Did you know that 80% of leveraged crypto traders lose money within their first year? Yeah, that stat hit me like a truck when I first started diving into crypto signal trading. I remember thinking I was some kind of genius when I made my first few leveraged trades – turning $500 into $2,000 in just two weeks following some «premium» signals on Telegram. Man, was I cocky.

Then reality slapped me hard. One bad signal, one miscalculated position size, and BOOM – liquidated. Gone. All of it. I learned the hard way that leverage trading risks aren’t just theoretical numbers on a screen. They’re real money disappearing from your account faster than you can blink.

Here’s the thing about margin trading dangers that nobody talks about upfront: it’s not just about the potential for bigger losses. It’s about how leverage messes with your head. When you’re in leveraged positions, every tiny price movement feels like a heart attack. I’ve literally lost sleep watching my phone, refreshing charts every five minutes, praying I wouldn’t wake up to a margin call.

The worst part? Most traders dive into crypto leverage without understanding the basics of position sizing or proper risk management. They see a signal promising 300% gains and throw their entire account at it with 50x leverage. I’ve done it. My friends have done it. Hell, probably half the people reading this have done it too.

But here’s what I’ve figured out after years of making every mistake in the book: signal-based trading with leverage isn’t inherently evil. It’s just that most people approach it completely wrong. They ignore liquidation risk, skip stop loss orders, and let trading psychology drive their decisions instead of logic.

The crypto market’s market volatility is already insane without leverage – adding 10x or 100x multipliers is like driving a Ferrari in a thunderstorm while blindfolded. You might make it to your destination, but the odds aren’t exactly in your favor.

In this article, I’m gonna share everything I wish someone had told me before I started combining leverage with crypto signals. We’ll talk about calculating proper risk reward ratios, building a solid portfolio management strategy, and most importantly, how to sleep at night knowing your trades won’t blow up your account while you’re dreaming. Trust me, your future self will thank you for reading this.

What Is Leverage Trading and How Crypto Signals Amplify Risks

I’ll never forget my first experience with margin trading. It was 2021, Bitcoin was pumping, and I thought I was some kind of genius trader. I had been following this Telegram signal group religiously for weeks, making decent profits with my regular spot trades. Then I discovered leverage.

«Why make 5% when I could make 50%?» I thought to myself. That’s the siren song of leveraged positions – they promise to multiply your gains, but they’ll multiply your losses just as fast.

Leverage trading is essentially borrowing money from the exchange to open larger positions than your account balance would normally allow. If you have $1,000 and use 10x leverage, you can control a $10,000 position. Sounds amazing, right? Well, here’s where it gets tricky with crypto signals.

Most signal providers don’t account for the brutal reality of crypto margin requirements. They’ll drop a signal like «BTC long at $42,000, target $45,000» without considering that leveraged traders need perfect signal timing. I learned this the hard way when a signal came in during my lunch break, but by the time I executed it 30 minutes later, the entry was already blown.

The thing about leveraged positions is they amplify everything – not just profits, but also the impact of poor timing. That 2% move against you on a 20x position? Boom, 40% of your account is gone. I watched my $500 test account get liquidated in less than 10 minutes because the signal I followed didn’t account for the volatility spike that happened right after entry.

What makes crypto signals particularly dangerous with leverage is the speed factor. Crypto moves fast – like, ridiculously fast. A signal that looks great when posted can turn into a nightmare by the time you’ve fumbled through your exchange’s interface to set up your margin trading position. I’ve seen traders miss entries by mere minutes and then chase the price, only to get liquidated when the inevitable pullback happens.

The psychological pressure is intense too. When you’re leveraged 10x or 20x, every tiny price movement feels like a heart attack. You start making emotional decisions, closing profitable trades too early or holding losers too long. Signal providers rarely mention this part – they just show you the winning screenshots.

That’s why understanding both the mechanics of leverage and the timing challenges with signals is crucial before you even think about combining them. Trust me, your future self will thank you for taking this seriously.

The Hidden Dangers of High Leverage in Signal-Based Trading

I’ll never forget the night I learned about liquidation risk the hard way. It was 2 AM, and I was following what seemed like a bulletproof signal from a popular Telegram channel. Bitcoin was rallying, the signal called for 50x leverage, and I thought «why not maximize my gains?»

Within 30 minutes, my entire position was gone. Liquidated. The market volatility that crypto is famous for had eaten my account alive, and I was staring at a balance of zero.

