Did you know that 78% of crypto traders lose money within their first year? Here’s the shocking truth: most fail because they’re trading blind without proper signals!

I learned this the hard way back in 2021 when I was throwing money at random altcoins based on Twitter hype. Lost about $3,000 in my first two months – ouch. That’s when I discovered crypto trading signals telegram groups, and honestly, it changed everything for me.

But here’s where it gets tricky. Not all telegram crypto signals are created equal. I’ve been in probably 50+ different signal groups over the past three years, and let me tell you – some are absolute gold mines while others are straight-up scams that’ll drain your wallet faster than you can say “to the moon.”

The crypto signal space on Telegram is wild. You’ve got everything from free crypto signals telegram channels with thousands of members posting random calls, to premium crypto signal channels charging $200+ per month. I’ve seen guys make 300% gains following the right telegram trading signals, and I’ve also watched people lose their entire portfolios chasing bad advice.

What really frustrates me is how many traders jump into cryptocurrency signals without understanding what they’re actually following. They see a flashy channel with “90% win rate” plastered everywhere and think they’ve found the holy grail. Trust me, I fell for that BS too many times to count.

The reality is that finding legitimate bitcoin trading signals and reliable altcoin signals telegram groups requires serious research. You need to understand the difference between crypto trading alerts that actually help you time the market versus random noise from wannabe influencers.

Over the years, I’ve developed a system for evaluating telegram signal groups and crypto signal providers. I track performance, analyze their risk management, and most importantly – I test their signals with small amounts before going all-in. Because let’s be real, anyone can post a trading signal telegram message, but making consistent profits? That’s where most people fail.

In this guide, I’m sharing everything I’ve learned about navigating the world of crypto signals free and premium services. We’ll dive deep into how to identify the best telegram crypto channels, red flags to avoid, and practical strategies that have actually worked for me. No fluff, no BS – just real experience from someone who’s been through the trenches and lived to tell the tale.

What Are Crypto Trading Signals on Telegram?

So you’ve probably stumbled across those telegram crypto signals channels while scrolling through your phone at 2 AM, right? I know I did back in 2021 when I was desperately trying to figure out why my portfolio kept bleeding red.

Here’s the thing – crypto trading signals are basically trading alerts that tell you when to potentially buy or sell a specific cryptocurrency. Think of them like your buddy texting you “Dude, Bitcoin’s about to pump!” except these come from traders who (hopefully) know what they’re talking about.

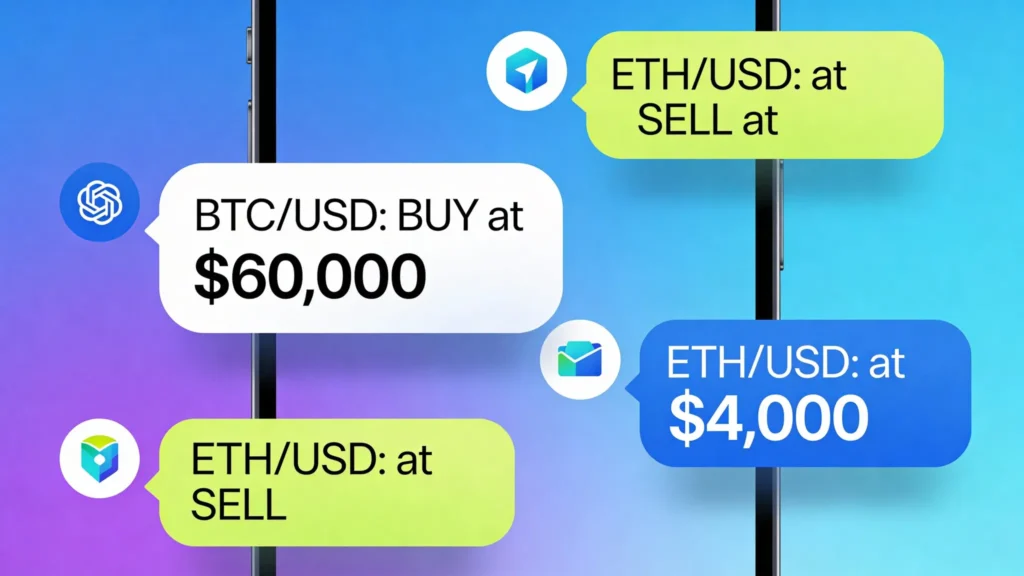

Most of these signals show up in Telegram channels because, let’s face it, Telegram is where the crypto community lives. I’ve been in probably 50+ signal channels over the years, and they all follow a similar pattern. You’ll get a message that looks something like this:

