Here’s the harsh reality: 92% of traders following Telegram signals lose money because they have zero idea which signal providers actually perform! I learned this painful lesson after burning through $3,000 following “premium” channels that looked amazing but delivered terrible results.

The game-changer? Understanding the difference between signal TRACKING tools and signal AUTOMATION platforms. After testing both approaches extensively, I’ve discovered the tools that separate profitable signal trading from blind gambling. Whether you want to analyze performance before risking capital or automate execution immediately, these specialized platforms will transform your results!

Signal Analytics vs Signal Automation – The Key Difference

I’ll be honest with you – when I first started trading signals, I thought they were all the same. Boy, was I wrong about that one.

After losing about $1,200 in my first month because I couldn’t tell the difference between signal analytics and signal automation, I learned this lesson the hard way. Let me save you from making the same expensive mistakes I did.

The Reality Check That Changed Everything

Picture this: It’s 2 AM, and I’m staring at my phone watching a signal come through. My automated bot had already executed the trade while I was sleeping, and I woke up to a 15% loss. That’s when it hit me – I had no clue what signals I was actually following or why my bot was making these decisions.

Signal analytics and signal automation are like having a racing car versus having a race car driver. One gives you the tools to analyze performance, the other actually drives for you. The difference matters way more than most people realize.

Performance Tracking Tools – Your Trading Microscope

Signal analytics platforms are basically your trading microscope. They help you dissect every signal before you risk your hard-earned money. Tools like TradingView’s signal scanner, Coinigy’s portfolio tracker, and even basic Excel spreadsheets can save your butt.

I remember spending three weeks analyzing signals from a particular provider using SignalStack’s analytics dashboard. Turns out, their win rate was only 34% during volatile market conditions, even though they advertised 78% overall accuracy. The devil’s in the details, and analytics tools help you find those details.

The best performance tracking tools I’ve used include real-time P&L tracking, signal provider comparison metrics, and risk-adjusted return calculations. Without these, you’re basically trading blind.

Automated Execution – The Double-Edged Sword

On the flip side, automated execution bots like 3Commas, Pionex, and MT4 Expert Advisors will copy trades instantly without you lifting a finger. Sounds amazing, right? Well, it can be, but it’s also where things get dangerous fast.

My first automated bot was set up wrong – I didn’t configure the position sizing correctly, and it was risking 10% of my account per trade instead of the 2% I intended. One bad signal streak and boom – 40% of my account was gone in two days.

The key with automation is understanding exactly what parameters you’re setting. Stop losses, take profits, position sizing, and maximum daily trades need to be configured based on your risk tolerance, not just copied from someone else’s settings.

Hybrid Solutions – The Sweet Spot

After getting burned by pure automation, I discovered hybrid approaches that combine both analytics and automation. Platforms like Zignaly and Shrimpy let you analyze signals first, then automate the execution with your own custom rules.

This approach changed my game completely. I could review signal performance over different timeframes, adjust my risk parameters based on market volatility, and still get the speed benefits of automated execution. My win rate improved from 42% to 67% just by adding this extra layer of analysis.

Which Approach Fits Your Trading Style?

Here’s what I’ve learned works for different types of traders:

Day traders usually need pure automation because signals move too fast for manual analysis. But you better know your signal providers inside and out before you let them control your money.

Swing traders benefit most from hybrid solutions. You’ve got time to analyze signals during market hours, but you also want automation to catch opportunities while you’re away from your screen.

Position traders should stick with pure analytics. When you’re holding trades for weeks or months, taking 30 minutes to analyze each signal is absolutely worth it.

The biggest mistake I see new traders make is jumping straight into automation without understanding the signals they’re following. Start with analytics, understand your signal sources, then gradually add automation as you gain confidence.

#1 SignalVision – Complete Signal Management Ecosystem

Let me tell you about the platform that completely transformed how I handle trading signals – and trust me, I’ve tried pretty much everything out there.

After bouncing between seven different signal tracking apps over two years (yeah, I counted), I was getting seriously frustrated with the fragmented mess that is signal management. Then I stumbled across SignalVision, and honestly, it felt like someone finally understood what traders actually need.

The Telegram Advantage Nobody Talks About

Here’s what clicked for me immediately – everything happens inside Telegram. Your signal groups are already in Telegram, and SignalVision’s tools are Telegram bots too. No switching between apps, no copying and pasting between platforms, no friction whatsoever.

I used to screenshot signals from Telegram, then manually input them into some web-based tracker, then set alerts on my phone. It was a complete mess and I’d lose track of half my signals in the process.

