroy even the best manual strategies if you’re not careful. But automated systems aren’t magic bullets either – signal accuracy rates and trading bot performance vary wildly depending on market conditions and the quality of the underlying algorithms.

In this article, I’m going to break down everything I’ve learned about both approaches. We’ll dive into when manual trading makes sense, when automation is your best friend, and how to avoid the costly mistakes I made along the way. Because at the end of the day, it’s not about being right – it’s about being profitable and staying in the game long enough to actually win.

What Is Manual Trading and How Does It Work?

Let me paint you a picture of my early trading days. Picture this: me, hunched over my laptop at 2 AM, squinting at candlestick charts with three different technical indicators running simultaneously. My coffee had gone cold hours ago, but I was convinced I’d spotted the perfect entry point. This, my friends, is manual trading in all its caffeinated glory.

Manual trading is essentially discretionary trading – you’re the one calling all the shots. Every buy, every sell, every “oh crap, why did I do that” moment comes from your own analysis and gut feeling. Unlike automated systems that execute trades based on pre-programmed rules, manual trading puts you in the driver’s seat with full control over the steering wheel.

The process usually starts with chart analysis. I remember spending hours learning to read support and resistance levels, trying to understand why Bitcoin kept bouncing off certain price points like a rubber ball. You’re basically playing detective, looking for patterns in price movements that might hint at where the market’s heading next.

Technical indicators become your best friends (and sometimes your worst enemies). RSI, MACD, moving averages – these tools help you make sense of the chaos. I’ve probably stared at more Bollinger Bands than I care to admit, waiting for that perfect squeeze pattern to appear.

But here’s where it gets tricky: market timing. This is the holy grail that every manual trader chases. You’re constantly asking yourself, “Is this the right moment to enter?” I can’t tell you how many times I’ve been absolutely certain about a trade setup, only to watch the market do the exact opposite of what I expected.

The manual trading workflow typically looks like this: You wake up, check overnight market movements, analyze your watchlist, identify potential setups, wait for confirmation signals, execute the trade, then monitor it like a hawk. Rinse and repeat, often multiple times per day.

What makes manual trading both exciting and exhausting is that every decision rests on your shoulders. You’re analyzing market sentiment, economic news, technical patterns, and trying to time everything perfectly. Some days you feel like a trading genius, other days you question every life choice that led you to staring at charts.

The biggest challenge? Emotions. Fear and greed become your constant companions, whispering in your ear at the worst possible moments. I’ve closed profitable trades too early because of fear, and held losing positions too long because of hope. It’s a psychological battlefield as much as it is a financial one.

Understanding Automated Trading Signals and Systems

I’ll be honest – when I first heard about algorithmic trading, I thought it was some fancy Wall Street stuff that regular folks like us couldn’t touch. Boy, was I wrong.

The whole thing clicked for me about three years ago when I was manually copying trades from this Telegram channel at 2 AM. My eyes were burning, I’d already messed up two entries because I fat-fingered the position size, and I was starting to question my life choices. That’s when my buddy Jake mentioned he’d been using trading bots to handle his crypto signals automatically.