📈 BTC/USDT LONG

Entry: $42,500 – $42,800

Stop Loss: $41,200

Take Profit: $45,000

The signal provider is essentially saying “Hey, I think Bitcoin is going up from this price range.” They’ll give you an entry point (where to buy), a stop loss (where to cut your losses if things go south), and take profit levels (where to sell for gains).

Now, I learned the hard way that not all buy sell signals are created equal. Some channels pump out 20 signals a day like they’re running a signal factory. Others are more selective, maybe 2-3 quality setups per week.

The tricky part? Actually executing these signals fast enough. I remember missing out on a killer ETH signal because I was stuck in a meeting and by the time I got to my phone, the price had already moved 8%. That’s when I realized manual execution just wasn’t cutting it anymore.

What makes Telegram perfect for this is the instant notifications. The moment a signal drops, boom – it’s on your phone. No waiting for emails or checking websites. Plus, most signal providers use Telegram’s formatting features to make their alerts crystal clear with emojis, bold text, and structured layouts.

The reality is that good signal providers are essentially sharing their market analysis and trade ideas with you in real-time. They’re doing the chart reading, the technical analysis, and the market research – then packaging it into easy-to-follow trading alerts that you can act on immediately.

But here’s what nobody tells you upfront: the execution speed can make or break your results with these signals.

How to Find Legitimate Crypto Signal Telegram Channels

I’ve been down this rabbit hole more times than I care to admit. Back in 2021, I probably joined 50+ telegram trading channels looking for the holy grail of crypto signals. Spoiler alert: most of them were garbage, and I learned some expensive lessons along the way.

The first red flag I should have noticed? Channels promising 90%+ win rates with screenshots that looked like they were made in MS Paint. But hey, we’ve all been there, right? The FOMO was real, and I wanted to believe I’d found the shortcut to crypto riches.

Start with the basics when evaluating signal provider verification. Check how long the channel has been active – anything under 6 months is sketchy in my book. I once joined a channel that was only 3 weeks old but claimed years of trading experience. Yeah, that didn’t end well.

Look for transparency in their trading history. The best crypto signal groups will show you their actual trades, not just cherry-picked winners. I remember finding this one channel that posted every single trade – wins, losses, everything. Their win rate was around 65%, which seemed realistic compared to the 95% claims I’d been seeing everywhere else.

Here’s something that took me way too long to figure out: check if they’re actually trading their own signals. Some providers will post a signal and then immediately contradict themselves in the comments. That’s a massive red flag.

Community engagement is huge. Legitimate telegram trading channels have active discussions where members share their results – both good and bad. If the chat is just the admin posting signals with zero interaction, run. The best channels I’ve found have members helping each other, sharing screenshots of their trades, and discussing market conditions.

Don’t fall for the “VIP group” trap immediately. I’ve seen too many channels offer free signals just to upsell you to their premium service. Test their free signals for at least a month before considering any paid options. Track everything yourself – don’t trust their reported results.

Another thing I wish I’d known earlier: legitimate providers explain their reasoning. They’ll tell you why they’re entering a trade, what they’re watching for, and their exit strategy. If someone just posts “BTC long” with no context, that’s not a signal – that’s a guess.

Finally, be wary of channels with too many members. I’ve noticed that once a telegram channel hits 10,000+ members, the signal quality often drops. The best performers I’ve found usually have smaller, more engaged communities where the admin actually knows their members.