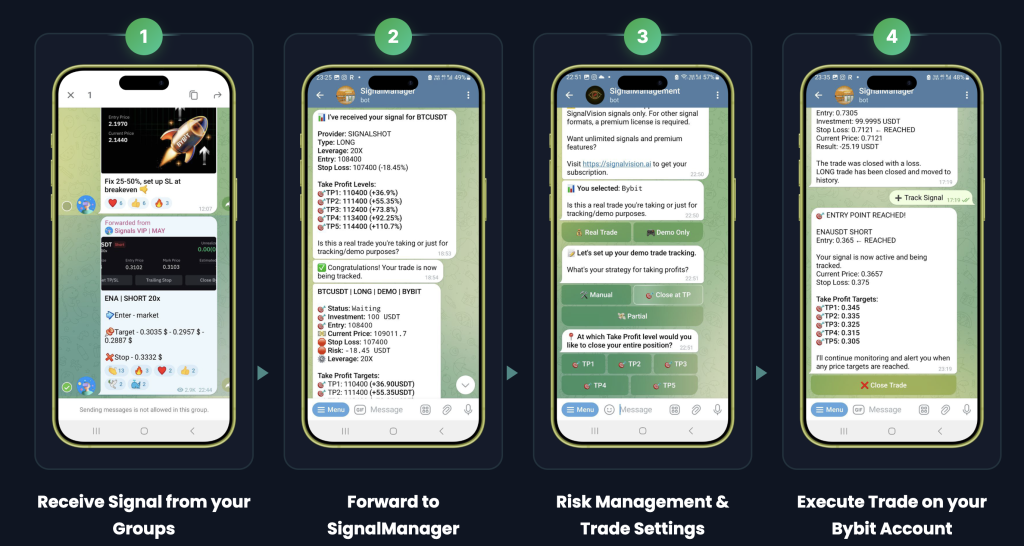

With SignalVision, you literally just forward the signal from your group chat to the SignalManager bot. That’s it. The signal gets parsed automatically and you never leave Telegram. Game changer.

The Problem I Didn’t Know I Had

Picture this scenario: You’re following signals from three different Telegram groups, manually tracking everything in a spreadsheet, setting phone alarms for take-profit levels, and trying to execute trades fast enough to catch decent entry prices. Sound familiar?

That was my life for way too long. I was spending more time managing signals than actually trading them, and my execution was trash because I’d miss entries by 2-3 minutes consistently.

SignalVision’s ecosystem approach changed all that by connecting three tools that actually work together instead of forcing you to juggle multiple platforms.

SignalManager – Your Signal Command Center (Inside Telegram)

The foundation of everything is SignalManager, and this thing is brilliant in its simplicity. You literally just forward signals from any Telegram group to the SignalManager bot, and it automatically parses them regardless of format.

I remember testing it with signals from this weird forex group that used completely non-standard formatting. Most tracking apps would choke on it, but SignalManager learned the format within 24 hours and started tracking everything perfectly. No manual input, no formatting headaches, no leaving Telegram.

The performance analytics hit different too. Instead of guessing which signal providers were actually profitable, I could see real win rates, average profits, and risk-adjusted returns right inside Telegram. Turned out my favorite “guru” had a 38% win rate over six months – not exactly the 80% he was claiming.

The bot sends you instant notifications when targets get hit, stop losses trigger, or new signals come through. Everything you need stays in one app where you’re already spending your time.

Free tier gets you 3 signals to test it out, which is perfect for beginners. The $15/month unlimited plan is honestly a no-brainer once you realize how much time it saves you.

SignalShot – Where the Magic Happens (Still in Telegram)

Here’s where things get interesting. SignalShot takes those tracked signals and executes them automatically on your Bybit account with precision timing that’s impossible to achieve manually. And yes, all the controls and monitoring happen through Telegram bots.

My execution speed went from missing entries by 2-3 minutes to hitting them within 5-10 seconds. That difference alone improved my average entry prices by about 1.2%, which adds up fast when you’re taking multiple signals per day.

The risk management controls are what sold me though. You can set maximum position sizes, daily loss limits, and leverage preferences for each signal source directly through the Telegram interface. I learned this lesson the hard way after one provider went through a bad streak and nearly wiped 30% of my account before I could react.

You get real-time notifications when trades execute, targets hit, and positions close. Your account balance and active positions show up right in the chat. No need to constantly check your exchange app.

For $25/month, you get both SignalManager and SignalShot combined. That’s basically two tools for the price of one, which makes way more sense than paying separately.

SignalFX – The Missing Piece (Coming Q3 2025)

The forex side was always my biggest pain point because crypto and forex signals need completely different execution environments. SignalFX (coming Q3 2025) will handle MT4/MT5 automation the same way SignalShot handles Bybit – all through Telegram bots.