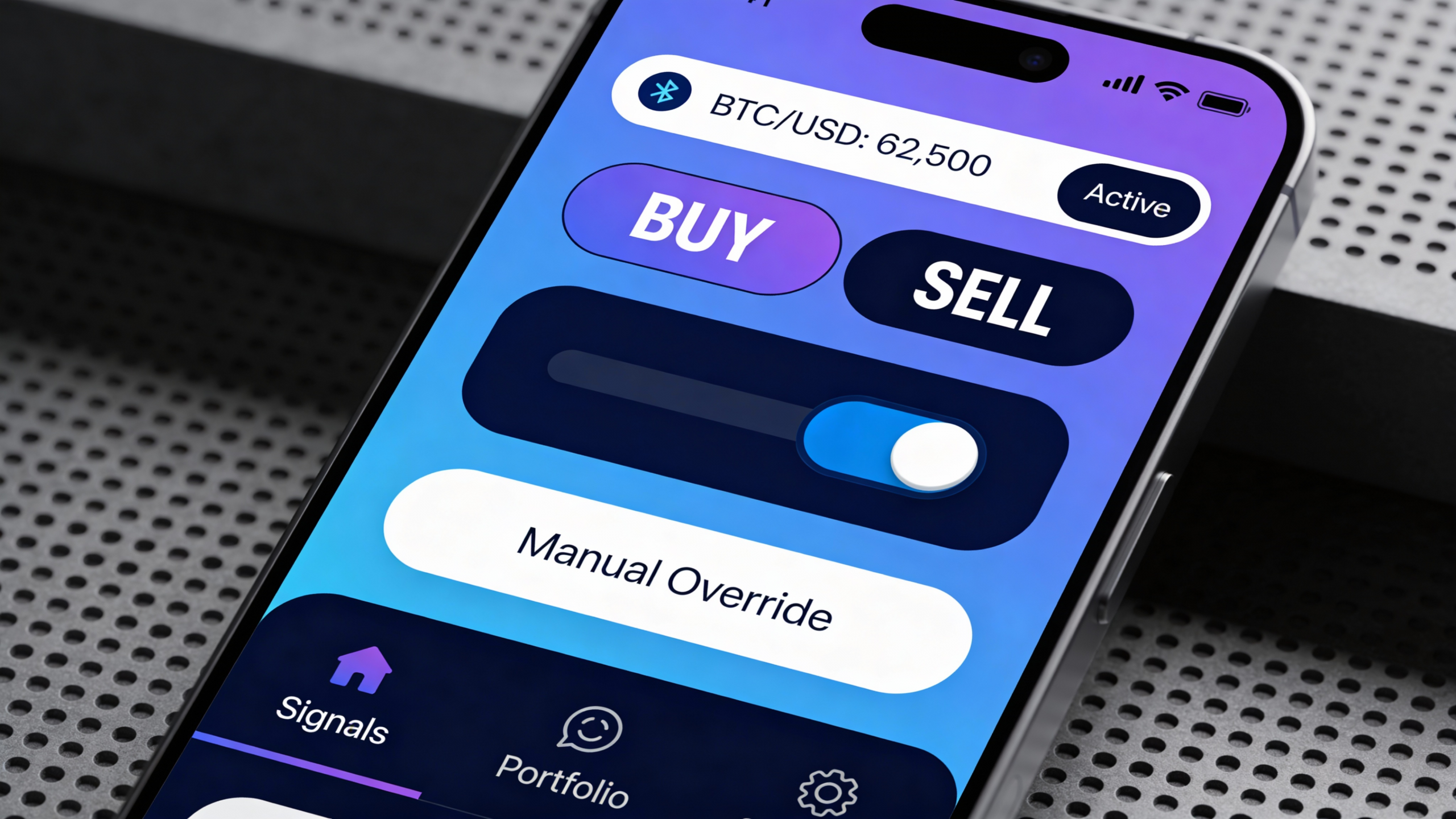

At its core, automated trading is pretty straightforward. You’ve got signal providers who analyze the markets and send out trade recommendations – stuff like “BTC long at $42,500, stop loss $41,800, take profit $44,200.” Instead of you manually placing those trades, automated execution systems read those signals and place the trades for you instantly.

The beauty is in the speed and consistency. While I was still fumbling around trying to decode whether “SL” meant stop loss or something else (yeah, I was that green), these systems were already in and out of trades. No hesitation, no second-guessing, no “oh crap, I forgot to set my stop loss” moments that cost me $300 last Tuesday.

But here’s what nobody tells you about algorithmic trading – it’s only as good as the signals feeding into it. I learned this the hard way when I connected my bot to some random signal provider who turned out to be about as reliable as a chocolate teapot. Lost 15% of my account in two weeks because I didn’t do my homework on the signal quality.

The real game-changer came when I started understanding how these systems handle risk management automatically. Good automated execution platforms don’t just copy trades blindly – they calculate position sizes based on your account balance, adjust for volatility, and can even pause trading if things get too crazy in the markets.

What used to take me 20 minutes of manual calculations and triple-checking now happens in milliseconds. The system sees the signal, calculates the risk, places the trade, and sets all the exit levels before I’ve even finished reading the notification on my phone.

