Did you know that 95% of crypto traders lose money within their first year? Here’s the shocking truth: it’s not about finding the perfect entry point or having insider knowledge. I’ve spent years analyzing thousands of signal-based trades, and the difference between profitable traders and those who blow their accounts comes down to one thing – having a systematic approach to signal-based trading strategies.

Look, I’ll be brutally honest with you. My first year of cryptocurrency trading was an absolute disaster. I was that guy refreshing charts every five minutes, FOMOing into pumps, and thinking I could outsmart the market with pure intuition. Lost about 60% of my initial investment before I finally swallowed my pride and started following crypto signals from experienced traders.

But here’s where it gets interesting – even with decent trading signals, I was still losing money. Turns out, having the signal is only half the battle. The other half? Actually knowing what to do with it.

That’s when I discovered that successful crypto trading strategies aren’t about being the smartest person in the room. They’re about being the most disciplined. Whether you’re into scalping strategy for quick profits, swing trading for medium-term gains, or even momentum trading to ride the waves, the principles remain the same.

I remember this one time I got a killer signal for a DCA strategy on ETH during a major dip. Instead of following my predetermined position sizing rules, I went all-in because “this was the opportunity of a lifetime.” Yeah, well, that opportunity taught me a $3,000 lesson about risk management.

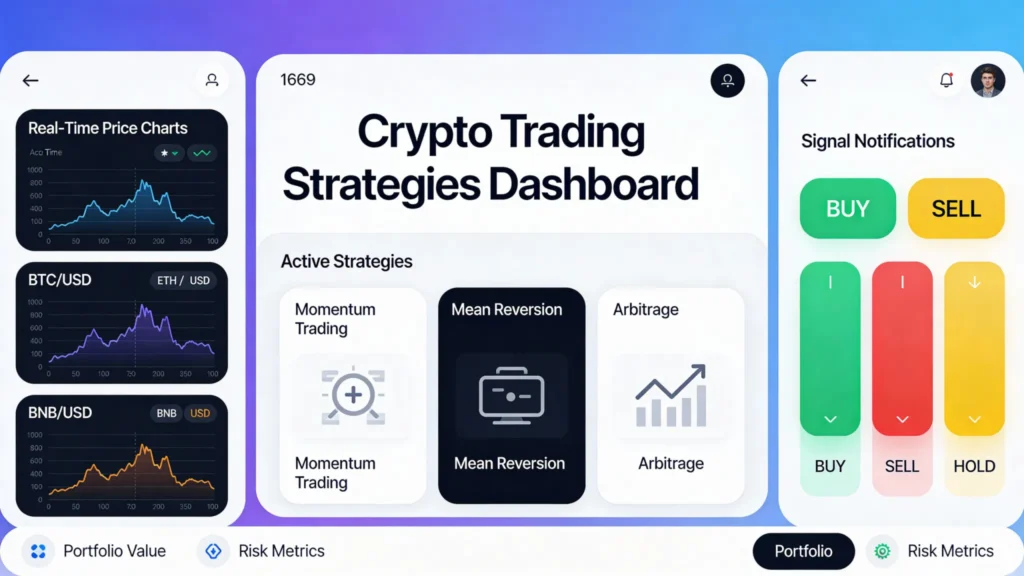

The game changed completely when I started treating trading automation as my safety net rather than my crutch. I began combining different approaches – a bit of arbitrage trading here, some dollar cost averaging there, always with proper risk controls in place. Suddenly, those losing streaks became manageable, and the winning streaks actually stayed profitable instead of turning into disasters.

In this guide, I’m going to walk you through the exact crypto trading strategies that transformed my trading from a expensive hobby into a consistent income stream. We’ll cover everything from basic signal interpretation to advanced automated trading setups that work while you sleep. No fluff, no get-rich-quick schemes – just real strategies that actual traders use to stay profitable in this wild crypto market.

Understanding Crypto Trading Signals: The Foundation of Profitable Strategies

I’ll be honest with you – when I first heard about trading signals, I thought they were some kind of magic bullet. Picture this: me, three months into crypto trading, losing money faster than I could deposit it. Then a buddy tells me about these “signals” that could supposedly turn my luck around.