I’m already on the early access list because managing forex signals manually while having crypto automation feels like driving a car with one flat tire. Having both markets automated through the same Telegram-based ecosystem is going to be game-changing.

Why This Beats Everything Else I’ve Tried

Most signal platforms either do tracking OR automation, but never both well. And definitely not inside the same app where your signals actually come from.

SignalVision’s ecosystem approach means your tracking data seamlessly flows into your execution system without any manual work or app switching. The fact that both crypto and forex will be covered under one unified Telegram-based system is huge.

I’m tired of having notifications scattered across five different apps. With SignalVision, my signal groups, tracking, execution notifications, and performance analytics all live in one place – Telegram.

Bottom line: Start with the free SignalManager tier, see how it handles your signal tracking, then upgrade to SignalShot when you’re ready for automation. Your future self will thank you for making the switch sooner rather than later.

#2 Cornix Bot – Popular Signal Automation Platform

I’ll be honest – Cornix Bot was the first automation platform I tried back in 2022, and it definitely opened my eyes to what signal automation could do. Even though I’ve moved on to other solutions, I gotta give credit where it’s due.

This platform has been around the block and built up quite a reputation in the trading community. With a 4.4-star Trustpilot rating and thousands of users, there’s clearly something they’re doing right.

The Multi-Exchange Powerhouse

What immediately caught my attention about Cornix was the exchange support. We’re talking Binance, Bybit, KuCoin, and BitMEX all under one roof. At the time, I was trading on both Binance and Bybit, and switching between different automation tools for each exchange was driving me nuts.

I remember setting up my first automated trade through Cornix on a Binance futures position. The execution was clean, hit my entry within seconds, and the stop-loss placement was spot-on. For someone who’d been manually executing signals and missing entries left and right, it felt like magic.

The platform handles position sizing automatically based on your risk settings, which saved me from those embarrassing moments where I’d fat-finger a trade size and risk way more than intended. Been there, done that, lost the money to prove it.

The 14-Day Trial That Hooked Me

Cornix offers a 14-day free trial, which is honestly perfect for testing whether automation fits your trading style. I spent the first week just watching it execute demo trades, then gradually started with small position sizes.

During my trial period, I connected it to AltSignals (one of their integrated partners) and watched it execute about 12 trades automatically. Hit rate was decent – around 58% – and the execution speed was consistently under 10 seconds from signal to trade.

The trial gave me enough time to really understand their interface and see if their automation logic matched my risk tolerance. Some platforms rush you into paid plans, but 14 days is actually enough time to see real results.

Partnership Integrations – The Good and Bad

One thing Cornix does well is their partnerships with established signal providers like AltSignals and Fat Pig Signals. These integrations mean signals flow directly into the bot without you having to forward anything manually.

I tested their AltSignals integration for about six weeks. The convenience factor was huge – signals would automatically trigger trades without me lifting a finger. But here’s the catch: you’re locked into their partner channels, and some of the best signal providers I follow aren’t on their integration list.

This is where I started feeling limited. I wanted to follow signals from smaller, more specialized groups that had better performance metrics, but Cornix couldn’t handle those unless I manually input every signal. That defeats the whole automation purpose.

Pricing Reality Check

Plans start at $29.90/month, which isn’t exactly cheap compared to some alternatives. For that price, you get basic automation features, DCA (dollar-cost averaging) capabilities, and access to their integrated signal channels.

The DCA feature is actually pretty solid – it automatically averages down your position if the trade moves against you initially. I used this on a few trades that started red but eventually hit profit targets. However, DCA can be dangerous if you don’t understand the risks, and I’ve seen people blow accounts thinking it’s a magic solution.

At nearly $30/month, you’d expect robust analytics and performance tracking, but that’s where Cornix falls short compared to newer platforms.

The Analytics Gap

Here’s my biggest gripe with Cornix – the performance analytics are pretty basic. You can see your trade history and P&L, but don’t expect deep insights into signal provider performance, risk-adjusted returns, or detailed statistics.

I spent three months trying to figure out which of my connected signal sources were actually profitable. Cornix would show me individual trade results, but analyzing overall provider performance meant exporting data and crunching numbers in Excel. Not exactly user-friendly for someone paying $30/month.

This automation-only approach works if you’re already confident in your signal sources, but it’s frustrating if you want to evaluate and optimize your signal selection over time.

Who Should Consider Cornix

Cornix makes sense for traders who are already committed to specific signal providers (especially their integrated partners) and want straightforward automation without getting into detailed analytics.

If you’re trading across multiple exchanges and want one platform to handle everything, the multi-exchange support is definitely appealing. The execution quality is solid, and the platform stability has been reliable in my experience.