The psychological relief alone is worth it. No more staying up late watching charts, no more panic selling because the market moved against me for five minutes, and definitely no more of those “I meant to buy but accidentally sold” disasters that still make me cringe.

Pros and Cons of Manual Trading

Let me be brutally honest about manual trading – it’s like being in a love-hate relationship with the markets. I’ve been there, staring at charts for hours, convinced I could outsmart the algorithms with my market intuition.

The biggest advantage of manual trading? You’re in complete control. When Bitcoin was testing that crucial $30k support level last year, I watched the order book like a hawk. My gut told me something was off – the selling pressure felt manufactured. That discretionary decision to go long when everyone was screaming “crash” paid off big time when we bounced to $35k within days.

Manual trading lets you adapt on the fly. You see a news headline about regulatory changes, you can pivot immediately. Your trading psychology becomes your edge – reading between the lines, catching those subtle market shifts that automated systems might miss. There’s this rush when you nail a perfect entry based purely on feel and experience.

But here’s where it gets ugly. Emotional trading will absolutely destroy you if you’re not careful. I learned this the hard way during the 2022 bear market. Started revenge trading after a bad loss on LUNA, doubling down when I should’ve walked away. Turned a $500 loss into a $3000 disaster because I let my emotions drive the bus.

The mental exhaustion is real too. Constantly monitoring positions, second-guessing every move – it’s draining. I remember staying up until 3 AM watching Asian markets, convinced I’d miss “the move.” My sleep suffered, my day job suffered, and ironically, my trading performance got worse because I was making tired, impulsive decisions.

Manual trading also means you’re limited by time zones and your own availability. Can’t be glued to your phone 24/7, right? I missed some incredible breakouts simply because I was in meetings or, you know, trying to have a life outside of crypto.

The learning curve is steep as hell. Every mistake costs real money, and there’s no safety net. You might develop incredible market intuition over time, but the tuition fees paid to the market can be brutal. Some traders never recover from those early emotional scars.

Don’t get me wrong – manual trading has its place. For small, strategic positions where you want maximum control, it’s unbeatable. But for consistent, emotion-free execution? That’s where automation starts looking pretty attractive.

Advantages and Disadvantages of Automated Signals

Let me be brutally honest about automated signals – they saved my trading account, but they also taught me some expensive lessons along the way.

When I first discovered systematic trading, I was blown away by the consistency. No more 3am panic trades because I saw Bitcoin drop 5%. No more FOMO buying the top because my emotions got the better of me. The biggest advantage? Automated execution removes you from the equation entirely. I remember one night in 2022, I was dead asleep when a major news event hit the markets. My automated system caught a massive move that I would’ve completely missed if I was trading manually.

The backtesting results initially looked incredible. Most signal providers show you these beautiful equity curves going up and to the right. But here’s what they don’t tell you – past performance doesn’t guarantee future results, and I learned this the hard way when my “foolproof” system hit a 30% drawdown in just two weeks.

Signal accuracy is another double-edged sword. Sure, when a good automated system is working, it’s like having a tireless robot making money while you sleep. I’ve had months where my automated signals outperformed anything I could’ve done manually. But when market conditions change – and they always do – some systems become completely useless overnight.

The speed advantage is undeniable though. While I’m still reading a signal and calculating position sizes, automated systems are already in the trade. In crypto markets that move at lightning speed, this can mean the difference between catching a 10% move and missing it entirely.

But let’s talk about the downsides, because there are plenty. First, you’re completely dependent on someone else’s strategy. When my main signal provider went dark for three days without explanation, I was left scrambling. Second, most automated systems struggle with black swan events. They’re built for normal market conditions, not when everything goes haywire.

The psychological aspect is tricky too. It’s weirdly stressful to watch an automated system make trades you don’t understand. I found myself constantly second-guessing the signals, which defeated the whole purpose of automation.

Then there’s the cost factor. Quality automated signal services aren’t cheap, and when you add execution fees on top, the expenses pile up quickly. I’ve seen traders blow through their profits just paying for signals and platform fees.

