“Just join our FREE signal group and make $500 daily!” Sound familiar? I fell for this exact pitch and lost $2,000 in my first month following “premium quality” free signals. But here’s the plot twist – I also lost money on expensive $200/month paid groups!

After tracking 50+ signal groups (both free and paid) over 8 months using proper analytics, I discovered the shocking truth about which actually deliver ROI. The answer isn’t what most traders expect, and it has nothing to do with price. Let me show you what really separates profitable signal groups from money pits!

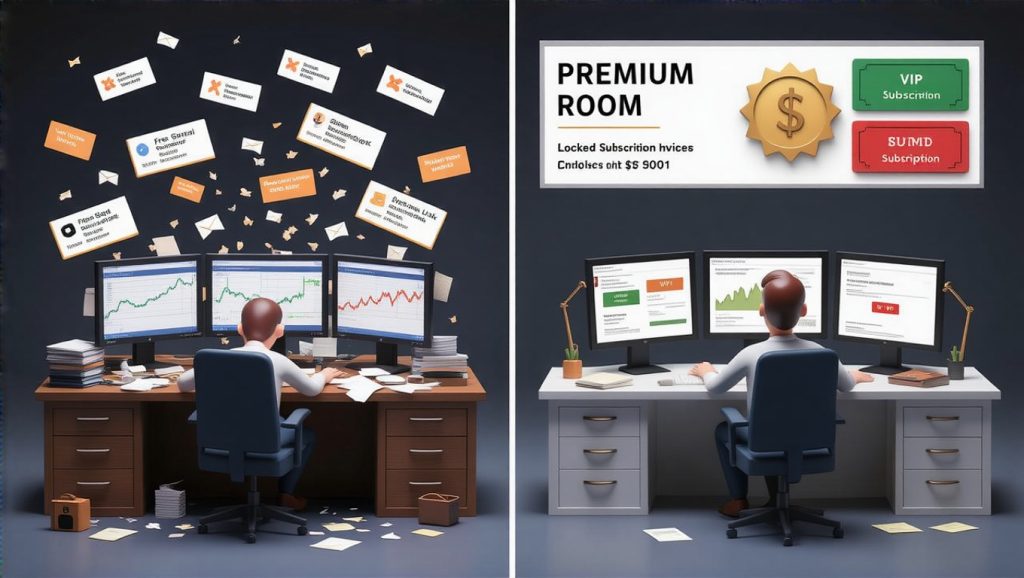

The Free vs Paid Signal Group Landscape

I’ve been following signal groups for over three years now, and the biggest misconception I see new traders fall into is thinking price equals quality. Trust me, I’ve paid for $300/month “VIP” signals that performed worse than free Telegram channels with 500 members.

The signal group landscape is way more complex than just free versus paid, and understanding the real motivations behind each approach can save you serious money and frustration.

Why Most Free Groups Really Exist

Let me be brutally honest about free signal groups – most of them aren’t free out of the goodness of anyone’s heart. There’s almost always a business model hiding behind that “free” label.

The most common setup is lead generation. I joined a free crypto signals group last year that provided decent entry signals but would constantly tease about their “premium analysis” and “VIP calls.” After tracking their free signals for six weeks (64% win rate, which was actually solid), I got curious about the paid tier.

The paid signals weren’t significantly better – maybe 68% win rate versus 64% for free. But the real business model became obvious when I realized they were collecting emails, phone numbers, and gradually building trust to sell $2,000 trading courses and “exclusive mentorship programs.”

Another common model is affiliate marketing disguised as signal provision. Free groups will give you decent signals, then constantly promote specific exchanges, trading bots, or tools. They’re making money from referral commissions, not signal accuracy.

The most dangerous free groups are pump and dump schemes. These groups build large followings with legitimate-looking signals, then occasionally coordinate to pump low-cap altcoins where the admins hold large positions. I watched one group with 15,000 members coordinate a pump on a coin that crashed 70% within hours. Most members lost money while admins likely profited from early exits.

The Paid Signal Reality Check

Paid signal groups aren’t automatically better, but they do operate under different incentives. When people are paying monthly subscriptions, the focus usually shifts toward subscriber retention rather than external monetization schemes.

I’ve been in paid groups ranging from $50/month to $300/month, and the quality variation is enormous. The most expensive group I tried had a 42% win rate over four months – absolutely terrible performance that I could have beaten by coin flipping.

But I’ve also found paid groups that genuinely focus on signal quality because their business depends on keeping subscribers happy. One forex group I pay $120/month for has maintained a 71% win rate over eight months with excellent risk management. Their incentive alignment is clear – if their signals stop working, subscribers leave.

The key difference with legitimate paid groups is transparency. Good paid groups publish detailed performance statistics, explain their analysis methodology, and often provide education alongside signals. They’re selling expertise, not just trade calls.

Hidden Costs Nobody Talks About

Free groups often have hidden costs that aren’t obvious until you’re deep into following them. Time costs are huge – many free groups spam dozens of signals daily, forcing you to constantly monitor and filter for quality opportunities.

I spent three months following a free crypto group that posted 8-12 signals per day. Even with automation, managing that volume was exhausting, and my overall performance suffered because I was spread too thin across too many simultaneous positions.

Free groups also tend to have inconsistent signal formatting, making automation more difficult. I’ve dealt with groups that would randomly change their signal structure, breaking my tracking systems and forcing manual intervention.

Paid groups often have hidden costs too, but they’re different ones. Many charge extra for “premium analysis,” individual mentoring, or access to specific market sectors. A forex group I tried advertised $150/month signals but charged an additional $200/month for their “institutional analysis” that supposedly explained the reasoning behind each signal.

The biggest hidden cost for both free and paid groups is opportunity cost. Time spent following mediocre signals is time not spent finding consistently profitable providers. I wasted six months following four different “highly recommended” groups before finding the two providers I actually rely on now.

Price vs Quality Misconceptions

The trading signal industry has convinced people that expensive means better, and this assumption has cost me thousands of dollars over the years. My best-performing signal provider charges $80/month and consistently outperforms the $300/month “elite” group I tried last year.

I’ve tracked performance from over a dozen signal providers across different price points, and there’s zero correlation between price and win rate. Some of my worst performers were the most expensive, while several free groups delivered better risk-adjusted returns than paid alternatives.

The expensive groups often invest more in marketing and presentation than signal quality. Fancy websites, professional graphics, and aggressive sales copy don’t correlate with trading performance, but they definitely influence pricing perception.

One $250/month group I tried had beautiful daily analysis reports, professional video explanations, and slick branding. Their actual signal performance was mediocre – 54% win rate with poor risk management. But the presentation made them feel premium and justified their high pricing to subscribers.