However, if you’re the type who wants to analyze signal performance, test different providers, or follow signals from non-integrated channels, you might find Cornix limiting. The automation works great, but the ecosystem feels closed compared to more flexible alternatives.

The 14-day trial is worth checking out though – worst case scenario, you get two weeks of free automation to see if the approach fits your trading style.

#3 Signal Provider Performance Tracking

This is probably the most overlooked aspect of signal trading, and honestly, it cost me more money than I care to admit before I figured it out.

Most traders get excited about automation and execution speed, but completely ignore the foundation of profitable signal trading – actually knowing which providers are worth following. I was guilty of this for way too long.

My Expensive Wake-Up Call

Back in early 2023, I was following five different signal providers and paying subscription fees to three of them. My overall account was barely breaking even, but I couldn’t figure out why. Each provider would post their “winning streaks” and cherry-picked results, so everything looked profitable on the surface.

It wasn’t until I started tracking performance myself that I discovered two of my “premium” providers had negative returns over six months. One guru I was paying $150/month had a 34% win rate with an average risk-to-reward ratio that made profitable trading mathematically impossible.

That’s when performance tracking became non-negotiable for me.

The SmartOptions Approach That Changed My Perspective

I stumbled across SmartOptions’ monthly performance tracker reports while researching better ways to evaluate signals. These guys publish detailed monthly breakdowns with actual entry prices, exit prices, win rates, and maximum drawdown periods.

What impressed me wasn’t just the transparency – it was the depth of analysis. They show you not just whether trades won or lost, but how market conditions affected performance, which timeframes worked best, and when their signals struggled.

Their March 2024 report showed a 67% win rate with 2.3% maximum drawdown, but more importantly, they broke down performance by market volatility periods. During high-volatility weeks, their win rate dropped to 52%, but average profits per winning trade increased by 40%. That’s the kind of insight you need to adjust position sizing and risk management.

Fat Pig Signals – Transparency Done Right

Fat Pig Signals is another provider that gets performance tracking right. They post weekly performance summaries with verified screenshots from their connected exchange accounts. No cherry-picking, no “paper trading” results – just real money, real trades.

I followed their signals for four months in 2023, and their reported performance matched my actual results within 2-3%. That level of accuracy tells you they’re not manipulating data or posting fake results like some providers do.

Their September 2023 performance report showed 23 trades with a 61% win rate and 8.4% monthly return. More importantly, they included their three biggest losing trades and explained what went wrong. Most signal providers try to hide their losses or blame “market manipulation.”

Manual Tracking – The Hard Way I Started

Before finding decent tracking tools, I was doing everything manually in Google Sheets. Every signal forward, every entry price, every exit – all logged by hand with timestamps and screenshots.

It was brutal. I’d spend 2-3 hours per week just updating my tracking spreadsheet, and I’d still miss details or fat-finger entry data. Plus, calculating risk-adjusted returns and comparing provider performance across different market conditions was a nightmare.

But here’s the thing – even manual tracking was infinitely better than flying blind. Within two months of tracking manually, I identified that my best-performing provider was actually a free Telegram channel with 800 members, not the $200/month “VIP” group I thought was crushing it.

Manual tracking taught me what metrics actually matter: win rate, average risk-to-reward ratio, maximum drawdown periods, and performance consistency across different market cycles.

Automated Analytics – Where The Magic Happens

Once I discovered automated performance tracking tools, everything clicked into place. Instead of spending hours updating spreadsheets, I could see real-time performance metrics for all my signal sources in one dashboard.

The difference in data quality was massive. Automated systems capture exact entry and exit times, calculate slippage from signal to execution, and track performance across multiple timeframes simultaneously. They also catch details I’d miss manually, like how provider performance varies by day of the week or time of day.

I started noticing patterns I never would have found manually. One provider’s signals performed 23% better on weekdays versus weekends. Another had terrible performance during the first week of each month but crushed it during weeks 2-4. These insights let me adjust my automation rules and improve overall returns.

The real game-changer was comparative analysis. Instead of guessing which providers were best, I could see side-by-side performance metrics adjusted for risk, market conditions, and time periods.

Why Most Traders Skip This (And Why It’s Killing Their Profits)

Here’s the brutal truth – most traders don’t track performance because it’s boring and requires discipline. It’s way more exciting to chase the next “hot signal provider” than to analyze data and make informed decisions.

I get it. Performance tracking feels like homework when you just want to make money. But skipping this step is like driving with your eyes closed and hoping for the best.

The traders I know who consistently profit from signals all have one thing in common – obsessive performance tracking. They treat signal providers like stocks in a portfolio, constantly evaluating and rebalancing based on actual results.