Top Crypto Trading Signal Telegram Channels in 2026

Alright, let me save you some time here. I’ve been down the rabbit hole of hunting for the best telegram crypto groups more times than I care to admit. Started back in 2021 when I was convinced I could find that one magical channel that would make me rich overnight. Spoiler alert: didn’t happen.

The landscape has changed dramatically since then. What used to be a wild west of pump-and-dump schemes has evolved into something more… well, still pretty wild, but at least there are some legitimate players now.

Free vs Premium: The Eternal Debate

Here’s what I learned the hard way about free crypto signals. They’re everywhere, and most of them are absolute garbage. I joined probably 50+ free channels in my first year, and maybe 3 were worth keeping notifications on.

The problem with free signals? No skin in the game. Anyone can create a channel, post some random TA, and call it a day. I remember this one channel that had 80k members posting signals like “BTC to the moon 🚀” with zero entry points, stop losses, or actual strategy.

But here’s the thing – some free channels are actually run by traders building their reputation before going premium. I found a couple gems this way, though it took months of filtering through the noise.

Premium Trading Signals: Worth the Investment?

Now premium trading signals – that’s where things get interesting. I’ve probably spent close to $2,000 testing different premium services over the years. Some were complete scams, but others? Game changers.

The best premium channels I’ve found share a few characteristics. First, they’re transparent about their track record. Not just showing winning trades, but actual P&L over months. Second, they provide detailed entry and exit strategies, not just “buy XYZ coin.”

One channel I still follow charges $99/month and has consistently delivered 15-20% monthly returns. Not get-rich-quick money, but solid, compound-worthy gains. They post maybe 3-4 signals per week, each with clear risk management.

Red Flags I Wish I’d Known Earlier

Channels promising 1000% gains? Run. Groups with more rocket emojis than actual analysis? Skip. Any service asking for your exchange API keys? Hell no.

I got burned once by a channel that seemed legit for two months, then suddenly started pushing their “exclusive coin launch.” Lost $500 on that lesson. Now I stick to channels that focus purely on established coins and proven strategies.

The real winners are the channels that teach you why they’re making trades, not just what to buy.

How to Evaluate and Use Crypto Signals Effectively

I’ll be honest – my first month following crypto signals was a complete disaster. I was basically throwing money at every signal that popped up in my Telegram feed, treating each one like a lottery ticket. Lost about 30% of my portfolio before I realized I needed an actual signal trading strategy.

The biggest mistake I made? Not doing my homework on the signal providers. I was following this one channel with 50k subscribers, thinking bigger meant better. Turns out their win rate was garbage – maybe 35% – but they were great at marketing. Now I track everything in a spreadsheet for at least two weeks before risking real money.

Here’s what actually matters when evaluating signals: consistency over flashy wins. I look for providers who share their losses too, not just the moonshot trades. Red flag if someone’s posting screenshots of 500% gains but never mentions the duds. Real traders lose money sometimes, and honest signal providers admit it.

Risk management crypto style became my saving grace after those early losses. I learned this the hard way when a “sure thing” BTC signal wiped out 15% of my account in one trade. Now I never risk more than 2% per signal, period. Doesn’t matter how confident the provider sounds or how many rocket emojis they use.

The position sizing game changed everything for me. I use a simple rule: if a signal has a stop loss more than 5% away from entry, I reduce my position size accordingly. So if the SL is 10% away, I’m only putting half my usual amount. This saved my ass during that crazy May 2022 crash when everything was gapping down.

I also learned to ignore signals during major news events. Made that mistake during a Fed announcement once – followed a long signal right into a 12% dump. Now I just sit on my hands when there’s big macro stuff happening. The market’s too unpredictable during those times.

One trick that’s worked well: I only follow signals that include proper risk-reward ratios. If someone’s calling for a 2% target with a 8% stop loss, that’s an automatic pass. The math just doesn’t work long-term. I stick to signals with at least 1:2 risk-reward, preferably better.

The timing thing is crucial too. I’ve missed plenty of good signals because I was sleeping or busy with work. That’s actually why I started using automation tools – can’t be glued to my phone 24/7 waiting for the next trade setup.

