Did you know that 90% of crypto traders lose money not because they pick bad signals, but because they size their positions incorrectly? I learned this the hard way back in 2021 when I thought I was some kind of crypto genius.

Picture this: I’m sitting there with a $5,000 account, feeling invincible after hitting three winning trades in a row. Then I see this “guaranteed moonshot” signal in my Telegram group. Instead of my usual $200 position, I went all-in with $4,500. You can probably guess what happened next – that trade wiped out 90% of my account in less than 24 hours.

That brutal lesson taught me something every signal trader needs to understand: position sizing crypto strategies aren’t just math exercises, they’re survival tools. The difference between traders who consistently profit and those who blow up their accounts isn’t about finding better signals – it’s about proper crypto risk management.

I’ve spent the last three years obsessing over signal trading position size optimization, testing everything from the Kelly Criterion to volatility-adjusted models. What I discovered completely changed how I approach crypto trading. Most traders focus 80% of their energy on finding the perfect entry signal and maybe 20% on risk management. Successful traders flip that ratio.

The reality is, you can be wrong on 60% of your trades and still be profitable if you nail your position sizing formula. I’ve seen traders turn $1,000 into $50,000 using mediocre signals but excellent crypto money management. Meanwhile, others with incredible win rates still lose money because they don’t understand risk per trade crypto principles.

In this guide, I’m going to share everything I wish someone had taught me before I nearly nuked my account. We’ll cover practical crypto position calculator methods you can use right now, explore different percentage risk model approaches, and dive deep into advanced techniques like volatility adjusted sizing and stop loss position sizing.

Whether you’re manually executing signals or using automation tools, mastering portfolio risk management is what separates the pros from the gamblers. By the end of this article, you’ll have a complete framework for sizing positions that protects your capital while maximizing your profit potential.

Trust me, your future self will thank you for taking crypto trading risk seriously from day one.

What Is Position Sizing in Crypto Signal Trading

I’ll never forget my first month following crypto signals back in 2021. Bitcoin was pumping, everyone was making money, and I thought I was some kind of trading genius. Then came that one signal for LUNA (yeah, that LUNA) where I threw 40% of my portfolio at it because “it couldn’t possibly go wrong.” Spoiler alert: it went very, very wrong.

That painful lesson taught me what crypto position sizing really means. It’s basically deciding how much of your trading capital to risk on each signal you follow. Think of it like this – if your portfolio is a pizza, position sizing is deciding how big each slice should be before you hand it over to potentially hungry bears in the market.

Most people think signal trading basics are just about finding good signals. Wrong. The real game-changer is knowing how much to bet on each one. I’ve seen traders with terrible win rates still make money because they sized their positions smart. And I’ve watched others with 80% accuracy blow up their accounts because they went all-in on the wrong 20%.

Here’s the thing about crypto that makes position sizing even trickier than traditional markets – volatility is absolutely insane. A 30% swing in a day? That’s just Tuesday in crypto land. Your altcoin can pump 200% or dump 50% while you’re sleeping. This is why proper risk management isn’t optional, it’s survival.

Position sizing in signal trading works like this: every time you get a signal, you decide what percentage of your total portfolio you’re willing to risk losing on that trade. Notice I said “risk losing,” not “invest.” That’s the mindset shift that saved my account.

The math is actually pretty simple. If you decide to risk 2% of your portfolio per trade, and your stop loss is 10% below entry, then your position size should be 20% of your portfolio (2% ÷ 10% = 20%). But here’s where most people mess up – they see a “sure thing” signal and suddenly that 2% becomes 10% or 20% because FOMO kicks in.

I learned this the hard way when I started using tools that could automate my position sizing based on my risk rules. No more emotional decisions at 2 AM when some random altcoin signal comes through promising 500% gains. The system just calculates the right size and executes – takes all the emotion out of it.

Essential Position Sizing Methods for Crypto Traders

Look, I’ve blown up more accounts than I care to admit before I figured out proper position sizing methods. The worst was back in 2021 when I threw 40% of my portfolio into a single DOGE signal because “it was a sure thing.” Spoiler alert: it wasn’t.

After that painful lesson, I dove deep into the math behind position sizing. Turns out there are three main approaches that actually work in crypto, and each one serves different trading styles.