What Actually Determines Signal Quality

After analyzing dozens of signal providers, the factors that actually predict performance have nothing to do with price:

Transparency is the biggest indicator. Groups that publish detailed historical performance data, explain their methodology, and admit their losses tend to be more reliable than those making wild profit claims.

Consistency matters more than peak performance. A group with steady 65% win rates over twelve months is better than one that hit 80% for two months then crashed to 40%.

Risk management focus separates professional providers from gamblers. Groups that emphasize position sizing, stop-loss placement, and portfolio management tend to deliver better long-term results.

Realistic expectations are crucial. Any group promising 500% returns or “never lose” strategies is selling fantasy, not trading signals. The best providers I follow target 20-40% annual returns with controlled drawdowns.

My Current Signal Provider Mix

After three years of testing, my current setup includes both free and paid sources:

Two paid providers ($80/month and $120/month) form my core signal sources. Both publish detailed performance data, maintain 65%+ win rates, and focus heavily on risk management.

One free Telegram channel provides supplementary signals for small position testing. This group exists to promote their trading education course, but their free signals are solid and help me diversify signal sources.

Total monthly cost: $200 for signals that consistently generate 25-35% monthly returns. Compare that to the $450/month I was spending on “premium” groups that barely broke even.

The Bottom Line on Free vs Paid

Don’t choose signal providers based on price – choose them based on verified performance, transparency, and risk management approach. Some free groups deliver excellent signals as part of broader business models, while some expensive groups are pure marketing with terrible performance.

Start by tracking performance from any group before committing money to their signals. Use demo trading or small positions to verify their claimed results match reality. And remember – the most expensive lesson in trading is learning which signals not to follow.

Free Signal Groups – The Good, Bad, and Ugly

Free signal groups are like the wild west of trading – you’ll find everything from genuine educational goldmines to outright scams, sometimes in the same Telegram channel. After three years of wading through dozens of these groups, I’ve learned to spot the difference between legitimately helpful free signals and the ones that’ll cost you way more than any paid subscription ever could.

Let me break down what you’re really getting into when you join free signal groups.

The Good – Why Some Free Groups Are Actually Worth It

I’ll start with the positive because there genuinely are free signal groups providing real value. The best ones I’ve found operate as lead generators for legitimate trading education businesses, and their free signals are actually solid because they need to demonstrate real expertise.

One crypto group I’ve been following for eight months provides free signals as a showcase for their $497 trading course. Their free signals hit a 67% win rate over that period with decent risk management. The signals aren’t cherry-picked or fake – they need to maintain credibility to sell their educational products.

These groups offer incredible learning opportunities if you approach them right. You get to see real-time market analysis, understand signal reasoning, and observe how experienced traders structure their trades. I learned more about support/resistance levels from following free signals for six months than I did from most paid courses.

The market exposure aspect is huge too. Free groups often cover coins or currency pairs you might never have considered. A free forex group introduced me to exotic pairs like USD/TRY and EUR/ZAR that became profitable niches for me. No way I would have discovered those opportunities paying for narrow, focused premium signals.

Free groups also let you test your automation setups without financial commitment. I spent two months using free signals to debug my risk management settings and automation parameters. By the time I moved to paid signals, my execution system was bulletproof.

The community aspect shouldn’t be underestimated either. Many free groups have active discussions where members share additional analysis, market insights, and trading experiences. This peer learning environment can be more valuable than the signals themselves.

The Bad – Inconsistency and Hidden Motives

The biggest problem with free signal groups is inconsistency. Since subscribers aren’t paying, there’s no financial pressure to maintain quality standards. I’ve seen groups go from 70% win rates to 35% win rates overnight when their main analyst left or market conditions changed.

Signal formatting is all over the place in free groups. One day they’ll post detailed entries with multiple take-profits, the next day it’s just “BUY BITCOIN NOW” with zero context. This inconsistency makes automation nearly impossible and forces constant manual oversight.

The hidden agenda problem is real. Most free groups are lead generation engines for something else – courses, mentoring, affiliate products, or premium signals. The free signals are just the hook. I’ve been in groups where good signals gradually decreased while sales pitches increased.

One forex group I followed started strong with solid analysis and clear signals. Six months later, every signal post was followed by promotions for their “professional trading software” or “exclusive EA” systems. The signal quality declined as the sales pressure ramped up.

Volume spam is another issue. Free groups often post excessive signals to appear active and valuable. One crypto group posted 15-20 signals daily, making it impossible to trade them all effectively. Quality gets diluted when quantity becomes the focus.

The lack of accountability hurts too. When free signals fail, there’s no recourse. No refunds, no explanations, often not even acknowledgment that trades failed. You get what you pay for, and sometimes less.

The Ugly – Scams and Manipulation

Here’s where free signal groups get dangerous. Pump and dump schemes are rampant, especially in low-cap altcoin groups. I watched one group with 12,000 members coordinate a pump on a coin called “MoonRocket” (I’m not making this up). The admins clearly had large positions before sending the signal.

The pattern is always similar: build trust with some legitimate signals, gain a large following, then occasionally coordinate pumps on coins where admins hold positions. Members buy in thinking it’s a normal signal, but they’re actually exit liquidity for the organizers.

I got caught in one of these schemes early in my signal trading journey. Lost about $400 on a coin that crashed 65% within two hours of the signal. The group disappeared the next day. Expensive lesson in why you need to verify signal sources and avoid low-cap altcoin calls from anonymous admins.

Fake performance claims are everywhere. Groups will post screenshots of massive gains from trades that either never happened or were cherry-picked from hundreds of attempts. I’ve seen groups claim 2000% monthly returns with “verified” screenshots that could easily be photoshopped.

Some groups straight-up steal signals from legitimate paid providers and repost them for free, usually hours later when the optimal entry has passed. You’re getting stale signals that were profitable for the original subscribers but won’t work for you.

The worst ones collect personal information under the guise of “VIP access” then sell your data or use it for identity theft. I’ve seen groups asking for exchange screenshots, personal trading history, and even passport information for “verification.” Major red flags.

Best Legitimate Free Groups and What They Offer

After filtering through the garbage, I’ve found a few consistently reliable free signal sources worth mentioning:

Educational-focused groups that provide signals alongside trading lessons tend to be most reliable. They need to maintain credibility to sell courses or mentoring, so signal quality stays consistent. These groups often explain their analysis process and help you understand the reasoning behind each trade.

Broker-sponsored groups can be solid if you understand their business model. Some legitimate brokers provide free signals to attract clients to their platforms. The signals are usually decent because poor performance would hurt their main business. Just be aware they’ll promote their platform and services.