Automating Your Crypto Signal Trading

I’ll be honest – I spent way too many nights glued to my phone, waiting for signals to drop in those Telegram channels. The FOMO was real, especially when a signal would come through at 2 AM and I’d miss it because I was actually sleeping like a normal human being.

That’s when I realized automated crypto trading wasn’t just some fancy tech for hedge funds anymore. It was becoming essential for anyone serious about following signals consistently.

The thing about signal automation is that it eliminates the biggest enemy of profitable trading: human emotion. I remember this one time, I got a signal for a long position on SOL, but by the time I fumbled around trying to calculate position sizes and set my stop losses, the entry price had already moved against me by 3%. Automation would’ve caught that entry perfectly.

But here’s where most people mess up – they think crypto trading bots are these complex beasts that require coding knowledge. That’s old school thinking. Modern signal automation tools can literally read your Telegram signals and execute them automatically with proper risk management built right in.

I’ve tested a bunch of different approaches. Some traders try to build their own bots using APIs, which honestly is like trying to perform surgery with a butter knife if you’re not a developer. Others use these generic trading bots that require you to manually input every signal, which defeats the whole purpose of automation.

The sweet spot is finding a solution that bridges your signal source directly to your exchange. When I started using proper signal automation, my consistency improved dramatically because I wasn’t missing entries due to being in meetings or sleeping.

Here’s what changed the game for me: automated crypto trading that could handle position sizing based on my account balance, set stop losses and take profits automatically, and most importantly – execute trades within seconds of receiving a signal. No more screenshot-to-trade delays.

The psychological benefit is huge too. When you know your automation is handling the execution, you can actually focus on evaluating signal quality instead of frantically trying to copy trades. I started sleeping better knowing I wouldn’t miss profitable setups just because I had a life outside of crypto.

One warning though – automation amplifies everything. If you’re following garbage signals, automation will execute garbage trades faster than you can manually. The quality of your signal source becomes even more critical when you’re automating.

But when you combine solid signals with reliable automation? That’s when trading starts feeling less like gambling and more like running a systematic business.

Common Mistakes When Following Telegram Crypto Signals

Oh man, where do I even start with this one? I’ve probably made every crypto trading mistakes in the book when it comes to following Telegram signals. And trust me, my wallet has the scars to prove it.

The biggest whopper I pulled early on was going all-in on a single signal. Some guru posted a “100% guaranteed moon shot” for some random altcoin, and I literally threw my entire portfolio at it. The coin tanked 60% in two hours. I learned real quick that signal trading errors like this can wipe you out faster than you can say “diamond hands.”

Another classic mistake? Ignoring stop losses completely. I’d see these signals with clear stop loss levels, but my greedy brain would think “nah, it’ll bounce back.” Spoiler alert: it rarely did. Risk management failures like this turned what should’ve been small 5% losses into devastating 30-40% portfolio hits.

Here’s one that still makes me cringe – blindly following signals without understanding the reasoning behind them. I was basically a sheep following the herd, copying trades without doing any research on the coins or market conditions. When things went south, I had zero clue why or how to adjust my strategy.

Position sizing was another disaster for me. I’d risk the same amount on every signal, whether it was a “low confidence” play or a “high conviction” trade. That’s backwards thinking right there. High-risk signals should get smaller position sizes, not the same treatment as your bread-and-butter setups.

The FOMO trap got me countless times too. I’d see a signal that was already up 20% and think “I’m missing out!” So I’d jump in at the worst possible moment – right before the pullback. Learning to wait for proper entry points instead of chasing pumps saved me so much money once I finally got it through my thick skull.

And don’t get me started on revenge trading. After a bad signal would hit my stop loss, I’d immediately look for the next “sure thing” to make my money back. This emotional trading led to even bigger losses and turned single bad trades into week-long losing streaks.

The lesson? Treat signal following like a business, not a casino. Set clear rules, stick to your risk management, and never risk more than you can afford to lose on any single trade. Your future self will thank you for it.