Here’s what nobody tells you about high leverage in signal trading – it’s not just about the math. Sure, everyone knows that 50x leverage means a 2% move against you wipes out your account. But the real danger is psychological.

When you’re leveraged to the max, every tiny price movement becomes a heart attack. I’ve watched traders get margin calls on positions that were actually profitable in the long run, simply because they couldn’t handle the short-term fluctuations. Your trading psychology gets completely scrambled when you’re over-leveraged.

The worst part? Signal providers often don’t account for your risk tolerance. They might be trading with 1% of their portfolio while you’re going all-in with 50x leverage on the same signal. I learned this lesson when I followed a «conservative» signal that turned into a nightmare because of my leverage choices.

Market volatility in crypto can be absolutely brutal. I’ve seen Bitcoin drop 15% in an hour, then recover completely within the next two hours. If you’re running high leverage during those moves, you’re not participating in the recovery – you’re already liquidated and sitting on the sidelines.

The hidden danger isn’t just losing money – it’s losing the ability to trade altogether. After that first liquidation, I was gun-shy for months. Every signal felt like a potential trap, and I missed out on some genuinely good opportunities because my confidence was shot.

Smart signal trading means treating leverage like a loaded weapon. I now never use more than 5x leverage, regardless of how confident I am in a signal. Yeah, my gains are smaller, but I’m still in the game. That’s what matters most.

The key is understanding that liquidation risk compounds with signal frequency. If you’re taking multiple leveraged positions based on different signals, you’re essentially gambling with your ability to continue trading. One bad streak and you’re done.

Risk Management Strategies for Leveraged Crypto Signal Trading

I learned this lesson the hard way back in 2021 when I was throwing around 20x leverage like confetti at a wedding. One «guaranteed» Bitcoin signal wiped out 60% of my account in about 3 minutes. That’s when I realized that position sizing isn’t just some boring textbook concept – it’s literally what keeps you in the game.