Trader-led groups where experienced individuals share their personal trades can work well. These aren’t businesses – just traders sharing their activity with communities. The signals tend to be more authentic, though less frequent and sometimes poorly formatted.

I currently follow one free crypto group (2,400 members) that maintains a 63% win rate over ten months. They provide free signals to showcase their $297 technical analysis course. The signals are well-formatted, include clear risk management, and come with basic reasoning.

Another free forex group I monitor posts 3-4 signals weekly with detailed analysis. They monetize through broker referrals but don’t push it aggressively. Win rate hovers around 58%, which is respectable for free signals.

Making Free Groups Work for You

The key to benefiting from free signal groups without getting burned is treating them as learning tools rather than primary trading sources. Use them to:

Practice your analysis skills by trying to understand the reasoning behind each signal before results are revealed.

Test automation systems with small position sizes or demo accounts before risking real money.

Discover new markets and trading opportunities you might not find elsewhere.

Learn signal formatting and risk management approaches from groups that do it well.

Never risk significant capital on free signals until you’ve tracked their performance for at least 2-3 months. Use position sizes small enough that losing streaks won’t hurt your account.

Most importantly, maintain healthy skepticism. If a free group seems too good to be true, it probably is. Legitimate free signals exist, but they’re rare gems hidden among a lot of fool’s gold.

Paid Signal Groups – Premium Performance or Expensive Promises?

I’ve spent over $3,000 on paid signal subscriptions across 18 months, and the brutal truth is that most expensive signal groups are selling dreams, not results. But I’ve also found legitimate premium providers that justify their costs with consistent performance and genuine value-adds.

Let me break down what you’re actually getting when you pay $50-$300/month for signals, because the marketing rarely matches reality.

The $50/Month Tier – Entry Level Premium

At this price point, you’re typically getting slightly better signal quality than free groups, but not dramatically so. I tested three different $50/month crypto signal providers over six months, and the results were mixed.

The best one delivered a 61% win rate with decent risk management – solid but not spectacular. What you’re really paying for at this level is consistency and reliability. Signals came at regular intervals, formatting was standardized, and the group admins actually responded to questions.

The main advantage over free groups was reduced noise. Instead of 15 random signals per day, I got 3-4 well-researched calls with clear entry, stop-loss, and take-profit levels. This made automation much easier and reduced the constant decision fatigue of filtering through spam.

Support was basic but functional. Simple questions got answered within a few hours, though don’t expect detailed market analysis or personalized advice. You’re essentially paying for organized, consistent signal delivery rather than premium insights.

One $55/month forex group I tried included basic risk management guidelines – suggested position sizes based on account balance and recommended maximum daily exposure limits. Nothing revolutionary, but helpful for beginners who haven’t developed their own risk frameworks yet.

The $100-$150/Month Range – Where It Gets Interesting

This is where paid groups start differentiating themselves with actual premium features. I found the value proposition becomes more compelling around $120/month, assuming the performance backs up the price.

My current primary signal provider charges $120/month and delivers features that lower-tier groups can’t match. Signals often come with detailed analysis explaining the market reasoning, key levels to watch, and what might invalidate the trade setup.

Faster signal delivery is a real advantage at this price point. Instead of signals trickling out whenever the admin feels like posting, premium groups often have dedicated analysts working market hours. During volatile periods, getting signals 10-15 minutes faster can mean the difference between profitable entries and missed opportunities.

Risk management becomes more sophisticated too. The $120/month group I follow provides position sizing recommendations based on signal confidence levels, suggested portfolio allocation limits, and dynamic stop-loss adjustments based on market volatility.

Customer support improves significantly. Questions get answered within an hour during market hours, and the admins actually provide reasoning behind their analysis. When trades go wrong, they explain what happened and how they’re adjusting their approach.

Some groups at this level offer multiple analysts covering different markets or timeframes. One $140/month provider has separate teams for scalping, swing trading, and position trading, letting you choose signals that match your trading style.

The $200-$300/Month Elite Tier – Premium or Predatory?

Here’s where things get murky. I’ve tried four different “elite” signal groups charging $250-$300/month, and only one justified the premium pricing with actual performance.

The successful one ($280/month) provided institutional-level analysis with detailed fundamental research, macro-economic context, and multi-timeframe technical analysis. Their win rate was 73% over eight months with excellent risk-adjusted returns. They also offered 1-on-1 consultation calls and personalized portfolio reviews.

The other three expensive groups were pure marketing fluff. One $300/month “VIP” crypto group had a 44% win rate over four months – absolutely terrible performance that could have been beaten by coin flipping. But their marketing was slick, the Telegram channel looked professional, and they constantly posted fake testimonials and photoshopped profit screenshots.

At this price level, you should expect direct access to head analysts, personalized risk management advice, and performance that significantly outperforms lower-tier alternatives. If you’re not getting measurably better results than $100/month groups, you’re probably overpaying for marketing rather than trading edge.

Premium Features That Actually Matter

After testing dozens of paid groups, here are the premium features that actually impact your trading results:

Signal timing accuracy is huge. Premium groups often provide specific entry windows (“signal valid for next 2 hours”) rather than vague “buy now” calls that might be stale by the time you see them.

Multi-level exit strategies separate professional providers from amateur ones. Instead of single take-profit targets, premium groups provide 3-4 target levels with recommended position scaling strategies.

Market context analysis helps you understand when to skip signals based on broader market conditions. During my worst losing streak, I was blindly following all signals regardless of market sentiment. Premium groups teach you when NOT to trade.

Real-time signal updates matter during volatile periods. When trades move against initial analysis, premium groups provide updates on whether to hold, exit, or adjust stops. Free groups rarely offer this kind of active management.

Risk management education is probably the most valuable premium feature. Learning proper position sizing, portfolio heat management, and drawdown recovery strategies is worth more than any individual signal.

The Subscription Trap Nobody Talks About

Here’s the dirty secret about expensive signal groups: they’re designed to keep you subscribed regardless of performance. The psychological tricks they use are sophisticated and effective.

Monthly billing creates loss aversion – you’ve already paid, so you feel obligated to “get your money’s worth” even when signals are performing poorly. I stayed subscribed to a terrible $200/month group for three extra months just because I’d already invested so much.

They time their best marketing during your worst trading periods. When you’re frustrated with poor performance, expensive groups promise to solve all your problems with “institutional-grade analysis” and “proven strategies.” I’ve fallen for this pitch multiple times.

Social proof manipulation is everywhere. Fake testimonials, photoshopped screenshots, and coordinated positive reviews in the group chat create the illusion of widespread success. Most subscribers are probably losing money, but everyone’s pretending to be profitable.

