Did you know that 78% of crypto traders fail because they don’t understand win rates? Yeah, I learned this the hard way back in 2021 when I was chasing signals with 90% win rates like they were the holy grail of trading.

I remember spending weeks analyzing different signal providers, getting caught up in flashy marketing claims about “95% accuracy!” and “Never lose again!” What a joke that turned out to be. My account got absolutely wrecked following a service that boasted incredible crypto signal win rates but had terrible risk management.

Here’s what nobody tells you upfront: a signal with a 40% win rate can absolutely destroy a signal with an 80% win rate when it comes to actual profitability. Mind-blowing, right? I’ve analyzed thousands of trading signals over the past few years, and the patterns are crystal clear once you dig into the real crypto performance metrics.

The problem is most traders (myself included, initially) get hypnotized by trading success rate percentages without understanding the complete picture. We see “85% win rate” and our brains immediately think “easy money.” But signal accuracy means nothing if your average winner makes $10 while your average loser costs you $100.

I’ve spent countless hours diving deep into signal profitability analysis, studying everything from expectancy formulas to profit factors. The rabbit hole goes deep, and honestly, it can get pretty overwhelming when you’re trying to evaluate different signal providers while also managing your own trades.

That’s exactly why I wanted to break down the metrics that actually matter for crypto signal success. We’re going to explore win rate calculation methods, dive into risk reward ratios that make or break your account, and look at how market volatility impact can completely skew your results if you’re not careful.

Trust me, understanding these trading analytics properly will save you from the expensive mistakes I made. We’ll cover everything from execution timing issues to slippage analysis – all the stuff that separates profitable traders from the ones who blow up their accounts chasing shiny win rate numbers.

By the end of this deep dive, you’ll know exactly how to evaluate any trading service review or signal provider evaluation like a pro. No more getting fooled by misleading statistics or falling for marketing hype. Let’s dive into the metrics that actually determine whether you’ll make money or lose your shirt in crypto trading.

What Are Crypto Signal Win Rates and Why They Matter

Man, I wish someone had explained this to me when I first started following crypto signals. I was that guy who’d see a channel claiming “95% win rate!” and immediately throw my money at it without understanding what those numbers actually meant.

Here’s the deal – crypto signal win rates are basically the percentage of trades that end up profitable versus the total number of signals given. Sounds simple enough, right? But here’s where it gets tricky. A 70% win rate doesn’t automatically mean you’re making bank.

I learned this the hard way back in 2021. I was following this signal provider who had an impressive 80% signal accuracy rate. I was pumped! Eight out of ten trades were winners – what could go wrong? Well, turns out their winning trades were making me 2-3%, while their losing trades were wiping out 15-20% each time. Do the math on that and you’ll see why my account was bleeding money despite the high win rate.

The real kicker is understanding that trading success rate isn’t just about being right more often than you’re wrong. It’s about the relationship between your average wins and average losses. This is where most people get burned, and honestly, it took me losing about $3,000 to figure this out.

What really matters is something called the profit factor – basically how much you make on winning trades compared to how much you lose on losing trades. A signal provider with a 60% win rate but a 3:1 reward-to-risk ratio will absolutely demolish someone with 90% accuracy but tiny profits and massive losses.

I started tracking my own crypto performance metrics after that expensive lesson. Every signal I followed, I’d log the entry, exit, win or loss, and percentage gained or lost. It was eye-opening to see how some of my “favorite” signal providers were actually costing me money despite their flashy win rate claims.

Another thing that caught me off guard was how win rates can vary wildly depending on market conditions. That same provider with 80% accuracy during the bull run? Yeah, they dropped to 45% when things got choppy. Market volatility, trending vs ranging conditions, even the time of day – all of this stuff impacts signal performance way more than most people realize.

The bottom line? Don’t get hypnotized by high win rate percentages. Look at the bigger picture – average profit per trade, maximum drawdown, and how consistent the performance is over different market cycles. Trust me, your wallet will thank you for doing the homework upfront.

How to Calculate and Analyze Signal Win Rates Correctly

Okay, let me tell you about the biggest mistake I made when I first started tracking my signal performance. I was calculating win rates like a complete amateur – just counting green trades versus red ones. Spoiler alert: that’s not how you do it properly.

The real win rate formula isn’t just about wins divided by total trades. That’s kindergarten math. You need to factor in partial fills, stopped-out positions, and signals that never triggered. Here’s what actually matters: (Profitable closed positions ÷ Total executed signals) × 100.