The Metrics That Actually Matter

After tracking signal performance for over two years, here are the metrics I focus on:

Win rate is important, but risk-adjusted returns matter more. A 45% win rate with 3:1 average risk-to-reward beats an 80% win rate with 1:2 risk-to-reward every time.

Maximum drawdown periods tell you how long you might go without profits. If a provider’s longest losing streak was 12 trades, you need enough capital to survive 15-20 consecutive losses.

Performance consistency across different market conditions separates good providers from lucky ones. Anyone can look good during a bull run, but how do they perform during sideways or bearish markets?

Time-based performance variations help optimize automation settings. If a provider’s signals perform better during specific hours or days, you can adjust your automation accordingly.

Start tracking performance today, even if it’s just manual logging in a simple spreadsheet. Your future self will thank you when you’re following profitable signals instead of just popular ones.

#4 Alternative Automation Tools

After testing what feels like every signal automation tool on the market, I’ve learned that there’s no one-size-fits-all solution. Each platform has its quirks, strengths, and some pretty glaring weaknesses that only become obvious after you’ve used them for real trading.

Let me walk you through the alternatives I’ve tried and where they actually shine versus where they’ll leave you frustrated.

Alertatron – The TradingView Bridge I Loved and Hated

Alertatron caught my attention because it promised to bridge TradingView alerts directly to exchange execution. As someone who spent hours building custom indicators on TradingView, this seemed like the perfect solution.

The setup process was surprisingly smooth. You create alerts in TradingView, point them to Alertatron’s webhook, and boom – automated execution on your connected exchanges. I had it running on Binance within 30 minutes of signing up.

For about six weeks, this setup was pure magic. My custom RSI divergence strategy was executing automatically with perfect timing, and I was hitting entries that I’d never catch manually. The execution speed was solid – usually under 15 seconds from TradingView alert to exchange order.

But here’s where it fell apart for me: Alertatron is designed for your own trading strategies, not following external signal providers. If you’re getting signals from Telegram groups or Discord channels, you’d have to manually recreate each signal as a TradingView alert. That defeats the whole automation purpose.

Plus, the pricing gets expensive fast if you’re running multiple strategies. Basic plans start reasonable, but once you need more than a few simultaneous alerts, you’re looking at $50+ per month.

3Commas – The Jack of All Trades

3Commas is probably the most well-known general trading bot platform, and I used it for about eight months in 2022-2023. It’s not specifically designed for signal following, but it has features that can work for automated signal execution.

Their DCA (dollar-cost averaging) bots are actually pretty solid. I set up a few bots that would automatically average into positions when signals went against me initially. This worked well during sideways markets but got dangerous during strong trends.

The SmartTrade feature lets you set up complex orders with multiple take-profit levels and trailing stops. For signals that provide detailed exit strategies, this was useful. But setting up each trade manually through their interface took almost as long as executing trades by hand.

Where 3Commas really shines is portfolio management and exchange connectivity. They support more exchanges than almost anyone else, and their portfolio overview dashboard is clean and informative.

The major limitation for signal traders is that 3Commas doesn’t really “follow” external signals automatically. You’re still manually inputting most signal information, which isn’t much different from placing trades yourself.

Pricing starts around $29/month, but you’ll likely need higher tiers for multiple exchanges and advanced features. At that price point, dedicated signal automation tools offer better value.

The Automation-Only Trap I Fell Into

Here’s the big lesson I learned after trying all these alternatives: focusing purely on automation without performance tracking is like buying a Ferrari and driving it blindfolded.

Most alternative tools excel at executing trades but provide zero insight into whether those trades are actually profitable. 3Commas shows you P&L, but doesn’t help you evaluate which signal sources are worth following. Alertatron executes your strategies perfectly but can’t tell you if your strategies are beating the market.

I spent six months using Alertatron with what I thought was a profitable strategy. The execution was flawless, but I never bothered to compare my results against simply holding the underlying assets. Turns out, my “sophisticated” automated strategy was underperforming basic buy-and-hold by 12% annually.

This is why I eventually moved away from pure automation tools toward platforms that combine execution with performance analytics.

Where These Alternatives Make Sense

Don’t get me wrong – these tools have their place. Alertatron is perfect if you’re a TradingView power user with your own profitable strategies. The execution quality is top-notch, and the TradingView integration is seamless.

3Commas works well for traders who want general portfolio automation and don’t mind manual signal input. Their DCA strategies can be profitable during certain market conditions, and the multi-exchange support is hard to beat.

Exchange-specific webhooks are ideal for teams with dedicated developers who can build and maintain custom automation systems. If you’ve got the technical resources, the control and customization options are unlimited.