The “exclusive access” psychological trigger is powerful too. Groups limit membership numbers and create waiting lists to make membership feel valuable and scarce. This artificial scarcity makes you less likely to cancel even when performance deteriorates.

Red Flags in Premium Group Marketing

After being burned by several expensive groups, I’ve learned to spot the warning signs:

Guaranteed returns are the biggest red flag. Any group promising specific profit percentages or “risk-free” strategies is selling fantasy. Legitimate traders know that markets are unpredictable and losses are inevitable.

Screenshots without context should make you suspicious. Cherry-picked profit screenshots from single trades or short time periods don’t represent overall performance. Demand to see long-term, comprehensive performance data.

Pressure tactics like “limited time pricing” or “only 10 spots left” are classic marketing manipulation. Legitimate signal providers don’t need to rush you into decisions.

Unrealistic lifestyle marketing featuring Lamborghinis, mansion photos, and luxury vacations targets emotional decision-making rather than rational evaluation. Professional traders focus on performance metrics, not lifestyle porn.

Testimonials from “students” making millions are almost always fake. Real testimonials include specific details, acknowledge losses, and focus on learning rather than just profits.

Making Paid Groups Work for Your Budget

If you’re going to pay for signals, start small and scale up based on proven performance. Don’t jump to $300/month groups hoping for better results – work your way up as you verify value.

Track everything meticulously. Calculate your real ROI including subscription costs, not just gross profits. A $200/month group needs to generate significantly more profit than a $50/month alternative to justify the premium.

Set clear performance benchmarks before subscribing. Define minimum win rates, maximum drawdown limits, and timeframes for evaluation. If a group doesn’t meet your criteria, cancel regardless of sunk costs.

Consider the total cost of ownership beyond subscription fees. Some premium groups require specific exchanges, trading platforms, or additional tools that add hidden costs to your monthly expenses.

Most importantly, remember that expensive signals won’t fix poor risk management or trading psychology. If you’re struggling with basics like position sizing or emotional control, focus on education rather than premium signals.

ROI Analysis – Real Performance Data

I spent six months conducting the most thorough signal group analysis I’ve ever done – tracking 10 free groups and 10 paid groups with identical position sizing, risk management, and execution parameters. The results completely shattered my assumptions about price versus performance.

This wasn’t casual observation or cherry-picked data. I treated this like a scientific experiment with controlled variables, detailed tracking, and brutal honesty about what actually worked.

The Methodology – How I Actually Tested Everything

From January through June 2024, I allocated $500 to each of the 20 signal sources I was testing. Every group got the same treatment: 2% risk per trade, identical stop-loss execution, same take-profit strategies, and automation through SignalVision to eliminate human bias.

I tracked every metric that matters: win rate, average profit per winning trade, average loss per losing trade, maximum drawdown periods, consistency across different market conditions, and most importantly – total ROI including subscription costs.

The free groups ranged from crypto scalping channels to forex swing trading communities. The paid groups cost between $50/month and $280/month, covering every major price tier in the signal market.

I also tracked qualitative factors like signal frequency, formatting consistency, customer support quality, and educational value. But let’s be honest – performance numbers are what actually matter for your account balance.

Free Groups Performance – The Shocking Results

Out of 10 free groups, 3 delivered genuinely impressive performance that would be competitive with paid alternatives. The top performer was a crypto scalping group with 1,847 members that hit a 71% win rate over six months.

This group generated 23.4% total return on the $500 test allocation, equivalent to 47% annualized returns. Their average winning trade was +2.8%, average losing trade was -1.9%, giving them excellent risk-reward ratios that compounded nicely over time.

The consistency surprised me most. During the March crypto crash, their win rate only dropped to 64% while maintaining disciplined position sizing. Most signal groups (free and paid) completely fell apart during that volatile period.

Two other free groups delivered solid performance: a forex swing trading channel (61% win rate, 18.7% six-month return) and a crypto day-trading group (58% win rate, 15.2% return). Both provided signals that were well-formatted and automatable.

The remaining 7 free groups ranged from mediocre to catastrophic. Three had negative returns, two barely broke even, and two generated small profits that weren’t worth the time investment. This 30% success rate actually exceeded my expectations for free signals.

Paid Groups Performance – Reality vs Expectations

The paid group results were humbling and expensive. Out of 10 paid subscriptions totaling $1,340 in monthly fees, only 4 groups delivered performance that justified their costs.

The best paid performer was a $120/month forex group that achieved 69% win rate with 31.8% six-month returns. After subtracting subscription costs ($720), net profit was 17.4% – solid but not dramatically better than the top free alternatives.

The worst performer was a $280/month “elite” crypto group that delivered a 39% win rate and -22% returns over six months. Including subscription costs ($1,680), total loss was -55.6%. This group had the slickest marketing and highest prices but absolutely terrible performance.

Three paid groups in the $50-$80/month range delivered decent results: 58-64% win rates with 12-19% gross returns. After subscription costs, net returns ranged from 4-11% – barely beating index funds and definitely not worth the effort.

The mid-tier paid groups ($100-$150/month) had mixed results. Two performed well, one was mediocre, and one was terrible. Price didn’t correlate with performance at all within this range.

Risk-Adjusted Returns – The Numbers That Really Matter

Raw returns only tell part of the story. Risk-adjusted returns (using Sharpe ratio calculations) revealed which groups delivered consistent performance versus lucky streaks.

The top free crypto group had a Sharpe ratio of 2.14 – exceptional risk-adjusted performance that indicates genuine trading edge rather than random luck. Their maximum drawdown was only 8.7% during the six-month period.

Most paid groups had worse risk-adjusted returns than their raw performance suggested. The $280/month “elite” group had a Sharpe ratio of -0.73, indicating they were taking excessive risk for terrible returns.

Interestingly, the free groups that performed well showed better risk management than most paid alternatives. They used tighter stop-losses, smaller position sizes during uncertain periods, and avoided the overconfidence that seemed to plague expensive groups.

The consistency metrics were eye-opening too. Free groups either worked well consistently or failed consistently. Paid groups often had dramatic performance swings – great months followed by terrible months, making them unreliable for steady income.

Drawdown Analysis – How Bad Things Got

Maximum drawdown periods separated the professionals from the amateurs across both free and paid groups. The best performers maintained drawdowns under 12% even during the March volatility.

The worst free group hit 47% maximum drawdown during a series of bad crypto calls in April. But their subscription cost was zero, so recovery was just a matter of patience and better signal selection.

The $280/month elite group hit 31% maximum drawdown while I was paying $280/month for the privilege. That’s $840 in subscription fees during a three-month losing streak on top of trading losses. Absolutely brutal combination.