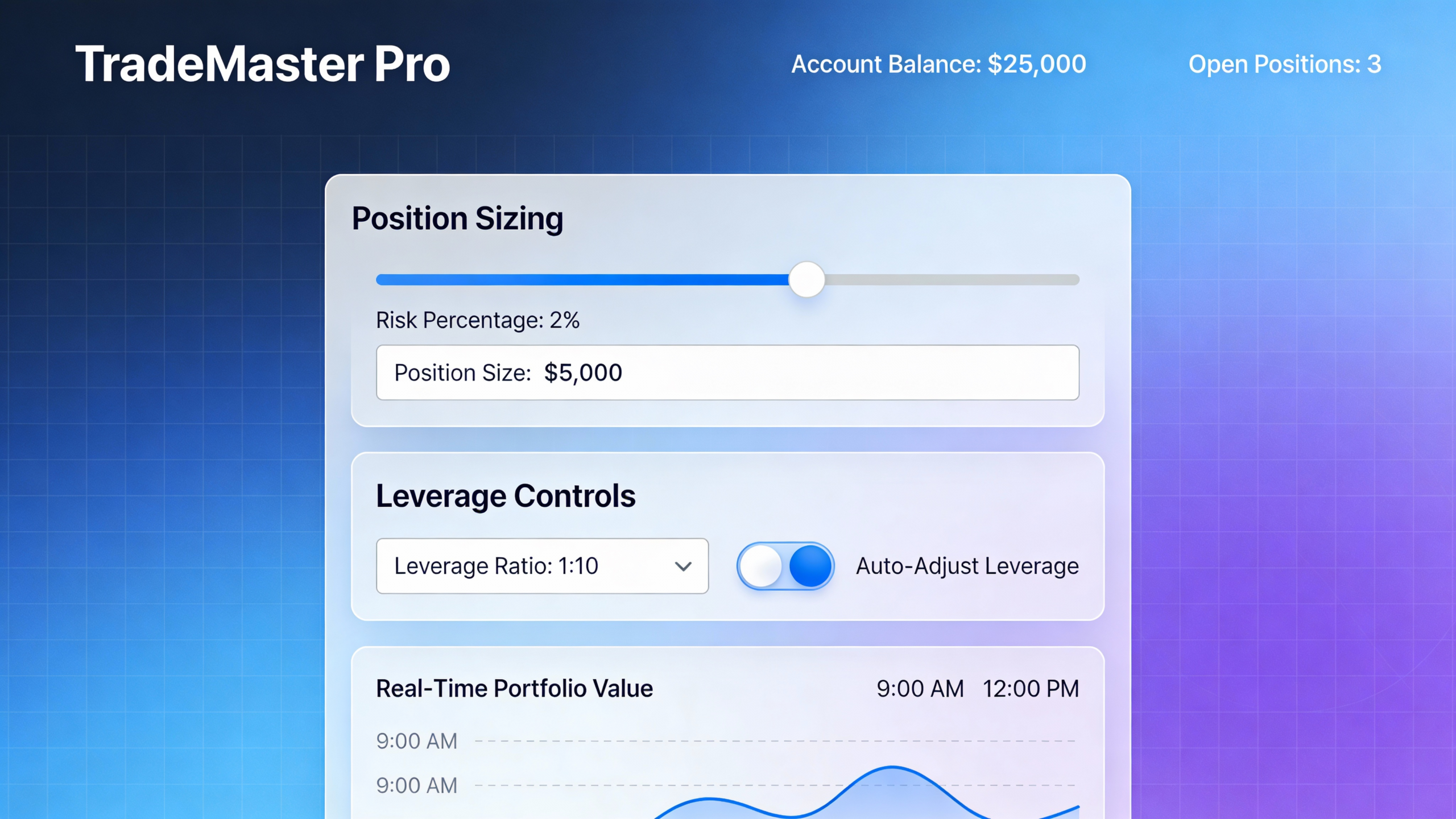

Here’s what I wish someone had drilled into my thick skull from day one: never risk more than 1-2% of your total portfolio on a single leveraged trade. I know, I know, it sounds conservative when you’re seeing people post screenshots of 500% gains. But trust me, those same people usually don’t show you the 90% losses that came after.

The stop loss game changed everything for me. I used to think I was smarter than the market, holding onto losing positions because «it’ll bounce back.» Wrong move. Now I set my stop loss before I even enter a trade, usually around 2-3% below my entry for spot trades, but way tighter for leveraged positions – sometimes just 0.5% because leverage amplifies everything.

Let me tell you about risk reward ratio – this one took me months to really get. I was taking trades where I could lose $100 to maybe make $50. That’s backwards thinking that’ll drain your account faster than a broken faucet. Now I only take trades where I can potentially make at least 2x what I’m risking, preferably 3x. If a signal doesn’t offer that kind of upside, I just skip it.

The biggest breakthrough came when I started treating portfolio management like running a business instead of gambling at a casino. I keep a trading journal – yeah, it’s tedious, but it shows me which signal providers actually make money and which ones are just lucky streaks waiting to end.

I also learned to diversify my signal sources. Following just one «guru» is like putting all your eggs in one very shaky basket. I spread my trades across 3-4 different signal providers, never allocating more than 25% of my trading capital to any single source.

Here’s a practical tip that saved my account multiple times: I set daily loss limits. If I’m down more than 5% in a single day, I close my laptop and walk away. Revenge trading after a bad day is like trying to put out a fire with gasoline – it just makes everything worse.

The crypto market doesn’t care about your feelings or your bills. It’ll take everything you give it if you don’t have solid rules in place. These risk management strategies aren’t sexy, but they’re what separate the survivors from the cautionary tales.

Choosing the Right Leverage Levels for Different Signal Types

Man, I learned this lesson the hard way back in 2022. I was treating every signal like it was the same beast – throwing 10x leverage at swing trading signals and wondering why my account kept getting nuked. It wasn’t until I started paying attention to the actual signal quality and timeframes that things clicked.

Here’s what nobody tells you about leverage: it’s not a one-size-fits-all game. Day trading signals and swing trades need completely different approaches. When I’m looking at a scalping signal that’s targeting a 15-minute move, I might use 5-10x leverage because the risk is contained and I can babysit the trade. But swing trading? That’s a whole different animal.

For swing positions that might run for days or weeks, I keep leverage between 2-5x max. I made the mistake once of using 15x on what I thought was a «sure thing» swing signal on ETH. The signal was actually solid – we eventually hit the target after three days. Problem was, the normal market volatility during those three days liquidated me twice before we got there. Expensive lesson.

The key is matching your leverage to the signal’s holding period and your ability to monitor it. Market conditions play a huge role too. During choppy sideways action, I dial everything back because even good signals get whipsawed. But when we’re in a clear trend with strong momentum? That’s when you can be more aggressive.