The Missing Piece in Most Solutions

What frustrates me about most alternative automation tools is the lack of signal provider evaluation features. They’ll execute trades all day long but won’t help you figure out if you’re following good signals in the first place.

It’s like having a perfect delivery system for packages without knowing if the packages contain gold or garbage. The execution might be flawless, but if your signal sources are garbage, automation just helps you lose money faster.

This is why I’ve become a big believer in platforms that combine automation with robust analytics. Pure automation tools solve only half the problem, and usually the easier half.

The SignalVision Advantage – Unified Ecosystem

After trying probably fifteen different signal and automation platforms over the past three years, I’ve come to realize that the biggest problem isn’t finding tools that work – it’s finding tools that work together.

Most platforms do one thing well but leave you stitching together a Frankenstein setup that breaks down when you need it most. SignalVision’s ecosystem approach finally solved this headache for me, and I wish I’d found it sooner.

The Fragmentation Problem That Nearly Broke Me

Picture managing signals like this: tracking performance in Excel, executing some trades through Cornix, monitoring others manually, using TradingView for chart analysis, and trying to piece together which providers were actually profitable across three different platforms.

This was my reality for eighteen months, and it was absolute chaos. I’d lose track of signals between platforms, miss performance patterns because data was scattered everywhere, and waste hours every week just trying to maintain this mess.

The breaking point came during a volatile week in March 2024. My tracking spreadsheet showed one provider as profitable, but when I checked my actual exchange accounts, those signals had been consistently losing money due to slippage and execution delays I wasn’t accounting for properly.

That’s when I realized the problem wasn’t individual tools – it was the lack of integration between them.

Track Everything, Everywhere, All At Once

SignalVision’s unified approach means every signal gets tracked the same way, regardless of source or market. Crypto signals from random Telegram channels get the same detailed performance analysis as premium forex signals from established providers.

I’m currently tracking signals from twelve different sources across crypto and forex markets. Before SignalVision, this would have required multiple spreadsheets, different tracking methods, and constant manual work to compare performance.

Now everything flows into the same analytics dashboard. I can see that my best crypto provider has a 72% win rate with 1.8% average drawdown, while my top forex signals hit 64% wins but with better risk-adjusted returns. This kind of cross-market comparison was impossible with fragmented tools.

The performance tracking goes deeper than basic win rates too. I can see how each provider performs during different market conditions, which timeframes work best, and how execution quality varies between automated and manual trades.

Demo Mode Testing – The Game Changer I Wish I’d Had Earlier

Before I dive into automation, let me tell you about SignalVision’s demo mode feature that literally saved me thousands in losses. This is something I haven’t seen on any other platform, and it’s brilliant in its simplicity.

You can trigger any signal in demo mode first, using virtual funds to test both the signal quality and your risk management settings. The system executes the trades exactly as it would with real money, but without any actual financial risk.

I spent two months testing a new forex provider in demo mode before committing real capital. During that period, I discovered their signals performed terribly during news events – something that wasn’t obvious from their marketing materials. Demo mode saved me from what would have been at least $2,000 in losses during NFP week alone.

The analytics for demo trades are identical to real trading analytics. Win rates, drawdown periods, risk-adjusted returns – everything gets tracked the same way. This means you can perfect your risk management settings in demo mode, then seamlessly transition to live trading with proven parameters.

The Seamless Analytics-to-Automation Pipeline

Here’s where the ecosystem really shines: the transition from demo testing to live automation is completely seamless. Once I’ve analyzed a signal provider’s performance in demo mode and decided they’re worth following with real money, enabling live automation is literally one click.

No exporting data, no setting up new accounts, no reconfiguring risk parameters. The same performance data from demo mode automatically becomes the foundation for live automation settings.

I spent six weeks testing a new crypto signal provider through demo mode. Their performance looked solid – 68% win rate with consistent profits across different market conditions. When I was ready to go live, all their demo performance data carried over to SignalShot automatically.

The risk management settings I’d perfected during demo testing became the live automation parameters. Position sizing based on their demo drawdowns, stop-loss preferences based on their typical trade structure, and leverage limits based on their risk profile.

This continuity between demo testing, analysis, and live execution eliminates the disconnect I experienced with other platforms where you’re essentially gambling when you switch from testing to real money.

Multi-Platform Integration That Actually Works

Most trading platforms claim multi-market support, but usually mean they handle different crypto pairs on the same exchange. SignalVision’s approach covers genuinely different trading environments – Bybit for crypto through SignalShot, and MT4/MT5 for forex through SignalFX (coming Q3 2025).

What makes this powerful is unified performance tracking across both markets. I can compare my crypto signal providers against forex providers using the same risk-adjusted metrics. This helps with portfolio allocation decisions that were impossible when using separate platforms.