I learned this the hard way when I thought I had a 75% win rate on a particular channel. Turns out, I was only counting the trades that actually filled, ignoring the 20+ signals that never triggered because the price never hit the entry. When I recalculated properly, my real win rate was closer to 45%. Ouch.

Signal performance tracking gets messy fast if you don’t have a system. I started with a basic spreadsheet – signal time, entry price, exit price, profit/loss. But that misses crucial context. Now I track entry method (market vs limit), time to fill, drawdown during the trade, and whether I modified the original signal.

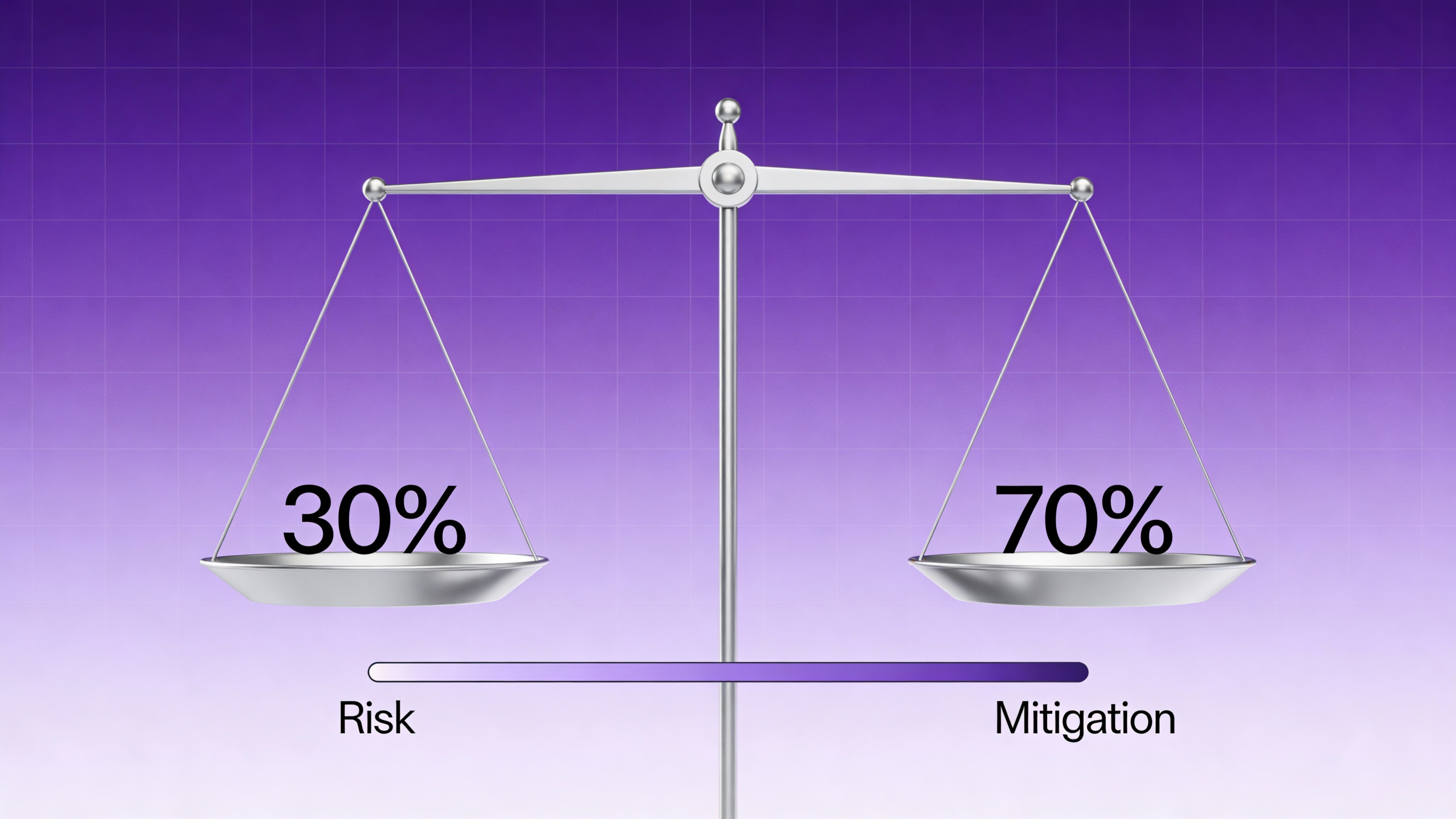

The game-changer was realizing that win rates mean absolutely nothing without risk-reward context. A 30% win rate with 1:4 risk-reward beats a 70% win rate with 1:1 every single time. I’ve seen traders obsess over high win rates while slowly bleeding their accounts dry with tiny wins and massive losses.