The Fixed Percentage Method

This is where most traders should start. You risk the same percentage of your account on every trade, usually between 1-3%. When I first started using this percentage risk model, I set it at 2% and stuck to it religiously.

Here’s the beauty of it – if you have a $10,000 account and risk 2% per trade, you’re only putting $200 at risk. Even if you hit a losing streak (and trust me, you will), you can survive 20+ consecutive losses without blowing up. That’s psychological safety right there.

The math is simple: Position Size = (Account Balance × Risk %) ÷ (Entry Price – Stop Loss Price). I literally have this formula saved in my phone because I’m terrible at mental math when emotions are running high.

The Kelly Criterion – For the Math Nerds

Now, the Kelly Criterion is where things get spicy. This method calculates your optimal bet size based on your historical win rate and average win/loss ratio. The formula looks intimidating: f = (bp – q) / b, where f is the fraction to bet, b is the odds, p is win probability, and q is loss probability.

I spent weeks backtesting my signals to get accurate numbers for this. Turns out my win rate was 58% with an average win 1.4x my average loss. The Kelly Criterion suggested risking about 12% per trade, which felt absolutely terrifying.

Here’s the thing though – Kelly assumes you can handle the volatility. In crypto, that 12% can swing wildly. I ended up using “fractional Kelly” at 25% of the suggested amount, so about 3% per trade. Much more manageable for my sanity.

The Volatility-Based Approach

This one’s my personal favorite for crypto signals. You adjust your position size based on how volatile the asset is. Bitcoin might get a 2% risk allocation, while some random altcoin gets 0.5%.

I calculate this using the 14-day Average True Range (ATR). Higher ATR means smaller position size. It’s saved me countless times when trading those wild small-cap altcoins that can move 20% in minutes.

Calculating Your Perfect Position Size Step-by-Step

Alright, let me walk you through exactly how I calculate position sizes now – because honestly, I used to wing it and that was a disaster waiting to happen. Lost about $800 in one week doing that nonsense.

Here’s my step-by-step process that’s saved my butt countless times. First thing – and I can’t stress this enough – decide your risk per trade before you even look at the chart. I stick to 2% of my account balance max. So if I’ve got $5,000 to play with, I’m only willing to lose $100 on any single trade.

Next, I identify where my stop loss needs to go. This isn’t some random number I pull out of thin air anymore. I look at support levels, recent swing lows, or whatever the signal provider suggests. Let’s say I’m buying BTC at $45,000 and my stop loss is at $43,500. That’s a $1,500 risk per coin.

Now here’s where the magic happens with the math. I take my dollar risk ($100) and divide it by my risk per coin ($1,500). That gives me 0.067 BTC as my position size. Simple as that.

But here’s what I learned the hard way – always double-check this with a position size calculator. I use one built into my trading app, but there are tons of free ones online. Just plug in your account size, risk percentage, entry price, and stop loss. Boom – it spits out exactly how much you should buy.

The thing that really clicked for me was realizing that position sizing isn’t about maximizing profits on winners. It’s about surviving the losers. I had this one streak where I hit 7 losing trades in a row – would’ve wiped me out if I hadn’t been sizing properly.

One more thing that’s been a game-changer: I actually write down my position size calculation before I enter the trade. Sounds nerdy, but it keeps me honest. Sometimes when you’re staring at a juicy signal, your brain starts doing funny math to justify bigger positions.

The best part about getting this right? You can actually sleep at night. No more 3 AM panic attacks checking your phone because you know exactly what you’re risking and you’re cool with it.

Risk Management Rules Every Signal Trader Must Follow

Let me tell you about the time I lost 40% of my portfolio in three days following signals without proper risk management rules. It was brutal, and honestly, I almost quit crypto trading altogether.

The worst part? I had decent signals. The problem was I threw every rule out the window because I was on a winning streak. Classic mistake that probably 90% of us make at some point.

Here’s what I learned the hard way, and what I wish someone had drilled into my head from day one:

Never risk more than 2-3% per trade, period. I don’t care how “sure” the signal looks or how much your favorite analyst is hyping it up. That BTC long that looked like free money? Yeah, it can still wreck you if you’re throwing 20% of your stack at it. I’ve seen too many traders get wiped because they confused confidence with recklessness.