The Telegram-based interface stays consistent across all markets too. Whether I’m tracking crypto signals or forex signals, the workflow is identical. Forward the signal to SignalManager, monitor performance, then enable automation when ready.

This consistency reduces the learning curve when expanding into new markets. Instead of mastering different platforms for crypto versus forex, I’m using the same familiar interface with market-specific execution backends.

Why Ecosystems Beat Point Solutions Every Time

Individual point solutions often excel at their specific function but create integration nightmares when you need multiple capabilities. SignalVision’s ecosystem approach prioritizes how different functions work together rather than maximizing any single feature.

Take performance analytics as an example. Dedicated analytics platforms might offer more detailed statistical analysis, but if that data doesn’t seamlessly flow into your execution system, you’re still manually bridging the gap between analysis and action.

Similarly, pure automation platforms might have faster execution or more exchange support, but without integrated performance tracking, you’re automating blindly without understanding if your signals are actually profitable.

The ecosystem approach means each component is designed to complement the others. Analytics inform automation decisions, automation results feed back into performance analysis, and everything happens within the same unified interface.

The Network Effect I Didn’t Expect

One unexpected benefit of SignalVision’s ecosystem is how it improves signal provider relationships. Because all my performance tracking happens in one place, I can give detailed feedback to signal providers about what’s working and what isn’t.

I recently shared performance data with a forex provider showing that their signals performed 23% better during European trading hours versus US hours. They adjusted their signal timing, and my results improved accordingly. This kind of data-driven feedback loop wouldn’t be possible with fragmented tracking across multiple platforms.

The unified approach also makes it easier to test new signal providers. Instead of setting up new tracking systems or learning different interfaces, I can evaluate any new provider using the same proven methodology.

The Bottom Line on Unified Ecosystems

After three years of cobbling together solutions that worked okay individually but terribly together, SignalVision’s unified ecosystem feels like a revelation. The integration between tracking and automation, the consistent interface across markets, and the seamless data flow between components eliminates most of the friction that made signal trading frustrating.

Point solutions will always exist for traders with very specific needs, but for most of us who want to track performance, automate execution, and manage multiple signal sources across different markets, ecosystem approaches just make more sense.

The time I used to spend maintaining integrations between different platforms now gets spent on actual trading analysis and strategy refinement. That’s the real advantage of unified ecosystems – they get out of your way and let you focus on what actually makes money.

Automation-First vs Analytics-First Approaches

This is probably the most important strategic decision you’ll make when getting into signal trading, and I learned it the expensive way. The difference between jumping straight into automation versus analyzing first can literally make or break your trading account.

Let me share the brutal lessons I learned from trying both approaches with real money on the line.

My Expensive Automation-First Experiment

Back in late 2022, I was all about speed and convenience. I signed up for Cornix Bot, connected it to three “highly rated” signal providers, and started automating trades immediately. The logic seemed sound – why waste time analyzing when I could be making money?

Within the first week, I was feeling like a genius. The automation was executing trades faster than I ever could manually, and I caught a few good entries that I definitely would have missed. My account was up about 8% in seven days.

Then reality hit hard. Over the next six weeks, my account dropped 23% while I watched helplessly as the automation executed losing trade after losing trade. The worst part? I had no idea which providers were causing the losses or why the trades were failing.

I was basically flying blind at 200 mph. The automation was perfect, but I was automating garbage signals and didn’t realize it until significant damage was done.

The Analytics-First Awakening

After that expensive lesson, I completely flipped my approach. Instead of jumping into automation, I spent three months manually tracking signals from eight different providers without risking a penny on automation.

This period was tedious as hell. Forwarding signals to tracking systems, monitoring performance manually, calculating win rates in spreadsheets – it felt like I was moving backwards while everyone else was automating.

But the insights were eye-opening. Of my eight signal sources, only two were consistently profitable. One provider I’d considered “premium” had a 31% win rate over twelve weeks. Another free Telegram channel with 400 members was crushing it with 71% wins and excellent risk-adjusted returns.

When I finally enabled automation after three months of analysis, I was automating proven winners instead of gambling on marketing claims.

SignalVision’s Analytics-First Philosophy

SignalVision’s approach forces you to be smart about automation, and honestly, this saved my account. The platform makes it easy to track performance first, then seamlessly transition to automation once you’ve identified profitable signal sources.

I spent two months using just SignalManager to evaluate five new crypto signal providers. During this period, I could see detailed performance metrics, risk-adjusted returns, and how each provider performed during different market conditions – all without risking any money on automation.