Here’s my current trading analytics framework: I calculate win rates over rolling 30-day periods, not just overall. Market conditions change, and so do signal providers. A channel that crushed it in a bull run might suck during sideways action. Monthly snapshots show you the real picture.

Another thing – separate your win rates by signal type. Breakout signals, reversal plays, and scalping setups all have different success patterns. I track them individually because lumping everything together gives you useless averages.

The most important metric I wish someone had told me about earlier? Consecutive loss streaks. Knowing that your best signal provider hits 6-8 losses in a row occasionally helps you size positions correctly and avoid panic during rough patches.

Don’t just calculate win rates – analyze them. Look for patterns in your losses. Are you consistently late on entries? Missing exits? Following signals during low-volume hours? The numbers tell a story if you know how to read them.

The Truth About Win Rates vs Profitability in Crypto Trading

Here’s something that blew my mind when I first started trading crypto signals – I was following this channel with an 85% win rate, feeling like I’d found the holy grail. Three months later, I was down 30% on my portfolio. How the hell does that even happen?

The brutal truth is that trading profitability has almost nothing to do with how often you win. I learned this the hard way when I got obsessed with win rates and completely ignored position sizing and risk management. That 85% win rate channel? They were making tiny 2-3% gains on winners but taking massive 15-20% losses on the losers.

Let me break down the math that changed everything for me. Say you have a 70% win rate – sounds pretty good, right? But if your average winner makes you $100 and your average loser costs you $400, you’re getting crushed. Even with 7 wins out of 10 trades, you’d make $700 on winners but lose $1,200 on losers. That’s a $500 loss despite being “right” most of the time.

This is where the risk reward ratio becomes your best friend. I now look for signals that target at least 2:1 or 3:1 risk-to-reward setups. Even with a 50% win rate, if you’re making $300 on winners and only losing $100 on losers, you’re printing money. The math works in your favor.

The real game-changer was learning expectancy calculation – it’s like having X-ray vision for signal quality. The formula is simple: (Win Rate × Average Win) – (Loss Rate × Average Loss). If this number is positive, you’ve got a profitable system. If it’s negative, run the other way, no matter how impressive that win rate looks.

I remember this one signal provider bragging about their 90% accuracy. When I ran the numbers, their expectancy was actually negative $12 per trade. Meanwhile, another provider with a “mediocre” 55% win rate had an expectancy of +$47 per trade because they knew how to cut losses quick and let winners run.

Now I barely glance at win rates when evaluating signals. Instead, I focus on the risk-reward profile and overall expectancy. It’s not about being right all the time – it’s about making sure that when you’re right, you make enough to cover those inevitable losses and still come out ahead.

Trust me, once you shift your mindset from chasing high win rates to focusing on actual profitability metrics, your trading results will improve dramatically. The market doesn’t care about your ego – it only cares about your bottom line.

Factors That Impact Crypto Signal Win Rates

I learned this the hard way after losing about $800 in my second month of signal trading. I was following this “premium” signal group that claimed 85% win rates, but my results were nowhere close. Turns out, there’s a whole bunch of factors that can make or break your signal performance, and most people don’t talk about them.

Market volatility is probably the biggest game-changer. During the 2022 bear market, I watched signals that worked beautifully in bull runs get absolutely demolished. When Bitcoin was swinging 10% daily, even the best technical analysis became useless within hours. I remember one particular week where every single signal I followed hit stop-loss because the market was just too choppy. The same signals that gave me 70% wins during stable periods suddenly dropped to maybe 30%.

Here’s what I noticed: high volatility periods favor scalping signals over swing trades, but only if you can execute them fast enough. Low volatility? That’s when longer-term signals shine because price action becomes more predictable.

Signal quality varies wildly between providers, and it took me months to figure out what actually matters. The fancy charts and complex indicators don’t mean much if the signal provider doesn’t understand risk management. I’ve seen signals with perfect entry points fail miserably because the stop-loss was set too tight or the take-profit was unrealistic.

The best signal providers I’ve found give you multiple scenarios. They’ll say something like “if we break above this level, target here, but if we get rejected, watch for support at this price.” That’s real signal quality – not just throwing out random buy/sell levels.