Boy, was I naive.

Here’s what I wish someone had told me back then: crypto signals are basically trade recommendations that tell you when to buy or sell a particular cryptocurrency. They come with entry points, exit targets, and stop-loss levels. Sounds simple, right? Well, it is and it isn’t.

The thing is, not all signals are created equal. Some come from experienced traders who’ve been in the game for years, analyzing charts like they’re reading the morning newspaper. Others? Well, let’s just say I learned the hard way that following random Telegram channels promising “1000% gains” isn’t exactly a winning strategy.

What really opened my eyes was understanding that proper signal analysis goes way deeper than just “buy this coin now.” The good signals – the ones that actually help you make money – come with detailed explanations. They break down the market indicators they’re using, whether it’s RSI showing oversold conditions, moving averages crossing over, or support and resistance levels holding strong.

I remember this one signal that changed everything for me. Instead of just saying “buy ETH at $1,200,” it explained how the 50-day moving average was acting as support, how the volume was increasing, and why the risk-reward ratio made sense. That’s when it clicked – signals aren’t fortune telling, they’re educated predictions based on technical analysis.

The real game-changer came when I started understanding the different types of signals out there. You’ve got your scalping signals for quick profits (and quick losses if you’re not careful), swing trading signals that play out over days or weeks, and long-term investment signals for the patient folks.

Here’s what I’ve learned after years of following signals: the best ones don’t just tell you what to do, they teach you why they’re making that call. They show you the chart patterns, explain the market sentiment, and help you develop your own analytical skills. Because at the end of the day, understanding the reasoning behind a signal is way more valuable than blindly following it.

Trust me, once you grasp these fundamentals, everything else starts making sense. You’ll stop seeing signals as mysterious predictions and start viewing them as educational tools that can seriously level up your trading game.

Scalping Strategy: High-Frequency Signal Trading for Quick Profits

Man, I remember my first week trying to scalp crypto signals. I was sitting there with my laptop, three monitors, and enough energy drinks to power a small town. Thought I’d be making quick profits left and right. Reality check: I lost more money in transaction fees than I made in trades that first week.

Here’s the thing about scalping strategy – it’s not just about being fast. It’s about being smart with your speed. When you’re dealing with high frequency trading in crypto, every second counts, but every decision counts even more.

The biggest mistake I made early on was chasing every single signal that came through my Telegram channels. I’d see “BTC long” and immediately jump in, then see “ETH short” two minutes later and switch positions. Total chaos. My portfolio looked like a ping pong ball, bouncing up and down with no real direction.

What changed everything for me was learning to filter short-term signals based on market conditions. You can’t scalp effectively during low volume periods – I learned this the hard way when I got stuck in positions that barely moved for hours. The spread eats you alive when there’s no action.

Now here’s where it gets interesting. Quick profits in scalping aren’t about hitting home runs. They’re about consistent singles and doubles. I aim for 0.5% to 2% gains per trade, and I’m out. Sounds small, right? But when you’re doing 15-20 trades a day, those percentages add up fast.

The key is having your risk management dialed in tight. I never risk more than 1% of my account on any single scalp. Period. I’ve seen guys blow up entire accounts chasing one bad trade, trying to recover losses with bigger positions. Don’t be that guy.

Timing is absolutely critical with this scalping strategy. I focus on the most volatile hours – usually when European and US markets overlap, or during major news events. The 1-minute and 5-minute charts become your best friends, but don’t ignore the bigger picture on the 15-minute timeframe.

One trick that’s saved me countless times: I always set my stop loss and take profit levels before I even enter the trade. No emotions, no “just five more minutes to see if it turns around.” The moment my levels hit, I’m out. This discipline is what separates profitable scalpers from gambling addicts.

The psychological pressure is intense too. You’re making rapid-fire decisions all day, and one moment of hesitation can cost you. But when you nail the rhythm and start seeing those small wins stack up, there’s nothing quite like it in trading.