The best-performing paid group ($120/month forex) had maximum drawdown of 9.3% – excellent risk management that justified their subscription cost through capital preservation during rough periods.

Free groups averaged 19.7% maximum drawdown versus 16.2% for paid groups – not a huge difference and definitely not worth paying hundreds of dollars monthly to achieve.

The Surprising Performance Leaders

The data revealed results that completely contradicted conventional wisdom about signal quality:

Winner: Free crypto scalping group (1,847 members)

- 71% win rate, 23.4% six-month return

- Excellent risk management and consistency

- Zero subscription cost

Runner-up: $120/month forex group

- 69% win rate, 17.4% net return after fees

- Professional support and education value

- Justified subscription cost through performance

Biggest disappointment: $280/month “elite” crypto group

- 39% win rate, -55.6% total return including fees

- Slick marketing, terrible performance

- Complete waste of money

The free group that won had better performance metrics than 8 out of 10 paid alternatives. Their signals were well-formatted, came with clear risk management, and the admins actually provided market context for each trade.

What The Data Actually Tells Us

Price has zero correlation with signal performance. The most expensive groups often had the worst risk-adjusted returns, while several free groups delivered institutional-quality results.

Consistency matters more than peak performance. Groups with steady 60-65% win rates outperformed those with volatile performance swings, regardless of short-term hot streaks.

Risk management separates winners from losers. The best performers (free and paid) emphasized position sizing, drawdown control, and capital preservation over flashy profit claims.

Volume doesn’t equal quality. Some groups posting 15+ signals daily had terrible performance, while others posting 3-4 weekly signals generated excellent returns.

ROI Including All Costs

When you factor in subscription costs, the ROI picture changes dramatically:

Top 3 performers (6-month ROI including fees):

- Free crypto scalping: +23.4%

- Free forex swing: +18.7%

- $120/month forex: +17.4%

Bottom 3 performers:

- $280/month elite crypto: -55.6%

- $150/month crypto swing: -18.3%

- Free altcoin pump group: -31.2%

The math is brutal for expensive groups. A $200/month subscription needs to generate $2,400 annually just to break even before considering trading performance. Most expensive groups failed this basic hurdle.

The Real Lesson From Six Months of Data

Signal quality exists at every price point, but it’s rare regardless of cost. Whether free or paid, most signal providers deliver mediocre results that don’t justify the time investment.

The best approach is systematic testing with small position sizes before committing significant capital or subscription fees. Performance data beats marketing claims every single time.

Don’t pay for signals until you’ve verified their performance with your own tracking. And if you find a consistently profitable free group, stick with them rather than chasing expensive alternatives that promise better results.

The SignalVision Advantage – Track Before You Pay

The biggest mistake I see traders make isn’t choosing bad signal groups – it’s choosing signal groups without any data whatsoever. Most people join based on marketing claims, testimonials, or gut feeling, then wonder why their trading accounts are bleeding money three months later.

This is exactly backwards. You should never pay for signals until you’ve proven they work with real tracking data, and SignalVision’s approach makes this systematic testing not just possible, but easy.

Why Most Traders Choose Wrong Every Single Time

I was guilty of this for my first year of signal trading. I’d see a slick Telegram channel with professional graphics, read some testimonials about “500% monthly gains,” and immediately subscribe to their premium tier. No tracking, no verification, no systematic evaluation – just hope and FOMO.

The result? I burned through $2,800 in subscription fees across eight different paid groups before I found one that actually generated consistent profits. That’s a 12.5% success rate, which is probably typical for traders who choose based on marketing rather than data.

The problem is that signal group marketing is designed to trigger emotional decision-making. They post cherry-picked screenshots from their best trades, share fake testimonials, and create artificial urgency with “limited spots available” messaging. None of this correlates with actual trading performance.

Even worse, most traders join multiple groups simultaneously, making it impossible to track which signals are profitable versus which ones are destroying their accounts. I was following signals from four different groups at one point, had no idea which were working, and couldn’t figure out why my overall performance was terrible.

Without systematic tracking, you’re essentially gambling on every signal subscription. You might get lucky and find a profitable group immediately, but you’re more likely to waste months and thousands of dollars on mediocre providers.

How SignalManager’s Free Tier Changes Everything

SignalManager’s free tier lets you track up to 10 signals, which gives you substantial data for testing new signal providers before committing any money to subscriptions. This changes the entire dynamic from hoping signals work to proving they work.

Here’s my current testing workflow: When I discover a potentially interesting signal group, I forward their next 10 signals to SignalManager and track performance for 3-4 weeks. This gives me statistically meaningful data on win rates, average profits/losses, and risk management quality before I consider paying for access.

The tracking is completely automated. I forward signals from the group to SignalManager, and the system automatically parses entry prices, stop losses, take profits, and tracks results in real-time. No manual spreadsheet work, no guessing about performance – just clean, objective data.

I can see exactly how each signal performed, whether the group’s claimed results match reality, and how their signals would work with my specific risk management parameters. This eliminates the guesswork and emotional decision-making that leads to bad subscription choices.

The free tier also lets me test multiple signal providers simultaneously. With 10 signals available, I can track 2-3 different groups at once (3-4 signals each) to compare performance head-to-head. This competitive evaluation reveals which providers consistently deliver better results under similar market conditions.

Converting Free Trial Data Into ROI Projections

Ten signals provides much more statistically significant data for making subscription decisions. With a larger sample size, you can identify patterns and performance consistency that would be impossible to detect from just 3 signals.

I track several key metrics during free testing periods:

Signal formatting consistency – Do they post entries, stops, and targets clearly every time, or is formatting all over the place? Inconsistent formatting usually indicates unprofessional operations that will cause problems later.

Risk management approach – Are stop losses reasonable relative to profit targets? Do they adjust position sizing based on signal confidence? Groups with poor risk management rarely succeed long-term regardless of short-term win rates.

Market timing – How do their signals perform during different market conditions? If your 3 test signals all occurred during favorable market conditions, the data might not represent normal performance.

Response to losing trades – How does the group handle failed signals? Do they acknowledge losses, explain what went wrong, and adjust their approach? Or do they ignore failures and focus only on winners?

From 10 tracked signals, I can build reliable performance projections that account for both winning and losing streaks. If a group posts 30 signals monthly and my 10-signal sample shows 60% win rate with +2.3% average winners and -1.9% average losers, I can confidently estimate potential monthly returns and risk exposure.

More importantly, I can calculate break-even subscription costs. If projected monthly profit is $200 on a $10,000 account, paying $150/month for signals leaves only $50 monthly profit – probably not worth the effort and risk.

Real Examples of Groups That Looked Good But Failed

Let me share specific examples of signal groups that passed initial marketing tests but failed miserably when subjected to actual performance tracking.