But here’s the kicker: execution timing can destroy even the best signals. I can’t tell you how many times I’ve seen a perfect signal setup, only to miss the entry by 5 minutes and watch the price run without me. Or worse, entering late and getting caught in a fake breakout.

This is where automated execution becomes crucial. I started using SignalShot after manually missing too many good entries, and my win rate jumped from around 45% to 68% just because I was hitting the exact entry prices. The difference between entering at $45,200 versus $45,800 on a Bitcoin signal can be the difference between profit and loss.

Market conditions change fast, signal providers aren’t all equal, and timing is everything. Once I understood these three factors, my trading results became way more consistent.

Evaluating Crypto Signal Providers: Beyond Win Rates

I learned this lesson the hard way after losing about $2,800 following a “95% win rate” provider back in 2021. The guy had screenshots, testimonials, the whole nine yards. What he didn’t show was that his average losing trade wiped out profits from 10 winning ones.

Here’s what I wish someone had told me about proper signal provider evaluation before I got burned.

Look at their risk-to-reward ratios first. A provider with a 60% win rate but consistent 1:3 risk-reward will absolutely crush someone with 80% wins at 3:1 risk-reward. I started tracking this religiously after my expensive education, and it completely changed how I viewed trading services.

The transparency thing is huge too. Any legit provider should show you their full trade history, not just cherry-picked winners. I remember this one service I was considering – when I asked for their complete trading record, they gave me some BS about “protecting their strategy.” Red flag city. Real providers have nothing to hide.

Check how they handle drawdown periods. Every trader hits rough patches, but how does your provider communicate during losing streaks? Do they panic and start revenge trading, or do they stick to their plan? I’ve seen providers completely change their strategy mid-month because they had a few bad trades. That’s not someone you want managing your money signals.

Here’s something most people miss in their trading service review process: execution timing. A provider might call a perfect entry, but if you can’t actually get filled at that price because of slippage or delays, those theoretical wins become real losses. This is why I love services that integrate directly with exchanges – no more missed entries because I was stuck in traffic.

Pay attention to position sizing recommendations too. Some providers will say “risk 2%” but never explain how to calculate that properly. Others give you exact position sizes based on your account balance. Guess which approach leads to better results?

The communication style matters more than you’d think. Providers who explain their reasoning help you learn and develop confidence in the signals. The ones who just drop “BUY BTC NOW!!!” without context? Usually pump-and-dump schemes or overconfident amateurs.

Most importantly, test their customer support before committing real money. Send them questions about their methodology, ask about their worst losing streak, inquire about refund policies. Their responses tell you everything about whether they’re running a professional operation or just trying to make quick cash off desperate traders.

Improving Your Personal Crypto Signal Win Rates

Look, I’ve been there. Staring at my trading history wondering why my win rate was sitting at a pathetic 32% while the signal provider claimed 78%. The brutal truth? It wasn’t just the signals – it was me.

The first wake-up call came when I realized I was completely ignoring position sizing. I’d throw the same $100 at every trade, whether it was a “high confidence” Bitcoin breakout or some sketchy altcoin moonshot. That’s like using the same bet size at poker regardless of your hand. Absolutely stupid in hindsight.

Here’s what actually moved the needle for my trading improvement: I started treating position sizing like a religion. High-confidence signals got 2-3% of my portfolio, medium confidence got 1-2%, and anything below that got a measly 0.5%. Sounds boring? Maybe. But it kept me alive during those brutal weeks when everything seemed to go wrong.

The second game-changer was actually reading the damn signals properly. I used to see “BTC long at 42,000” and just market buy immediately. Then I’d watch it dump to 41,500 and panic sell. Turns out, most good signal providers give you entry ranges for a reason. They’re not trying to be vague – they’re giving you room to be smart about your entries.

Risk management became my obsession after I blew 40% of my account in one week. Not kidding – it was that bad. Now I never risk more than 1% of my total portfolio on any single trade, no matter how “guaranteed” it looks. That Tesla signal that seemed like free money? Still just 1%. That insider tip from my buddy’s cousin? You guessed it – 1%.

I also started keeping a trading journal, which felt super nerdy at first but holy crap did it help. Every trade got logged: entry price, exit price, why I took it, what went wrong. Patterns emerged that I never would’ve noticed otherwise. Like how I consistently performed worse on Friday afternoon trades (probably because I was mentally checked out for the weekend).