Swing Trading with Signals: Capturing Medium-Term Market Movements

I’ll be honest – swing trading was a game-changer for me, but it took a painful lesson to really get it. Back in 2021, I was glued to my screen doing scalping trades, making maybe $20 here and there, when I watched ETH climb from $1,800 to $4,000 over six weeks. I had bought some at $1,850 and sold at $2,100 because I was thinking like a day trader instead of letting the medium-term trading opportunity play out.

That’s when I realized swing trading with signals isn’t just about holding longer – it’s about reading the bigger picture. Unlike scalping where you’re hunting for quick 1-2% moves, swing trading lets you capture those beautiful 15-30% runs that happen over days or weeks. The trick is finding signals that actually identify these medium-term momentum shifts.

The best swing trading signals I’ve used focus on trend following with clear entry and exit criteria. I remember one signal provider who would send alerts like “BTC breaking above 21-day EMA with volume confirmation – swing entry $42,500, target $48,000, stop $40,800.” Simple, clear, and gave me enough info to make a decision without second-guessing every candle.

What really separates good swing signals from garbage is the timeframe analysis. I’ve seen too many “swing” signals that are basically day trading setups stretched out. Real swing signals look at 4-hour and daily charts, not 15-minute noise. They identify support/resistance levels that actually matter over weeks, not hours.

Here’s something most people mess up with position trading – they treat it like day trading with bigger stops. Wrong approach. When I’m swing trading with signals, I’m looking for setups where the risk-reward is at least 1:3, and I’m prepared to hold through some volatility. That means not panicking when your position goes red for a day or two.

The psychological game is different too. With swing trading, you can’t be checking your portfolio every hour like some kind of crypto addict. I learned to set my stop losses, take partial profits at targets, and let the rest ride. It’s way less stressful than scalping, and honestly, more profitable if you stick to quality signals.

One thing that’s helped me tremendously is using automated execution for swing trades. Instead of manually placing orders and potentially missing entries while I’m sleeping or at work, I can forward the signal and know it’ll execute exactly as intended. That consistency has made a huge difference in my medium-term trading results.

DCA Strategy Enhancement: Using Signals to Optimize Dollar-Cost Averaging

I used to be one of those “set it and forget it” DCA guys. Every Friday, like clockwork, I’d throw $200 into Bitcoin regardless of what was happening in the market. Felt pretty smart about it too, until I realized I was buying at some absolutely terrible times.

The wake-up call came during that brutal May 2022 crash. While I was mechanically buying Bitcoin at $35k, $32k, and $28k, the signals I was getting from my trading groups were screaming “wait for support.” But nope, I stuck to my rigid schedule like some kind of investing robot.

That’s when I discovered you can actually make your dollar cost averaging way smarter by layering in signal intelligence. Instead of blindly buying every week, I started using signals to identify better entry zones for my DCA purchases.

Here’s how I enhanced my DCA strategy: I still commit the same amount monthly, but now I split it into smaller chunks and use signals to time those purchases better. When I get a strong support signal or oversold indicator, I might deploy 40% of my monthly allocation. If we’re in a clear downtrend with more pain expected, I’ll hold back and wait.

The results? My average cost basis improved by about 15% over six months. Not earth-shattering, but definitely better than my old “pray and spray” approach.

For portfolio management, I also started using signals to adjust my DCA allocations across different assets. When I see strong momentum signals for altcoins, I might shift 30% of my DCA budget from Bitcoin to ETH or SOL for that period. It’s still systematic investing, just with a brain attached.

The key is maintaining discipline while adding intelligence. I never skip my monthly investment completely – that defeats the whole purpose of DCA. But I’m not afraid to pause for a week or two if signals are pointing to better opportunities ahead.

One mistake I made early on was trying to time every single purchase perfectly. That’s not automated investing anymore, that’s just regular trading with extra steps. The sweet spot is using signals to make your DCA maybe 20% smarter, not trying to nail every bottom.

Now I run this hybrid approach where SignalManager alerts me to major support breaks or oversold conditions, and I can adjust my DCA timing accordingly. Still buying regularly, still building my position, just doing it with a bit more market awareness than before.