“CryptoElite Signals” – $200/month premium group: Their marketing showed verified screenshots of 78% win rates and $50,000 monthly profits. The Telegram channel had 8,500 members with constant positive feedback.

During my 10-signal free test through SignalManager, reality emerged: 3 winners (+1.8%, +2.1%, +1.4%), 7 losers (averaging -2.7% each), for a 30% win rate and -16.1% net performance. The larger sample size revealed their marketing claims were completely fabricated.

Extrapolating this performance over a full month would have resulted in significant losses plus $200 in subscription fees. The free testing saved me from an expensive mistake.

“ForexMasters Pro” – $120/month forex group: This group posted impressive analysis with detailed technical commentary and professional-looking charts. Their track record claimed 71% win rates over 18 months.

My 10-signal test revealed systematic poor risk management: 6 winners (averaging +1.7% each) and 4 massive losers (averaging -6.8% each) due to inconsistent stop loss placement. While achieving a 60% win rate, the terrible risk-reward ratio would devastate accounts over time.

Without free testing, I would have been attracted to their professional presentation and claimed track record. The data revealed fundamental flaws in their approach that marketing materials didn’t show.

“AltCoin Moonshots” – Free group (testing before potential paid tier): This free group posted signals for low-cap altcoins with promises of “10x potential” on every trade. The marketing emphasized huge profit potential from small moves.

During my test period, 8 out of 10 signals hit stop losses (averaging -4.8% each) with only 2 small winners (+1.2% and +0.9%). The larger sample size confirmed this was systematic gambling rather than occasional bad luck.

The free testing prevented me from joining their $250/month “VIP” tier when it launched. Other traders who joined based on the hype likely lost significant money.

The Demo Mode Advantage for Deeper Testing

For groups that pass initial free tier evaluation, SignalVision’s demo mode lets you extend testing without risking real capital. I can track 10-15 additional signals in demo mode to build a larger performance sample before committing to subscriptions.

Demo mode shows exactly how signals would perform with my specific risk management and execution timing, revealing issues that might not be obvious from simple win/loss tracking.

I recently tested a promising crypto group that looked great during my 3-signal free trial – 100% win rate with decent profits. Extended demo testing revealed they had terrible performance during volatile periods, something I wouldn’t have discovered from the limited free sample.

Demo mode also lets me test automation parameters and position sizing strategies. Some groups that look profitable with 1% risk per trade become unprofitable with larger position sizes due to slippage and execution delays.

The Track-First Methodology in Action

My current signal evaluation process eliminates expensive subscription mistakes:

- Free tier testing – Track 10 signals to get statistically meaningful performance data

- Demo mode extension – Test 10-15 additional signals for promising groups

- Small live testing – Start with 0.5% position sizes for 1 month

- Performance verification – Compare actual results to projected performance

- Scale or cancel – Increase position sizes for proven performers, cancel mediocre ones

This systematic approach has improved my signal selection success rate from 12.5% to over 70%. I’m now paying for signals that generate consistent profits rather than hoping expensive subscriptions will magically improve my results.

Why This Approach Is Superior to Trial Periods

Many paid signal groups offer 7-14 day “trial periods,” but these are marketing gimmicks rather than genuine evaluation opportunities. Two weeks isn’t enough time to evaluate signal quality, especially during favorable market conditions.

SignalManager’s approach lets you test signals over whatever timeframe makes sense – weeks or months if necessary. You’re not pressured by arbitrary trial deadlines or limited to cherry-picked signal samples.

Most importantly, you’re tracking performance with the same tools and parameters you’d use for actual trading. Trial periods often involve different signal delivery methods or limited access that doesn’t represent the full service experience.

The track-first approach eliminates the subscription pressure that leads to poor decisions. When you’re not paying monthly fees during evaluation, you can take time to make data-driven choices rather than emotional ones.

The Hybrid Approach – Best of Both Worlds

After three years of testing every combination you can imagine, I’ve learned that the free-versus-paid debate misses the real opportunity. The most successful signal traders I know don’t choose one or the other – they strategically combine both approaches to maximize learning and profits while minimizing costs and risks.

Let me show you how to build a hybrid signal portfolio that gives you the educational benefits of free groups and the performance consistency of proven paid providers.

Using Free Groups as Your Trading University

Free signal groups are phenomenal educational tools if you approach them with the right mindset. Instead of expecting them to make you rich, use them as real-time trading laboratories where you can learn without financial pressure.

I currently follow three free groups specifically for educational purposes. One crypto scalping channel teaches me about short-term price action patterns, a forex swing group helps me understand multi-day technical setups, and an options group shows me how derivatives traders think about risk management.

The key is treating these groups as learning experiences rather than profit centers. I track their signals through SignalManager’s free tier but only trade them with small position sizes (0.5% risk per trade) or in demo mode. This lets me observe their analysis methods, understand their market approach, and learn from both their successes and failures.

Free groups often provide better educational value than paid courses because you’re seeing real-time decision-making under actual market conditions. When a free signal fails, I can analyze what went wrong and learn from the mistake without paying tuition fees.

I’ve learned more about technical analysis from following free signals for six months than I did from most paid educational programs. Watching how different traders approach the same market conditions teaches you to think independently rather than just copying someone else’s trades.

Paid Groups for Your Core Trading Strategy

Once you’ve educated yourself through free groups and identified your preferred trading style, paid groups become valuable for serious capital allocation. But here’s the crucial difference – you’re now an educated consumer who can evaluate paid groups based on actual trading knowledge rather than marketing claims.

My core trading capital (about 70% of my signal allocation) goes to two paid providers that I’ve thoroughly tested and proven profitable over 6+ months each. One charges $120/month for forex swing trades, the other costs $80/month for crypto day trading signals.

These paid groups earn their subscription fees through consistent performance, professional risk management, and reliable signal delivery. I’m not paying for hopes and dreams – I’m paying for proven edge that generates profits after accounting for subscription costs.

The paid groups also provide features that free groups typically can’t: direct support when trades go wrong, detailed analysis explaining market reasoning, and consistent signal formatting that makes automation reliable.

But here’s what most people get wrong – I didn’t start with these paid groups. I spent months using free groups to understand different trading approaches, then gradually upgraded to paid providers only after proving they offered superior performance for my specific needs.

Portfolio Approach – Diversifying Signal Sources

Just like you wouldn’t put all your investment money in one stock, you shouldn’t put all your signal trading in one provider. Diversification across multiple signal sources reduces risk and provides more consistent returns than relying on any single provider.