The 2% rule saved my ass more times than I can count. Even when I hit a string of losses (and trust me, they come in bunches), I could still fight another day. Portfolio diversification isn’t just some fancy term – it’s your lifeline when the market decides to do the exact opposite of what everyone expects.

Speaking of diversification, don’t just spread across different coins. Diversify your signal sources too. I used to follow just one “guru” and when he went cold for two months, my account went with him. Now I track signals from multiple sources and never let one person control my entire trading destiny.

Set hard loss limits before you even enter a trade. Not suggestions, not “I’ll see how it goes” – actual hard stops. I learned this after watching a -15% loss turn into -45% because I kept thinking it would bounce back. It didn’t.

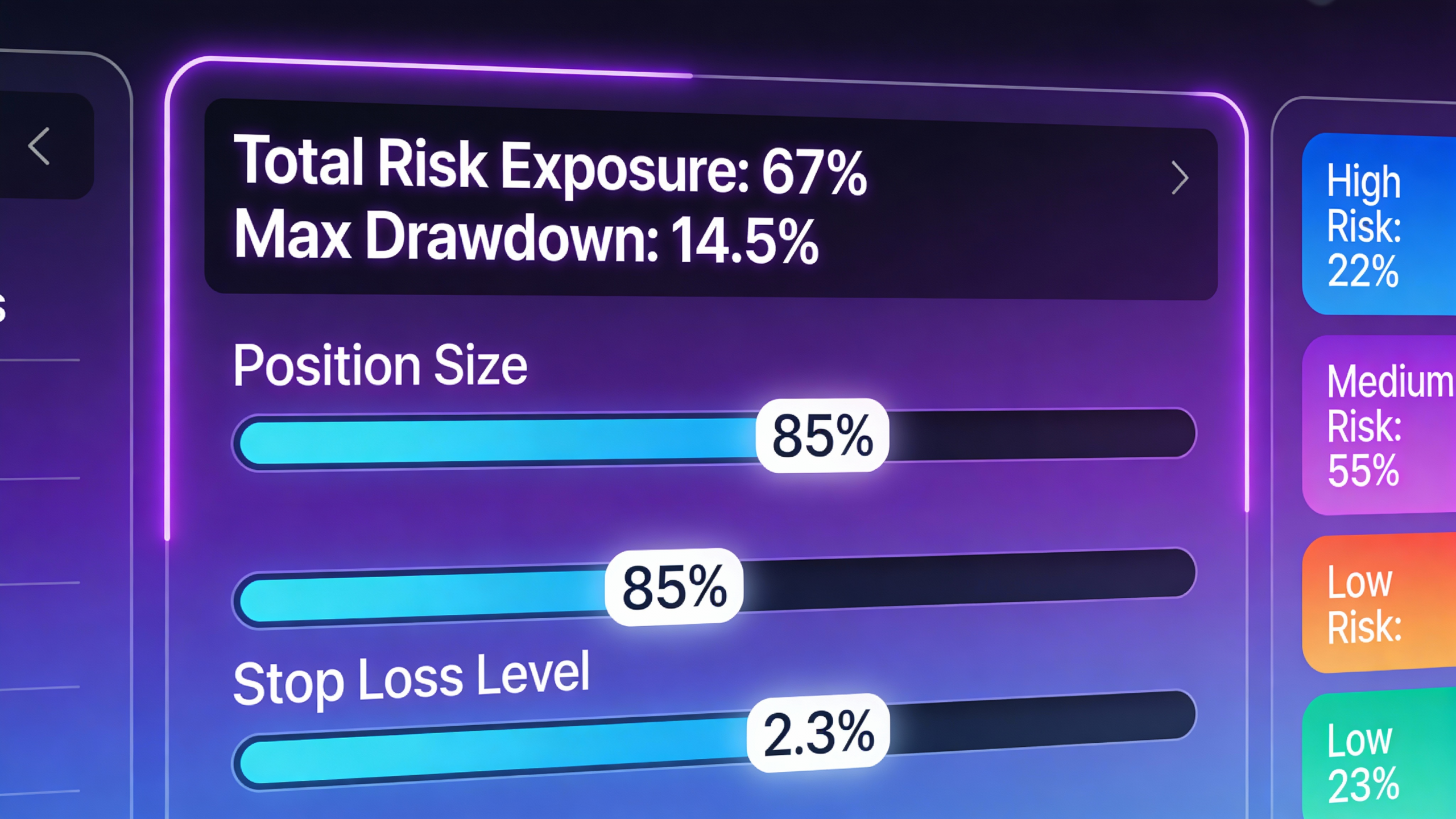

Here’s my current system: 2% risk per trade, maximum 10% of portfolio in active trades at once, and I’m out at -20% daily loss no matter what. Sounds conservative? Maybe. But I’m still here trading while half the people I started with are working at Starbucks.