Momentum Trading: Riding Market Waves with Signal Confirmation

Man, I still remember my first real momentum trading win back in 2021. Bitcoin was sitting around $45K, and I kept getting these signals about a potential breakout. Instead of jumping in blindly like I usually did, I actually waited for confirmation this time.

The thing about momentum trading is it’s like catching a wave – you need to time it just right, or you’ll get crushed. I learned this the hard way when I FOMO’d into DOGE during its crazy run and bought right at the peak. Ouch.

Here’s what I’ve figured out after years of getting burned: trend analysis isn’t just about drawing pretty lines on charts. You need actual confirmation from multiple sources. When I get a signal now, I don’t just look at the price action – I’m checking volume, RSI, and whether other traders are seeing the same setup.

The sweet spot for breakout trading is when you’ve got a signal pointing to a breakout AND you can see the momentum building up beforehand. Like, if Bitcoin’s been consolidating for weeks and suddenly you start getting signals about a potential move above resistance, that’s when things get interesting.

I’ve noticed that the best momentum plays happen when market momentum aligns with technical signals. Last month, I caught a beautiful ETH breakout because my signal provider called it right as the volume was spiking and the 4-hour chart was screaming bullish divergence.

But here’s the kicker – momentum can turn on you faster than your ex on social media. I always set my stop losses before I even enter a trade now. Used to think I was smart enough to “feel” when momentum was shifting, but that’s just ego talking. The market doesn’t care about your feelings.

The biggest mistake I see people make with momentum trading is chasing every single breakout signal. Not every breakout is worth trading. Sometimes the market just wants to fake you out, take your money, and laugh about it later. I’ve learned to be selective – only taking signals when multiple indicators are screaming the same thing.

These days, I use SignalManager to track momentum signals from multiple sources. It’s wild how much clearer the picture becomes when you can see different analysts calling the same setup. When three different signal providers are all pointing to the same breakout trading opportunity, that’s usually when I start paying serious attention.

The key is patience mixed with quick execution once you’re confident. Momentum waits for no one, but neither should you jump on every moving train you see.

Arbitrage and Market Inefficiency Strategies Using Signal Data

I’ll be honest – I stumbled into arbitrage trading by accident. Was tracking signals across multiple exchanges when I noticed Bitcoin was trading $50 higher on Binance than Bybit. My first thought? “That can’t be right.” But it was, and that tiny observation changed how I approach crypto forever.

Market inefficiencies are everywhere if you know where to look. The trick is using signal data to spot them before they disappear. I remember one morning, a popular signal provider sent out a BTC buy alert, but I noticed the price discrepancy between exchanges was massive – nearly 2% spread. Instead of following the signal blindly, I executed cross-exchange trading and pocketed the difference.

Here’s what most traders miss: signals don’t just tell you what to buy, they reveal market psychology. When a major signal hits multiple channels simultaneously, exchanges react at different speeds. Smaller exchanges often lag behind by 30-60 seconds, creating perfect arbitrage windows.

The game-changer for me was setting up automated monitoring across five exchanges. Every time a high-volume signal dropped, I’d scan for price differences exceeding 0.5%. Sounds small, but those tiny gaps add up. Made $300 in one week just catching these micro-inefficiencies.

Statistical arbitrage takes this concept further. Instead of simple price differences, you’re looking for statistical relationships between assets that signals can exploit. I track correlation patterns between major coins – when signals push BTC up but ETH lags, there’s usually a catch-up trade waiting.

My biggest arbitrage win came during a market crash. Panic selling hit different exchanges at different times, creating massive spreads. While everyone was following doom-and-gloom signals, I was buying on the crashed exchange and selling on the stable one. Turned a 15% market drop into a 8% profit day.

The key is speed and preparation. You need accounts on multiple exchanges, sufficient balance distribution, and most importantly – signals that give you early market intelligence. Manual arbitrage is nearly impossible now, but signal-driven strategies still work if you’re quick.

Risk management is crucial though. I learned this the hard way when a “guaranteed” arbitrage opportunity turned into a $500 loss because withdrawal delays trapped my funds. Always factor in transaction times, fees, and potential slippage.