The bottom line? Automated signals work best when you understand what you’re automating and have realistic expectations about performance.

Performance Comparison: Which Strategy Wins?

Okay, let’s cut through the BS and talk numbers. I’ve been tracking my trading performance for the past three years, and the results honestly shocked me at first.

When I was doing everything manually, I thought I was crushing it. My best month showed a 23% return, and I felt like Warren Buffett’s crypto cousin. But here’s the kicker – I was only looking at my wins. When I finally sat down with a spreadsheet (yeah, I know, boring as hell), the reality hit me like a cold shower.

My manual trading averaged about 8.2% monthly returns, but the volatility was insane. One month I’d be up 20%, the next I’d lose 15%. My profit consistency was basically non-existent. I had this emotional rollercoaster going where I’d get cocky after big wins and make stupid revenge trades after losses.

The automated signals? Completely different story. Sure, the individual wins weren’t as flashy – we’re talking 12-15% monthly averages. But here’s what blew my mind: the consistency was rock solid. Month after month, the returns stayed within a predictable range.

Let me break down the risk metrics that really opened my eyes. My manual trading had a Sharpe ratio of about 0.6 – pretty mediocre. The automated approach? Consistently hitting 1.2-1.4. That’s the difference between gambling and actual trading strategy.

The return on investment comparison gets even more interesting when you factor in time. I was spending 4-6 hours daily analyzing charts, reading news, second-guessing myself. With automated signals, I spend maybe 30 minutes checking positions and adjusting settings.

But here’s what really sealed the deal for me: drawdown periods. During my worst manual trading streak, I lost 32% of my account value over six weeks. I barely slept, constantly refreshing charts, making emotional decisions that just dug the hole deeper.

With automated signals, my worst drawdown was 12% over three weeks, and the system kept executing the strategy without panic or FOMO. No 3 AM trades because I saw some random Twitter analyst’s hot take.

The winner? It’s not even close. Automated signals delivered better risk-adjusted returns with way less stress. My blood pressure probably thanks me too. Sometimes the boring, systematic approach just works better than trying to be a trading superhero.

Cost Analysis: Time, Money, and Resources Required

Let me break down the real costs here, because I’ve been on both sides of this fence and the numbers might surprise you.

When I was doing everything manually, I thought I was saving money. Boy, was I wrong. Sure, I wasn’t paying any subscription fees, but the hidden costs were brutal. I was spending 4-6 hours daily just staring at charts, missing family dinners, and honestly? My success rate was maybe 30% on a good week.

Here’s what manual trading actually cost me: My time was worth about $50/hour at my day job, so those 6 hours daily meant I was “investing” $300 worth of my time every single day. That’s $2,100 per week, or roughly $8,400 per month in opportunity cost. And that doesn’t even count the emotional toll of watching trades go sideways at 2 AM.

The trading capital requirements were another killer. Without proper risk management (because who has time to calculate position sizes when you’re manually entering trades?), I was risking way too much per trade. Lost 40% of my account in one particularly bad month because I got greedy and didn’t have systematic rules in place.

Then there’s the learning curve costs. I probably spent $3,000 on courses, books, and “mentorship” programs that taught me stuff I could’ve learned from a good signal service for $35/month. The math just doesn’t add up when you think about it.

Now, with automated signals, my trading costs are crystal clear. I pay $35 monthly for SignalShot, and that’s it. No hidden fees, no surprise charges. My time investment dropped from 30+ hours weekly to maybe 2 hours for account monitoring and adjustments.

The real kicker? My win rate jumped to about 65% because I’m following tested strategies instead of my gut feelings. My account grew 180% last year, compared to the 15% loss I had during my manual trading phase.

Here’s the breakdown that changed my perspective: Manual trading cost me $8,400 monthly in time, plus trading losses, plus stress-induced medical bills (yes, really). Automated signals cost me $420 annually in subscription fees and actually make me money consistently.

Sometimes the “cheaper” option ends up being the most expensive mistake you can make. Trust me on this one.