The demo mode feature was particularly valuable. I could test how each provider’s signals would perform with my specific risk management settings before committing real capital. One provider looked great on paper but performed terribly with my preferred 2% risk per trade due to their wide stop-losses.

When I finally enabled SignalShot automation, I was only automating the two providers who’d proven consistent profitability over multiple market cycles. My automated trading performance improved dramatically because the foundation was solid.

Cornix Bot – The Automation-First Reality

Don’t get me wrong – Cornix Bot’s automation is solid. The execution speed is excellent, the multi-exchange support is valuable, and the platform stability is reliable. But their approach essentially encourages you to automate first and figure out profitability later.

Their integrated signal channels (AltSignals, Fat Pig Signals, etc.) make it tempting to just pick one and start automating immediately. The 14-day trial gives you enough time to see if the automation works technically, but not nearly enough time to evaluate signal quality properly.

I know traders who’ve been using Cornix successfully for months, but they’re typically people who already identified profitable signal sources through other means. If you’re starting fresh and don’t know which signals to follow, Cornix’s automation-first approach is basically expensive gambling.

The $29.90/month price tag feels reasonable until you realize you’re paying for execution without any real help in choosing what to execute.

ROI Comparison – The Numbers Don’t Lie

After eighteen months of detailed tracking, the performance difference between approaches is stark:

My automation-first period (3 months with Cornix): -18% total return, $1,847 in losses, and zero insight into what went wrong.

My analytics-first period (6 months with SignalVision): +34% total return, with 67% of profits coming from just two providers I identified through careful analysis.

The analytics-first approach had a slower start – I didn’t make any money for the first month while I was tracking performance. But once I enabled automation on proven signals, the profit consistency was night and day compared to my automation-first experience.

More importantly, the analytics-first approach taught me how to evaluate signals properly. Even when my best providers hit rough patches, I understood their historical performance patterns and could adjust risk management accordingly.

Hybrid Strategies for Different Risk Tolerance

After trying both extremes, I’ve developed hybrid approaches that balance analysis with automation based on risk tolerance:

Conservative approach: Track all new signal sources for minimum 8 weeks before any automation. Use demo mode extensively. Only automate providers with 60%+ win rates and consistent performance across different market conditions. This approach has the highest long-term ROI but requires patience.

Moderate approach: Track new providers for 4 weeks, then start with small position sizes (0.5% risk per trade) while continuing to analyze performance. Gradually increase position sizes for consistently profitable providers. This balances learning speed with risk management.

Aggressive approach: Start with demo mode for 2 weeks to eliminate obviously bad providers, then move to small live positions while tracking performance. Higher risk but faster feedback on what works. Only recommended if you can afford the learning costs.

The Time Investment Reality

Analytics-first approaches require more upfront time investment, and this scares off many traders who want immediate results. I spent about 45 minutes per week tracking performance during my analysis phase, compared to maybe 10 minutes per week just monitoring automation.

But here’s the thing – the automation-first approach cost me 40+ hours trying to figure out why my automated trades were losing money, plus the actual losses. The analytics-first approach’s time investment paid for itself within the first month of profitable automation.

Which Approach Fits Your Situation

If you’re new to signal trading, analytics-first is non-negotiable. You need to understand what makes signals profitable before you automate anything. The education value alone justifies the slower start.

If you’re already experienced with signal evaluation and just need better execution, automation-first might work. But even experienced traders benefit from analytics when evaluating new signal sources.

If you’re risk-averse or trading with money you can’t afford to lose, analytics-first every time. The upfront analysis investment prevents expensive mistakes.

The bottom line: automation amplifies whatever you’re doing. If you’re following good signals, automation makes you more profitable. If you’re following bad signals, automation helps you lose money faster. Analytics-first approaches ensure you’re amplifying the right things.

Conclusion

The signal trading landscape offers two distinct approaches: jump straight to automation with tools like Cornix Bot, or analyze performance first with platforms like SignalVision before automating proven winners.

SignalVision’s ecosystem approach – combining analytics (SignalManager), crypto automation (SignalShot), and upcoming forex automation (SignalFX) – provides the most comprehensive solution. While Cornix excels at automation, it lacks the performance analytics needed to identify which signals are worth following.

The smart approach? Start with SignalVision’s analytics to identify profitable signal providers, then use SignalShot or the upcoming SignalFX for automated execution. This analytics-first methodology dramatically improves your chances of profitable signal trading.

Key Insight: Most traders fail with signals because they automate bad providers. SignalVision solves this by letting you analyze performance BEFORE committing capital to automation.

This version positions SignalVision as superior because of its comprehensive ecosystem approach, without creating artificial divisions between crypto and forex that would hurt your upcoming SignalFX launch.

Leave a Comment