I’ve also learned to look at the signal provider’s track record for different trade types. Some analysts are killer at spotting swing setups but their day trades are hit-or-miss. Others nail the quick scalps but their longer-term calls are questionable. This directly impacts how much leverage I’m willing to use.

One trick that’s saved me countless times: I scale my leverage based on my confidence in the signal quality. Premium signals from proven providers with clear entry, stop, and target levels? I might push it a bit. But those vague «BTC going up» signals with no risk management? I’m keeping it under 3x or just skipping entirely.

The sweet spot I’ve found is starting conservative and only increasing leverage as you build a track record with specific signal providers. Your account will thank you for the patience, trust me on this one.

Technical Analysis and Leverage: Reading Charts for Risk Assessment

I’ll be honest – when I first started trading with leverage, I thought technical analysis was just fancy lines that smart people drew to look important. Boy, was I wrong. After blowing up my third account in 2019, I finally realized that technical analysis isn’t fortune telling – it’s risk management disguised as chart reading.

The wake-up call came when I followed a signal that looked amazing on paper. The channel was screaming «BUY BTC NOW!» with rocket emojis everywhere. I threw 10x leverage at it without even glancing at the charts. Within 20 minutes, I watched my position get liquidated as Bitcoin hit a resistance level that was so obvious, even my dog could’ve spotted it.

That’s when I learned that support and resistance levels aren’t suggestions – they’re like invisible walls that price bounces off. Now, before I even think about using leverage on any signal, I check where the current price sits relative to these levels. If a long signal comes in right at a major resistance zone, I either skip it or reduce my position size dramatically.

Here’s what changed everything for me: I started treating volume analysis like a lie detector for price movements. You know those signals that promise massive moves but the volume is flatter than a pancake? Yeah, those are traps waiting to happen. Real breakouts come with volume spikes – it’s like the market putting its money where its mouth is.

I remember this one Ethereum signal that looked perfect on the surface. Price was breaking out of a triangle pattern, the signal provider had a great track record, everything seemed golden. But the volume was pathetic – barely above average. I almost went in with 5x leverage anyway because FOMO was kicking in hard.

Thank god I checked the volatility indicators first. The ATR (Average True Range) was sitting near monthly lows, which basically meant Ethereum was in sleepy mode. When volatility is low and you’re using high leverage, you’re basically betting on a sleeping giant to suddenly wake up and run a marathon. Not smart.

Now I use a simple rule: if volatility indicators show low movement and volume is weak, I cut my leverage in half regardless of how confident the signal sounds. It’s saved me more money than I care to admit. The market will always give you another chance, but your account balance won’t if you keep ignoring what the charts are telling you.

Platform-Specific Risks: Bybit, Binance, and Other Exchanges

Here’s something nobody talks about enough – each exchange has its own quirks that can absolutely wreck your trading if you’re not paying attention. I learned this the hard way when I switched from manual trading to automated execution and suddenly my strategies were falling apart.

Bybit trading threw me for a loop when I first started using it for signals. Their liquidation engine is aggressive as hell, and I mean that in both good and bad ways. The positive? You won’t get stuck in underwater positions for long. The negative? I got liquidated on a position that would’ve been profitable on Binance because Bybit’s mark price calculation is different. They use a fair price index that sometimes diverges from the actual trading price, which can trigger liquidations even when the market hasn’t technically hit your liquidation level.

Then there’s the funding rates situation. Man, this one cost me serious money before I figured it out. Bybit’s funding happens every 8 hours, but the rates can swing wildly during volatile periods. I had a long position on ETH that was profitable, but the funding rate hit -0.75% during a bull run. That’s basically paying 2.25% per day just to hold the position! On Binance futures, the same trade would’ve had positive funding most of the time.

Speaking of Binance, their biggest risk isn’t the platform itself – it’s the regulatory uncertainty. I’ve had friends wake up to find their accounts restricted because of new compliance rules in their country. When you’re running automated execution strategies, you can’t afford to have your account suddenly locked. The platform works great, but their KYC requirements keep getting stricter, and they’ve been known to freeze accounts during investigations.

Here’s what really gets me though – the API differences between exchanges. Each one handles order types differently. Bybit’s conditional orders work differently than Binance’s stop-limit orders, and if your signal service doesn’t account for this, you’re gonna have a bad time. I once had a signal that was supposed to place a stop-loss at 2% below entry, but Bybit interpreted it as a trailing stop, which kept moving up as the price rose. Sounds good in theory, but it closed my position way too early.