The market doesn’t care about your feelings, your rent payment, or how confident you are. It’ll humble you faster than you can say “diamond hands.” Stick to your risk management rules like your financial life depends on it – because it does.

Advanced Position Sizing Strategies for Different Market Conditions

Man, I wish someone had taught me about adapting position sizes to market conditions when I first started. I was that guy who used the same 2% risk on every single trade, whether Bitcoin was in a raging bull run or bleeding out during a crypto winter. Spoiler alert: that approach nearly wiped me out in 2022.

The reality is that different market conditions demand completely different position sizing approaches. During volatile periods, I’ve learned to cut my usual position sizes in half. When the VIX is screaming and crypto’s swinging 10% daily, that “safe” 2% position can turn into a 6% loss real quick when stop losses get gapped through.

Here’s where pyramid trading became my secret weapon, especially during trending markets. Instead of throwing my entire position size at once, I’ll start with maybe 0.5% risk on the initial entry. If the trade moves in my favor and I’m seeing strong momentum, I’ll add another 0.5% at the next resistance break. This way, I’m scaling positions into strength rather than weakness.

I remember this one ETH trade last year where I started small at $1,600. As it broke through $1,700, then $1,800, I kept adding smaller chunks. By the time it hit $2,000, I had a decent position but my average entry was way better than if I’d gone all-in at the start. The key is making each additional position smaller than the last – that’s the pyramid structure.

During choppy, sideways markets, I’ve switched to what I call “feather sizing.” These are tiny positions, maybe 0.25% risk each, because signals tend to whipsaw like crazy when there’s no clear trend. Better to make small profits consistently than get chopped up by false breakouts.

Bear markets are where I really dial back the aggression. Even the best signals can fail when the overall trend is down. I’ll drop my position sizes to 1% or even 0.5% during confirmed downtrends. It’s boring, but it keeps you alive to trade another day.

The biggest lesson? Market conditions should dictate your risk appetite, not your emotions. When everything’s pumping and you’re feeling invincible, that’s exactly when you should be most conservative. When you’re scared and want to stop trading entirely, that’s often when the best opportunities emerge – but still with smaller size until confidence returns.

Psychology and Discipline in Position Sizing Decisions

Let me tell you about the time I blew up 40% of my account in a single weekend. It wasn’t because my signals were wrong or my technical analysis failed. It was because I let my emotions drive my position sizing decisions, and man, did I pay for it.

I’d been on a winning streak for about three weeks, hitting signal after signal. My confidence was through the roof, and that’s when trading psychology started playing tricks on me. Instead of sticking to my usual 2% risk per trade, I started bumping it up to 3%, then 5%, then… well, you can see where this is going.

The worst part? When I finally hit a losing streak, I fell straight into revenge trading. You know that feeling when you’re down and you just NEED to make it back immediately? Yeah, that’s exactly what happened. I started doubling down on positions, thinking the next signal would be the one to save me.

FOMO is probably the biggest position sizing killer out there. I remember seeing Bitcoin pump 15% in one day while I was sitting on the sidelines with a small position. My brain went nuts – “What if it goes to 100k? What if this is THE breakout?” So I tripled my position size on the next signal. Spoiler alert: it wasn’t the breakout.

Here’s what I’ve learned about maintaining trading discipline with position sizing. First, write down your position sizing rules when you’re completely calm and rational. Not after a big win, not after a crushing loss. Just when you’re in that neutral headspace.

I keep a sticky note on my monitor that says “2% MAX” in big red letters. Sounds silly, but it works. When emotions are running high, that visual reminder has saved me more times than I can count.

Another trick that’s helped me is the “sleep on it” rule. If I ever feel the urge to increase my position size beyond my normal range, I force myself to wait until the next day. 90% of the time, that urge passes and I realize how stupid it would’ve been.