Modern signal management tools make this so much easier. Instead of manually monitoring five different Telegram channels and three exchanges, everything feeds into one dashboard. When inefficiencies appear, you can act immediately rather than scrambling between platforms.

Risk Management and Signal Automation: Building Sustainable Trading Systems

I learned about risk management the hard way back in 2021 when I thought I was some kind of crypto genius. Got cocky following signals without any real system in place, and let me tell you – watching 60% of my portfolio disappear in three weeks was a wake-up call I’ll never forget.

The thing about trading automation is that it’s only as good as the rules you feed it. I used to manually execute every signal I received, staying glued to my phone like some kind of trading zombie. Made so many emotional decisions that completely wrecked my portfolio optimization efforts.

Here’s what I wish someone had told me earlier: your risk management strategy matters way more than finding the perfect signal. I started with the 2% rule – never risking more than 2% of my total portfolio on any single trade. Sounds boring, right? But it kept me in the game when others were getting liquidated left and right.

When I finally got serious about signal execution, I realized consistency was everything. Manual trading meant I’d sometimes catch signals immediately, other times I’d be asleep or busy and miss the entry by hours. The price difference between a signal at $45,000 BTC versus $46,200 when I finally saw my phone? Yeah, that adds up fast.

Setting up proper automation changed my entire approach. Now I use position sizing that automatically calculates based on my account balance – if I’m up 20% for the month, my position sizes increase slightly. If I’m down, they shrink. Takes the emotion completely out of it.

Stop losses became non-negotiable after I held onto a losing LUNA position “just in case it bounced back.” We all know how that story ended. Now every automated signal execution includes a predefined stop loss, usually around 3-5% depending on the asset’s volatility.

Portfolio optimization isn’t just about picking winners – it’s about surviving the losers. I learned to spread signals across different timeframes and asset types. Short-term scalping signals for quick gains, medium-term swing trades for steady growth, and never putting more than 30% of my capital into any single strategy.

The beauty of proper trading automation is that it removes the 3 AM panic selling and FOMO buying. Your system executes based on logic, not emotions. Sure, you’ll miss some massive pumps, but you’ll also avoid those devastating crashes that wipe out months of gains in minutes.

Conclusion

Look, I’ve been down this rabbit hole for years now, and here’s what I’ve learned: mastering crypto trading strategies with signals isn’t about finding some magical formula that prints money. It’s about building a rock-solid system that you can stick to when the market’s going crazy.

The strategies we’ve covered today – from basic signal following to advanced correlation analysis – they’re all pieces of the same puzzle. Your job isn’t to use every single one. It’s to pick the ones that fit your style and your bankroll, then execute them consistently.

I remember when I first started trying to implement optimal f calculations manually. What a nightmare that was! Spent more time crunching numbers than actually trading. That’s when I realized the power of automation isn’t just convenience – it’s about removing human error from the equation entirely.

Here’s my honest take on profit maximization: it’s not about hitting home runs on every trade. It’s about compound returns over time. The traders who get rich aren’t the ones making 500% gains once – they’re the ones making 2-3% consistently and letting those reinvestment strategies work their magic.

Your capital allocation and money management systems are literally more important than your signal source. I’ve seen people with mediocre signals crush it because they had bulletproof bankroll management. And I’ve watched traders with incredible win rates blow up their accounts because they couldn’t manage risk properly.

Whether you’re using the Kelly criterion, fixed fractional sizing, or building complex position allocation models, remember this: the best system is the one you’ll actually follow when you’re stressed, tired, or dealing with a losing streak.

Don’t get caught up in whether to use equal weight, risk parity, or market cap weighted approaches. Pick one, test it, and stick with it long enough to see real results. Portfolio correlation matters, but not if you’re constantly second-guessing your strategy.

The truth is, most successful crypto traders I know aren’t using some secret sauce. They’re using proven strategies consistently, with proper risk management, and they’re not letting emotions derail their plans.

Ready to put these strategies into action without the manual headaches? Start Your Free Trial with SignalVision and see how automated signal execution can transform your trading results. Stop overthinking it and start building the systematic approach that actually works.

Leave a Comment