How to Choose Between Manual Trading and Automated Signals

Here’s the thing – I spent my first two years in crypto jumping between manual trading and automated signals like a ping pong ball. One week I’d be glued to my charts at 3 AM, convinced I was the next Warren Buffett. The next week I’d throw my hands up and let signals do everything. Total mess.

The breakthrough came when I realized this isn’t an either-or decision. Your trading strategy selection should match where you are right now, not where you think you should be.

Start with an honest risk assessment of yourself (not just your portfolio). Can you handle watching a trade go red without panic-selling? I couldn’t for the longest time. My hands would get sweaty, and I’d close profitable positions way too early. If you’re nodding along, automated signals might be your friend while you build that emotional muscle.

Next, get crystal clear on your trading goals. Are you trying to replace your day job income? Build a side hustle? Or just grow your savings faster than a bank account? I made the mistake of using a scalping strategy when my goal was long-term wealth building. Wrong tool for the job.

If you’re working full-time like I was, manual trading is honestly brutal. I remember missing a massive ETH breakout because I was stuck in a meeting. Meanwhile, my buddy’s automated setup caught the same move and banked 15%. That stung.

But here’s where it gets interesting – hybrid trading changed everything for me. I use automated signals for my bread-and-butter trades, the ones that happen when I’m sleeping or working. Then I reserve manual trading for special setups I’ve studied extensively.

Think of it like cooking. You might use a slow cooker for your weekday meals (automated), but still cook a fancy dinner manually on weekends. Both have their place.

For beginners, I’d honestly recommend starting with 80% automated signals and 20% manual trades. Learn from the signals – why did they enter here? What was the risk management? Treat it like a masterclass you’re paying for anyway.

As you gain experience, you might flip that ratio. Or maybe you discover you’re actually better at spotting entries than exits, so you use signals for profit-taking while handling entries manually.

The key is being brutally honest about your strengths and weaknesses. I’m great at research but terrible at timing. Knowing this shaped my entire approach and probably saved me thousands in losses.

Conclusion

After years of bouncing between pure manual trading and fully automated systems, I’ve learned that the best approach isn’t choosing one or the other—it’s finding your sweet spot somewhere in between. The whole manual vs automated debate reminds me of asking whether a hammer or screwdriver is better. They’re both tools, and the right one depends on what you’re trying to build.

Here’s what I wish someone had told me when I started: your trading approach should evolve with your life circumstances. When I was single and glued to my screens 12 hours a day, manual trading felt natural. I could handle trading session optimization across different time zones, making real-time adjustments based on market hours consideration. But once kids came into the picture? Yeah, that changed everything.

The beauty of today’s technology is that you don’t have to choose just one path. I’ve seen traders successfully combine manual analysis for major decisions with cryptocurrency trading signals for their smaller, more frequent trades. Others use forex automated systems during Asian sessions while manually trading US hours. Some focus their manual efforts on stock trading algorithms while letting futures trading bots handle the overnight moves.

What really matters is matching your strategy to your lifestyle and goals. If you’re working a 9-to-5 but want exposure to options trading automation, that makes perfect sense. If you love analyzing seasonal trading patterns but hate waking up at 4 AM for London open, commodity signal services might fill that gap perfectly.

I’ve watched too many traders fail because they tried to force themselves into the wrong approach. The day trader who insisted on manual execution despite traveling constantly. The busy parent who felt guilty for using automation instead of “learning properly.” The retiree who thought automated signals were “cheating” and burned out trying to monitor ETF trading strategies all day.

Your trading success isn’t measured by how “pure” your approach is—it’s measured by consistent profitability and sustainable habits. Whether you’re exploring index trading approaches, implementing sector rotation strategies, or testing market neutral strategies, the key is finding what actually works for your situation.

Start small, test different combinations, and be honest about what you can realistically maintain long-term. Consider factors like weekend gap strategies and holiday trading adjustments when planning your approach. Some traders thrive on the adrenaline of manual execution, others sleep better knowing their automated systems are handling the heavy lifting.

Start Your Free Trial to explore how automated signal solutions can complement whatever trading style you choose. The goal isn’t to replace your judgment—it’s to amplify your strengths and cover your weaknesses. Your future trading success depends on building a system that works with your life, not against it.

Leave a Comment