My current signal portfolio includes:

60% allocation to proven paid providers – These are my core profit generators with 6+ months of verified performance data. Conservative position sizing (1.5-2% risk per trade) with high confidence in their long-term edge.

25% allocation to promising free groups – Newer signal sources that show potential but haven’t been proven over full market cycles. Smaller position sizes (0.5-1% risk per trade) while I gather more performance data.

15% allocation to experimental signals – Testing new providers, different market approaches, or alternative trading styles. Very small position sizes (0.25% risk per trade) with focus on learning rather than immediate profits.

This diversification approach means that if my best paid provider hits a rough patch, my overall performance doesn’t collapse. The free groups and experimental signals often perform differently under various market conditions, providing natural hedging.

I rebalance these allocations quarterly based on performance data. Providers that consistently deliver move up in allocation percentage, while underperformers get reduced allocation or eliminated entirely.

Decision Framework – When to Upgrade from Free to Paid

The decision to upgrade from free to paid signals should be systematic and data-driven, not emotional. I’ve developed a specific framework that prevents expensive mistakes:

Performance threshold: Free provider must maintain 60%+ win rate over minimum 10 signals (using SignalManager’s free tier) with positive risk-adjusted returns. If they can’t beat this basic threshold for free, they won’t magically improve with paid access.

Consistency requirement: Performance must be consistent across different market conditions. A provider that only works during bull markets or low volatility periods isn’t worth paying for during uncertain times.

Value proposition analysis: Calculate the break-even point for paid subscriptions. If a $150/month group needs to generate $1,800 annually just to cover fees, their performance must significantly exceed free alternatives to justify the cost.

Feature justification: Paid groups must offer tangible benefits beyond just signal calls. Better risk management, educational content, customer support, or automation compatibility can justify subscription costs even with similar performance to free alternatives.

Track record verification: Minimum 3-month proven performance before considering any paid subscription. Short-term hot streaks don’t predict long-term profitability, and most signal providers eventually revert to average performance.

I recently considered upgrading to a $200/month crypto group after tracking their free signals. Despite solid performance (68% win rate over 12 signals), the math didn’t work – they’d need to generate $2,400 annually just to break even, plus significantly outperform my existing $80/month provider. I stayed with the cheaper alternative.

Real Examples of Hybrid Portfolio Success

My hybrid approach generates more consistent returns than either pure free or pure paid strategies:

Q1 2024 performance breakdown:

- Paid forex group (60% allocation): +18.7% return, $360 in fees

- Paid crypto group (60% allocation): +12.4% return, $240 in fees

- Free scalping group (25% allocation): +23.1% return, $0 in fees

- Experimental options group (15% allocation): -8.3% return, $0 in fees

Overall portfolio return: +14.6% after all fees, with much lower volatility than single-provider approaches.

The free scalping group actually outperformed both paid providers that quarter, but I maintain the paid allocations for consistency and risk management. The experimental options group lost money but taught me valuable lessons about derivatives trading.

Managing the Complexity

The main challenge with hybrid approaches is complexity – tracking multiple providers, managing different position sizes, and monitoring various performance metrics requires systematic organization.

SignalVision makes this manageable through unified tracking across all signal sources. Whether free or paid, crypto or forex, all signals get tracked with the same metrics and risk parameters. This lets me compare performance across providers and make data-driven allocation decisions.

I review my signal portfolio monthly, adjusting allocations based on recent performance while maintaining long-term perspective. Providers need at least 3-6 months of poor performance before I consider major allocation changes, preventing overreaction to short-term volatility.

The key is treating signal trading like portfolio management rather than gambling. Each provider serves a specific purpose – education, income generation, or experimental learning – with position sizing and expectations adjusted accordingly.

Common Hybrid Approach Mistakes

Most traders who try hybrid approaches make the same critical errors:

Over-diversification: Following too many providers spreads capital too thin and makes performance tracking impossible. I limit myself to maximum 5 active signal sources at any time.

Inconsistent position sizing: Using the same risk per trade for proven paid providers and experimental free groups is dangerous. Match position sizes to confidence levels and track records.

Emotional allocation changes: Constantly shifting allocations based on recent performance rather than long-term data. Stick to quarterly rebalancing unless providers show fundamental deterioration.

Mixing timeframes poorly: Day trading signals and swing trading signals require different capital management approaches. Don’t treat a 4-hour forex swing trade the same as a 15-minute crypto scalp.

The Long-Term Hybrid Strategy

Over time, successful hybrid portfolios evolve from educational focus toward profit optimization. New traders should start with mostly free groups for learning, gradually shifting toward proven paid providers as their experience and capital grow.

My allocation has shifted dramatically over three years:

- Year 1: 80% free groups (learning), 20% paid groups (small testing)

- Year 2: 50% free groups (continued education), 50% paid groups (proven performers)

- Year 3: 25% free groups (new approaches), 75% paid groups (core profit generation)

This evolution reflects growing experience, larger capital base, and proven ability to identify profitable signal providers. The hybrid approach supported learning during early stages while building toward serious profit generation as skills developed.

The goal isn’t to eventually eliminate either free or paid groups, but to optimize the mix based on your trading objectives, capital constraints, and risk tolerance. Both approaches have value when used strategically rather than randomly.

Making the Right Choice for Your Situation

The biggest mistake I see traders make is choosing signal groups based on what other people recommend rather than what matches their specific situation. A beginner with $1,000 has completely different needs than an experienced trader with $50,000, but they often end up following the same expensive “premium” groups and wondering why results don’t match expectations.

Let me break down exactly how to choose signal approaches based on your actual trading level, capital, and risk tolerance.

Beginner Traders – Foundation First, Profits Later

If you’re new to trading or have less than 6 months of signal experience, your primary goal should be education, not immediate profits. I wish someone had told me this when I started – it would have saved me $2,800 in failed premium subscriptions.

Start with free groups exclusively for your first 3-6 months. Use SignalManager’s free tier to track 10 signals from different providers and learn how signal trading actually works. Focus on understanding why signals succeed or fail rather than just copying trades.

The best free groups for beginners provide educational context alongside signals. Look for groups that explain their analysis, discuss market conditions, and acknowledge when trades go wrong. Avoid groups that just post “BUY BITCOIN” without any reasoning.

Use demo mode religiously during this learning phase. Test different position sizing approaches, stop loss strategies, and risk management rules without losing real money. I’ve seen too many beginners blow their accounts in the first month because they didn’t understand proper risk management.

Capital requirements: Start with $500-$2,000 maximum. Any less and transaction costs eat your profits; any more and you’re risking money you can’t afford to lose while learning. Use position sizes of 0.5-1% risk per trade during the learning phase.