The hardest lesson? Learning to be okay with missing out. Sometimes you’ll watch a signal moon with your small position while others are bragging about their massive gains. But those same people usually give it all back when they hit a bad streak. Consistency beats home runs every single time in this game.

Tools and Automation for Perfect Position Sizing

Look, I’ll be honest with you – manually calculating position sizes for every single trade nearly drove me insane. Picture this: it’s 2 AM, I get a hot signal in my Telegram group, and I’m sitting there with my calculator trying to figure out how much to risk while the market’s already moving. By the time I finished my math, the opportunity was gone.

That’s when I realized I needed position sizing tools and automation to save my sanity. The first tool I tried was a simple Excel spreadsheet I found online. It worked… sort of. But every time I wanted to trade, I had to open Excel, plug in numbers, and hope I didn’t mess up the formulas. Not exactly the smooth experience you want when you’re trying to catch a breakout.

Then I discovered trading bots and everything changed. But here’s the thing nobody tells you – not all bots are created equal when it comes to position sizing. I tried this one bot that claimed it could handle everything automatically. It did… until it risked 15% of my account on a single trade because I misconfigured one setting. That was a $800 lesson I’ll never forget.

The game-changer for me was finding automated trading solutions that actually understood risk management. What you want is a system that can take a signal from Telegram and automatically calculate the perfect position size based on your account balance and risk tolerance. No more late-night math sessions, no more missed opportunities.

Here’s what I learned about risk management automation: it’s not just about calculating position sizes. The best systems also handle stop losses, take profits, and even adjust your position size based on your recent performance. If you’ve been on a losing streak, some tools will automatically reduce your risk per trade until you get back on track.

I’ve tried probably a dozen different position sizing tools over the years. Some were too complicated, others too simple. The sweet spot is something that works directly with your exchange, pulls your account balance in real-time, and can execute trades instantly when signals come in. You don’t want to be fumbling around with multiple apps when the market’s moving fast.

The biggest mistake I see traders make is thinking they can handle all this manually forever. Trust me, you can’t. Your brain gets tired, you make errors, and those errors compound. Good automation doesn’t replace your judgment – it just handles the boring, error-prone stuff so you can focus on the bigger picture.

Conclusion

Look, I’ve been there – staring at my screen at 2 AM, wondering why my crypto portfolio looked like a rollercoaster that only went down. The difference between where I was then and where I am now? Position sizing fundamentals became my north star.

Here’s the thing about crypto trading theory – it’s only as good as your ability to implement it consistently. I used to think I had solid crypto trading skills, but I was missing the most crucial piece: proper position sizing. Once I nailed down these position sizing concepts, everything clicked into place.

The journey from basic crypto trading concepts to true crypto trading expertise isn’t just about reading charts or following signals. It’s about developing risk management expertise that protects your capital while maximizing your upside. That’s exactly what proper position sizing gives you.

I remember the exact moment when signal trading theory finally made sense to me. I was following this amazing signal provider, but I kept sizing my positions based on emotions rather than math. Some trades I’d go all-in, others I’d barely risk anything. My results were all over the place, even though the signals themselves were profitable.

That’s when I realized that signal trading skills aren’t just about finding good signals – they’re about executing them with the right size every single time. Position sizing skills became my secret weapon for consistency.

The beautiful thing about mastering these risk management concepts is that they compound over time. Each properly sized trade builds on the last one, creating this momentum that eventually leads to position sizing mastery. It’s not glamorous, but it works.

Now, here’s where most traders get stuck. They understand the theory, but implementing it manually every single time? That’s where mistakes happen. I used to have spreadsheets, calculators, the whole nine yards. But when you’re dealing with fast-moving crypto markets and time-sensitive signals, manual calculations become your enemy.

That’s exactly why I fell in love with automated solutions. Signal trading mastery isn’t just about understanding the concepts – it’s about having systems that execute them flawlessly, every single time.

Ready to take your crypto trading mastery to the next level? Stop leaving your position sizing to chance or rushed calculations. Start Your Free Trial with SignalVision today and let our automated risk management handle the math while you focus on what matters – growing your portfolio consistently and safely.

Trust me, your future self will thank you for making this decision today.

Leave a Comment