The worst part about platform-specific risks? They compound when you’re using leverage. A small quirk in how an exchange calculates margin requirements can mean the difference between a 10% loss and complete liquidation. Always test your automated systems with small amounts first, and never assume what works on one exchange will work the same way on another.

Building a Sustainable Leveraged Signal Trading Strategy

Here’s the thing about building a sustainable leveraged signal trading strategy – I learned this the hard way after blowing through three different accounts in my first year. You can’t just wing it and hope for the best, especially when you’re amplifying every move with leverage.

My biggest mistake early on? I treated every signal like it was gospel and threw the same position size at everything. One particularly brutal week in 2022, I was following this popular crypto signal group that had been crushing it for months. Then came that massive Bitcoin dump from $69k, and because I hadn’t built any real trading strategy around position sizing or risk management, I watched 80% of my account evaporate in three days.

That’s when I got serious about backtesting. I spent the next two months going through historical data, testing different approaches to leverage ratios, stop losses, and position sizing. The results were eye-opening – what looked like amazing signals in real-time often had terrible risk-adjusted returns when you actually ran the numbers.

Now I use a systematic approach that’s saved my ass countless times. First, I never risk more than 2% of my account on any single leveraged trade, regardless of how «sure» the signal looks. Second, I track everything obsessively. I mean everything – entry times, exit reasons, market conditions, even my emotional state when I took the trade.

Performance tracking became my secret weapon. I use a simple spreadsheet that calculates my win rate, average R-multiple, and maximum drawdown for different signal sources. You’d be shocked how many «profitable» signal providers actually lose money when you factor in realistic slippage and fees.

The real game-changer was implementing strategy optimization based on actual data rather than gut feelings. I discovered that my best performing trades happened during specific market conditions – usually when Bitcoin was consolidating rather than trending hard in either direction. So now I adjust my leverage accordingly.

One trick that’s worked well: I paper trade new signal sources for at least 30 days before risking real money. Yeah, it’s boring and you miss some winners, but it’s also saved me from several disasters. Last month alone, I avoided a signal group that looked amazing on the surface but had a 60% drawdown during volatile periods.

The bottom line? Building a sustainable strategy isn’t about finding the perfect signals – it’s about creating a system that can survive the inevitable losing streaks while capturing enough upside to stay profitable long-term.

Conclusion

Look, I’ve been down this road for years now, and I can’t stress this enough: leverage trading with crypto signals can absolutely change your trading game, but only if you approach it with the right mindset. I’ve seen too many traders blow up their accounts because they got caught up in the excitement and forgot the basics.

The key takeaway here? Preserve your capital first, profits second. This isn’t just some motivational poster nonsense – it’s literally the difference between lasting in this game or washing out in six months. I learned this the hard way when I lost 60% of my account chasing 10x leverage trades back in 2021.

Start small, seriously. Begin with 2x or 3x leverage max, even if it feels boring. Master your risk management systems first. Get comfortable with stop losses, position sizing, and understanding how your chosen signal providers actually perform under different market conditions. The transparency requirements for good providers should include detailed track record analysis, not just cherry-picked screenshots.

When it comes to choosing between free signals, paid signals, or copy trading platforms, remember that due diligence is everything. I’ve used trading bots, algorithm trading systems, and followed community signals – each has its place. But signal verification should be your top priority. Look for providers who offer real-time performance data and aren’t afraid to show their losing trades alongside the winners.

Don’t underestimate the technical side either. API security and two factor authentication aren’t just nice-to-haves anymore – they’re essential. I’ve seen traders lose everything not because of bad signals, but because their accounts got compromised. Social trading platforms are getting better at scam prevention, but you still need to do your homework.

As you gain experience, you can gradually increase complexity. Maybe you’ll move into more sophisticated algorithm trading or start following multiple signal providers simultaneously. But that foundation of solid risk management? That never changes.

Here’s the thing – tools like SignalManager make this whole process so much smoother. Instead of manually copying signals and worrying about execution speed, you can focus on what really matters: analyzing performance and managing risk. The zero friction execution means you’re not missing entries because you were in a meeting or asleep.

Ready to take your signal trading to the next level? Start Your Free Trial with SignalVision today. Test it out with small positions first, see how it fits your trading style, and remember – the goal isn’t to get rich quick. It’s to build a sustainable, profitable trading system that works for you long-term.

Trust me, your future self will thank you for taking the time to do this right.

Leave a Comment