Building Your Own Crypto Signal Trading Strategy

Look, I’m gonna be real with you – following signals blindly is like driving with your eyes closed. I learned this the hard way after blowing through $2,000 in my first month because I thought every signal was gospel. The truth is, developing your own crypto trading strategy around signals is what separates the winners from the wannabes.

My wake-up call came when I was following this “guru” who had a 90% win rate (or so he claimed). Dude would drop these signals at 3 AM, and I’d wake up, see Bitcoin down 5%, and panic sell everything. Then it would rocket up an hour later. That’s when I realized I needed a proper trading system development approach instead of just copying trades like a zombie.

Here’s what actually works: Start by tracking every signal you receive for at least two weeks without trading a penny. I use a simple spreadsheet – signal time, entry price, exit targets, stop losses, and what actually happened. This signal analysis phase is crucial because you’ll start seeing patterns. Maybe your signal provider is great at spotting breakouts but terrible at timing entries during choppy markets.

Next, define YOUR rules. I learned this after getting burned on a Sunday night trade that went sideways for three days. Now I never take signals on weekends when volume is low, and I always wait for confirmation on the 15-minute chart before entering. Your rules might be different – maybe you only trade signals that come with clear risk-reward ratios, or you avoid anything during major news events.

The game-changer for me was building position sizing into my strategy. I used to throw the same amount at every trade like I was feeding a slot machine. Now I risk 2% on high-confidence signals (ones that align with my technical analysis) and 1% on everything else. This simple change turned my account from a roller coaster into steady growth.

Don’t forget about market conditions either. Bull market signals hit different than bear market ones. I keep a trading journal where I note whether we’re trending, ranging, or in full panic mode. Breakout signals work great when Bitcoin is pumping, but mean reversion strategies shine when everything’s moving sideways.

The biggest mistake I see people make is trying to automate everything from day one. Start manual, understand the logic behind each decision, then gradually add automation. That’s exactly why tools like SignalManager are so valuable – they help you track and analyze without taking away your decision-making power.

Conclusion

Look, I’ve been down this road before – chasing the perfect signal, jumping between different Telegram channels, and honestly making more mistakes than I care to admit. But here’s what I’ve learned after years of trial and error: crypto trading signals on Telegram can absolutely change your game, but only if you approach them with the right mindset and tools.

The biggest breakthrough for me came when I stopped treating signals like magic bullets and started building a proper crypto signal workflow. I’m talking about systematic evaluation, consistent risk management, and most importantly – tracking everything. You can’t improve what you don’t measure, and that’s where most traders fail.

Remember when I mentioned losing that $2,400 because I didn’t validate signals properly? That painful lesson taught me the importance of crypto signal validation and telegram signal reliability checks. Now I never enter a trade without understanding the source’s track record and methodology. It’s saved me countless headaches and probably thousands of dollars.

The truth is, signal trading efficiency comes down to three core elements: proper evaluation processes, disciplined execution, and continuous performance analysis. I’ve seen traders with modest bankrolls consistently outperform those with deep pockets simply because they focused on crypto signal consistency over flashy promises.

Your crypto signal optimization journey doesn’t end with finding good signals – it’s about building sustainable systems. Whether that’s implementing proper telegram signal management protocols, setting up comprehensive crypto signal tracking, or developing robust signal trading analytics to measure your progress.

I’ll be honest – manual signal management is exhausting. Constantly monitoring multiple channels, calculating position sizes, and keeping track of performance across different signal providers nearly burned me out. That’s exactly why I started looking for automation solutions that could handle the heavy lifting while keeping me in control.

The beauty of modern telegram signal automation tools is they don’t replace your judgment – they amplify it. Proper crypto signal reporting and signal trading performance tracking give you the data you need to make smarter decisions about which signals to follow and which to avoid.

Here’s my challenge to you: stop treating signal trading like gambling and start approaching it like the systematic business it should be. Focus on crypto signal benchmarking, build processes for signal trading scalability, and always prioritize crypto signal sustainability over quick wins.

Ready to take your signal trading to the next level? Start Your Free Trial with professional signal management tools today. Your future self will thank you for making the decision to trade smarter, not harder.

Leave a Comment