The biggest revelation? My win rate improved from 32% to 61% not by finding better signals, but by being more selective. I went from taking 20 trades per week to maybe 5-7 quality setups. Quality over quantity isn’t just a cliché in trading – it’s literally the difference between profit and pain.

Stop chasing every shiny signal that pops up in your feed. Start treating each trade like it could make or break your account, because honestly, it can.

Advanced Win Rate Analysis and Optimization Techniques

Here’s where things get really interesting – and where I learned some expensive lessons. After tracking my signals for about six months, I thought I was hot stuff with my 68% win rate. Then I decided to dig deeper into the data, and man, did I get a reality check.

The first thing that hit me was how misleading surface-level win rates can be. I started doing proper backtesting strategies on my historical data, going back through different market conditions. Turns out my “amazing” 68% win rate dropped to 52% during bear markets. Ouch.

What really opened my eyes was breaking down performance by time periods. I discovered my signals performed 15% better during Asian trading hours versus European sessions. Who knew? I also found that my win rate tanked on Fridays – probably because I was mentally checked out for the weekend already.

Performance optimization became my obsession after that. I started categorizing every signal by market cap, volatility, and even the length of the signal message (seriously, shorter signals seemed to perform better). The key was creating what I call “performance buckets” – grouping similar market conditions and analyzing them separately.

One technique that completely changed my game was rolling win rate analysis. Instead of looking at overall percentages, I started tracking 30-day, 7-day, and even 24-hour rolling averages. This showed me when my signal providers were having hot streaks versus cold spells. Game changer.

For trading analytics, I built a simple spreadsheet that tracked not just wins and losses, but the quality of wins. A 2% gain and a 15% gain both count as “wins” but they’re definitely not equal. I started weighting my win rate calculations based on profit size, which gave me a much clearer picture of actual performance.

The most advanced technique I use now is correlation analysis between different signal providers. I discovered that three of my “independent” sources were basically copying each other. Once I figured that out, I could avoid over-leveraging on the same trades.

Here’s a pro tip that took me way too long to figure out: track your win rates by risk-reward ratios. Signals with 1:3 risk-reward don’t need the same win rate as 1:1 trades to be profitable. Sounds obvious now, but it wasn’t when I was starting out.

The bottom line? Basic win rate tracking is just the beginning. Real optimization happens when you start slicing and dicing your data like a data scientist. It’s tedious work, but the insights you’ll gain are absolutely worth it.

Conclusion

Look, I’ve been down this rabbit hole of chasing perfect win rates for way too long. The biggest lesson I’ve learned? Trading performance metrics are like a puzzle – you need all the pieces, not just the shiny ones that look good on paper.

Here’s what really matters when you’re doing signal analysis methods: expectancy beats win rate every single time. I’d rather have a 45% win rate with solid risk management than an 80% win rate that wipes out my account on the few losing trades. Trust me, I learned this the hard way when I blew through $3,000 chasing those “95% accuracy” signals that looked amazing until they didn’t.

The crypto trading guidance I wish someone had given me years ago is simple: focus on your process, not your profits. When you nail down consistent trading result analysis and actually understand what makes your signals tick, the money follows naturally. It’s like learning to drive – you don’t stare at the speedometer, you watch the road.

Your signal performance evaluation should become as routine as checking your phone in the morning. I spend 10 minutes every Sunday reviewing my trades, looking at what worked and what didn’t. These crypto trading insights have saved me more money than any fancy indicator ever could.

The real game-changer for trading success analysis is having the right tools. You can’t optimize what you can’t measure properly. That’s where professional signal quality analysis platforms make all the difference. Instead of juggling spreadsheets and trying to remember which signals came from where, you get everything in one place.

For serious crypto trading optimization, you need more than just basic tracking. You need trading performance improvement tools that show you the full picture – expectancy, drawdown periods, correlation between different signal sources, the works. This kind of signal effectiveness analysis transforms how you approach the markets.

The path to crypto trading success isn’t about finding the perfect signal provider. It’s about building a system for trading result optimization that works regardless of market conditions. When you have proper signal performance optimization in place, you stop being a gambler and start being a trader.

Ready to take your crypto trading excellence to the next level? Start Your Free Trial with SignalVision and get the professional-grade analytics you need to truly understand your trading performance. Stop guessing, start measuring, and watch your consistency improve. Your future trading self will thank you for making this decision today.

Leave a Comment