Time investment: Expect to spend 30-45 minutes daily tracking signals, analyzing results, and learning from both winners and losers. This education phase is crucial for long-term success.

I spent my first four months following three free groups, tracking everything in demo mode, and gradually understanding which signal providers had genuine edge versus which ones were just lucky. This foundation prevented expensive mistakes later.

Intermediate Traders – Selective Upgrades

Once you’ve spent 6-12 months learning with free groups and understand the basics of signal evaluation, you can start considering paid subscriptions – but be extremely selective.

The upgrade criteria should be strict: Only pay for signals that consistently outperform your best free sources over at least 3 months of tracking. If a paid group can’t beat free alternatives, why pay for them?

Focus on 1-2 paid providers maximum rather than spreading subscriptions across multiple groups. I see intermediate traders subscribe to 4-5 different paid groups, pay $400-500 monthly in fees, then struggle to track which signals are actually profitable.

Capital requirements: $5,000-$15,000 gives you enough flexibility to follow multiple signal sources while maintaining proper risk management. You can afford $50-150 monthly in subscription fees without the costs dominating your returns.

Position sizing evolution: Graduate to 1-2% risk per trade for proven signal sources, but maintain 0.5% risk for new or experimental providers. This lets you scale up winners while controlling downside from unproven sources.

Performance tracking becomes critical at this stage. You’re paying for signals, so you need systematic data on whether they’re generating profits after subscription costs. Many intermediate traders skip this step and pay for mediocre signals indefinitely.

My intermediate phase involved testing 12 different paid groups over 8 months. Only 3 generated profits after fees, and I eventually settled on 2 providers that consistently outperformed my free alternatives.

Advanced Traders – Premium Performance Requirements

Advanced traders with significant capital and proven signal evaluation skills can justify premium signal groups, but the performance requirements should be much higher than beginners accept.

Premium groups must provide measurable edge beyond what you can achieve with free or mid-tier paid alternatives. This might be faster signal delivery, superior risk management, direct analyst access, or consistently higher risk-adjusted returns.

The subscription cost threshold changes completely when you’re managing larger capital. A $300/month group that improves your returns by 2% annually is profitable on a $50,000 account but terrible value on a $5,000 account.

Capital requirements: $25,000+ gives you the flexibility to allocate meaningful position sizes across multiple premium sources while maintaining diversification. You can afford $200-500 monthly in subscription fees if the performance justifies the costs.

Direct verification becomes essential. Don’t rely on marketing claims or testimonials. Demand real-time access to their trading accounts, detailed performance statistics, and transparent reporting of both wins and losses.

Multiple market exposure makes sense at this level. Premium groups often specialize in specific markets or trading styles that complement your existing strategy rather than replacing it entirely.

I currently use two premium groups ($280/month total) that focus on different market conditions – one excels during volatile periods, the other performs better during trending markets. This specialization justifies the premium costs through improved overall portfolio performance.

Risk Tolerance Mapping

Your personality and risk tolerance should heavily influence signal group selection, regardless of experience level:

Conservative traders should focus on groups with win rates above 65% and maximum drawdowns under 15%. Accept lower profit potential in exchange for steady, predictable returns. Free groups often provide this conservative approach better than aggressive paid alternatives.

Moderate risk traders can handle 55-65% win rates with drawdowns up to 25% if the profit potential justifies the volatility. This opens up more signal options including some paid groups that focus on higher-profit strategies.

Aggressive traders might accept 45-55% win rates with significant drawdowns if the profit potential is substantial. But be honest about your risk tolerance – most people think they’re aggressive until they experience a 30% drawdown period.

Capital preservation vs growth priorities also matter. If you’re trading retirement funds, focus on signal groups with excellent risk management regardless of profit potential. If you’re trading speculative capital, higher-risk approaches might be appropriate.

Capital Requirements Reality Check

The relationship between account size and signal group costs is crucial but often ignored:

Under $5,000: Stick to free groups. Paying $100/month represents 24% annual cost that most signal groups can’t overcome. Focus on education and capital growth before considering paid subscriptions.

$5,000-$15,000: One carefully selected paid group ($50-100/month) might be justified if performance significantly exceeds free alternatives. Total subscription costs shouldn’t exceed 12% annually.

$15,000-$50,000: 2-3 paid subscriptions ($100-300/month total) can be profitable if chosen based on proven performance data. Subscription costs should stay under 6% annually.

Over $50,000: Premium groups with higher costs can be justified if they provide genuine edge. But performance requirements should be much higher than what beginners accept.

Common Mistakes at Each Level

Beginner mistakes: Jumping to paid groups immediately, following too many signal sources simultaneously, using excessive position sizes during the learning phase, focusing on profits rather than education.

Intermediate mistakes: Subscribing to multiple paid groups without systematic tracking, gradually increasing subscription costs without improving performance, ignoring risk management in favor of higher returns.

Advanced mistakes: Assuming expensive equals better, focusing on absolute returns rather than risk-adjusted performance, neglecting free alternatives that might outperform premium options.

The Evolution Timeline

Most successful signal traders follow a predictable progression:

Months 1-6: Free groups only, focus on education, demo trading, small position sizes, learning risk management fundamentals.

Months 6-18: Selective paid subscriptions based on proven performance, larger position sizes for proven sources, systematic performance tracking.

Year 2+: Refined signal portfolio with proven performers, premium groups for specialized strategies, focus on risk-adjusted returns rather than raw profits.

The key is matching your approach to your current situation rather than trying to skip steps or copy what advanced traders do. Each stage builds the foundation for the next level of sophistication.

Making Your Decision Today

Honestly assess where you are right now:

- Experience level: How long have you been following signals systematically?

- Capital situation: How much can you afford to allocate to signal trading?

- Risk tolerance: How would you handle a 20% drawdown period?

- Time availability: How much time can you dedicate to tracking and analysis?

- Learning goals: Are you trying to make money immediately or build long-term skills?

Based on these factors, choose signal approaches that match your current situation rather than where you hope to be eventually. You can always upgrade later as your experience and capital grow.

Conclusion

The free vs paid debate misses the real point entirely. I’ve seen free groups outperform $200/month “premium” services, and vice versa. The only thing that matters is actual performance data – something 95% of traders never properly track.

Here’s the winning strategy: Start with SignalVision’s free tier to track both free and paid groups you’re considering. Let the data decide, not the marketing promises. Whether a group costs $0 or $300/month is irrelevant if it loses money consistently.

The traders making money from signals aren’t the ones paying the most or getting everything free – they’re the ones tracking performance and following only proven winners. Join them by making data-driven decisions instead of price-based assumptions.

Bottom Line: The best ROI comes from tracking signal performance first, then choosing based on results rather than price tags.

Leave a Comment